You are viewing 1 of your 1 free articles

Three landlords plan sector's biggest ever merger

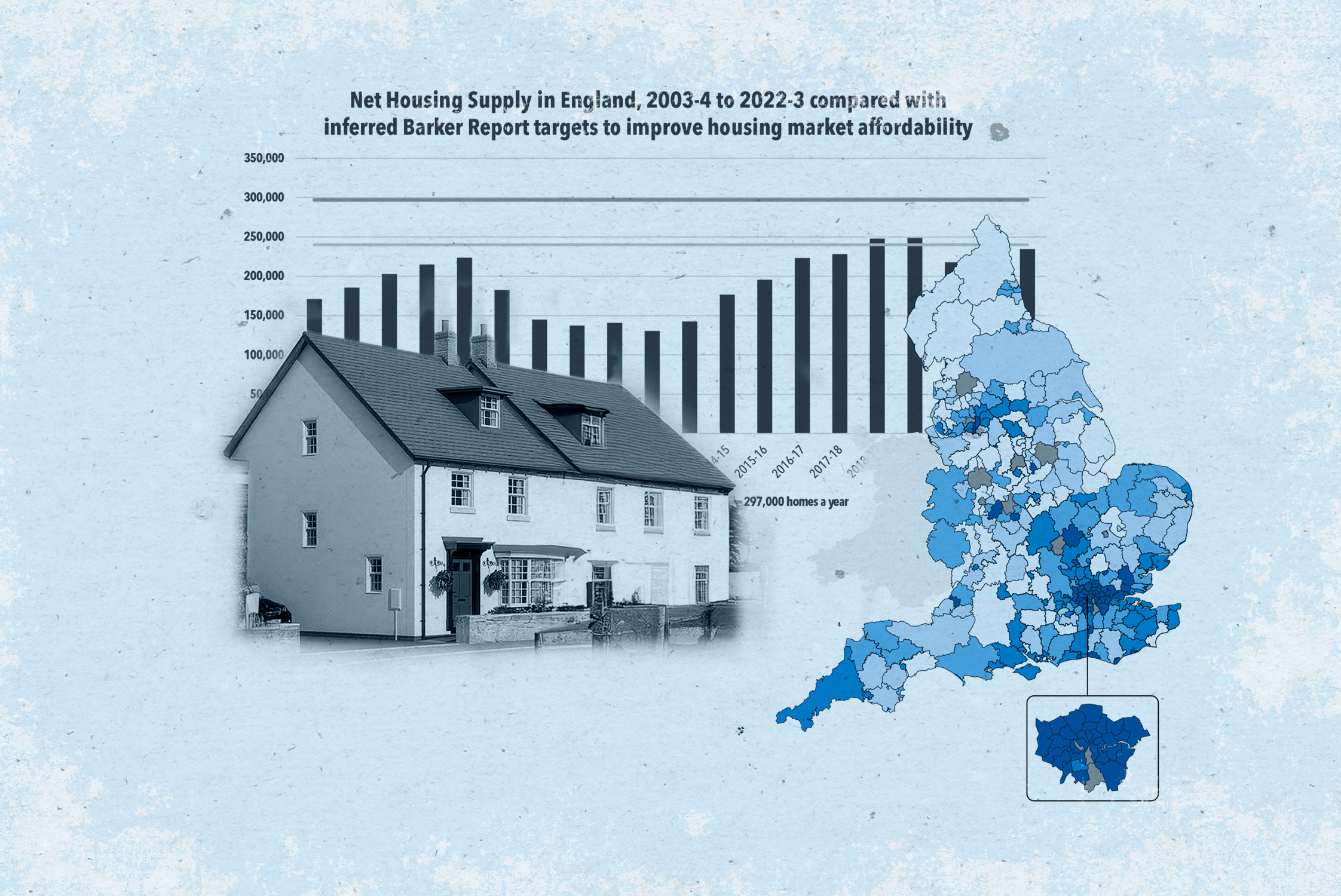

Three of London’s largest housing associations are planning to form a mammoth 135,000-home social landlord capable of building 100,000 homes in 10 years.

L&Q, Hyde Group and East Thames have opened talks on the biggest merger in the sector’s history and hope to make the new group the fourth largest house builder of any kind in the UK.

The combined organisation would have a turnover of £1.1bn, a book value of more than £30bn and own more than 5% of the English housing association sector’s stock if the merger goes ahead.

It follows Affinity Sutton and Circle’s plans for a 125,000-home merger, and comes at a time when the housing association sector is under increasing pressure to up its output and increase efficiency.

Welcoming the plans, Brandon Lewis, housing minister, said: “This shows what can be achieved by combining the strengths of each organisation and bringing them together.

“It will make a real difference to increasing their capacity to build, house and help thousands of people… In my mind this is exactly what housing associations should be doing.”

| Homes owned | Turnover | Surplus | Operating margin (%) | |

|---|---|---|---|---|

| L&Q | 71,700 | £642m | £245m | 38.2 |

| Hyde | 49,646 | £325.7m | £96.7m | 29.7 |

| East Thames | 15,125 | £146.3m | £37.9m | 25.9 |

| TOTAL | 136,471 | £1.14bn | £379.6m |

The 100,000 homes would comprise of 50,000 for market sale and rent and 25,000 each for sub-market rent and low-cost homeownership, representing an overall investment of £25bn.

This would be a 35,000-home increase on the associations’ current combined pipelines, supported by increased investment of £9bn in development.

It plans to focus its development on the capital with an emphasis on spreading out into surrounding commuter towns and the Home Counties.

It hopes to take on the development of new towns and large new communities – in a similar vein to L&Q’s current involvement with the 10,000-home scheme at Barking Riverside.

Yvonne Arrowsmith, David Montague and Elaine Bailey

Reaching an average of 10,000 homes built per year would place the association below only Barratt, Persimmon and Taylor Wimpey in the overall league of UK house builders.

The organisations stressed the merger plan was not driven by the recent social housing rent cut but a desire to increase their capacity.

Yvonne Arrowsmith, chief executive of East Thames, said the merger talks were not driven by her organisation’s financial position but did acknowledge it had been harder for smaller associations like East Thames to absorb the rent cut.

The 15,000-home landlord’s rating was downgraded by Moody’s last November, over concerns it was reliant on sales income to pay interest on its loans.

The new organisation will set aside £250m for community investment projects and £5m a year to create an academy scheme which will offer training and career development for staff and residents.

The planned savings of £50m per year will be achieved through combining back-office functions and IT systems, refinancing and using the combined strength of the organisation to secure better deals through procurement.

The proposed merger would see Hyde and L&Q amalgamate, and East Thames join the group as a 100% owned subsidiary responsible for its care and support operation.

David Montague is designate chief executive, while Elaine Bailey, chief executive of Hyde will be deputy and Ms Arrowsmith will be chief executive of the East Thames subsidiary.

The organisations hope the merger will be completed by the end of the year, following extensive consultation with residents and lender approval.