You are viewing 1 of your 1 free articles

Scammers seek thousands of pounds from individuals for fake L&Q bond

Scammers parading as a UK housing association have asked for investment worth tens of thousands of pounds in a fraudulent bond transaction, Inside Housing can reveal.

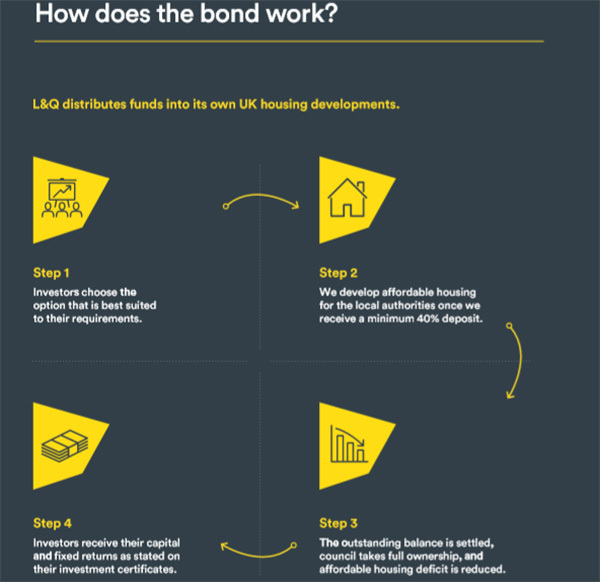

Inside Housing has seen correspondence and documents from fraudsters who have used L&Q branding to lure would-be investors into spending £10,000 on a supposed retail bond which promises returns of 12.9% in just two years.

The scammers have set up a website and published an investment brochure using the names of current L&Q employees.

Posing as investors, Inside Housing contacted the number linked to the website and a spokesperson said: “We really try and make this as simple as possible for the client, so your £15,000 is absolutely fine.

“There’s no fees or charges on top of that. You will receive your returns of 12.9% net of any taxes.”

Asked about details of the supposed investment, they said: “Our clients do not have to worry about particular projects or even [company] profits – we do not want clients to get too held up in the complexities of the corporate structure.”

Inside Housing has also received emails from the individual asking for two forms of identification and bank details.

The spokesperson said that once these are received, “your online investment account will be set up with all the details for you to transfer your £10,000 to £15,000”.

The fraudulent brochure offered three types of investment: the ‘beginner bond’ which offers 12.9% returns for a minimum £10,000 investment; the ‘flexi-bond’ for a minimum £20,000 investment over five years; and the ‘compounded bond’ which advertises 14.2% returns for investments above £30,000.

The individual Inside Housing spoke to said these rates are guaranteed.

“Whatever happens within our assets or the economy, we are not going to sacrifice our 100% record of happy clients. Returns will not fluctuate under any market conditions.”

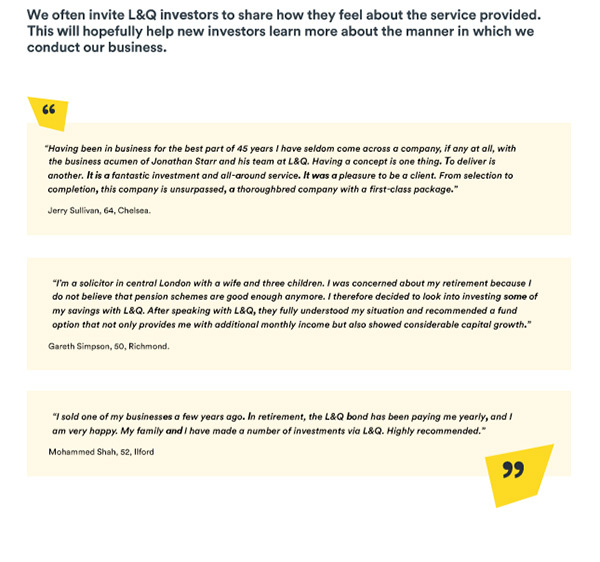

The investment brochure included fake testimonials from previous investors, including one which read: “It is a fantastic investment and all-around service. It was a pleasure to be a client. From selection to completion, this company is unsurpassed, a thoroughbred company with a first-class package.”

L&Q, after Inside Housing made it aware of the bond, confirmed that the scheme is not genuine and has warned anyone against investing and clicking on links if they receive similar emails.

The association said: “London & Quadrant Housing Trust has become aware of a fraudulent document and website using its name claiming to be publicising an L&Q investment opportunity.

“We can confirm that neither the document ‘L&Q Bond 2020/21 Investment Guide’ nor the linked website are genuine and would urge anyone in receipt of the document, or who has had any interaction with those responsible for it, to report it immediately to Action Fraud on 0300 123 2040 or on Action Fraud’s website.”

Sign up for our daily newsletter

Already have an account? Click here to manage your newsletters