Four arrested in social housing investment scheme probe

Four directors have been arrested as the police investigate companies running social housing investment schemes.

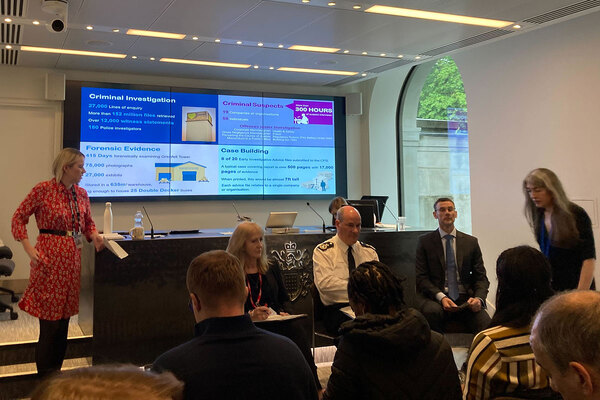

City of London Police said its economic crime department had made the arrests “on suspicion of fraud and money laundering offences”.

It said its investigation, codenamed Operation Lily, encompassed two companies named Social Housing Holdings and Citygate Housing.

Both companies are believed to have offered “investment opportunities within the social housing sector”, the police said.

In a post on its online portal, City of London Police said that alongside the arrests, it had “executed a number of search warrants at business and individuals’ premises”.

Further inquiries were “under way with employees of these companies”, it added.

The names of those arrested have not been released, and City of London Police confirmed to Inside Housing that no charges have been made as of 20 January.

Social Housing Holdings, also known as Social Housing Group and previously named Property Empire Holdings, had a registered address on Shelton Street in Covent Garden, London.

On social media, the company promised that investors who put in £16,000 to buy a share of a property would, after a three-month delay, receive £625 a month for the next 36 months: a total return of around 50%.

The company leased empty commercial spaces or run-down houses in multiple occupation (HMOs) and refurbished them. It then rented them out to large corporates such as Serco and Clearsprings Ready Homes to use as asylum seeker accommodation or supported housing under a “rent-to-rent” model.

The money to refurbish the properties came from investors, who were sourced by sales representatives. Social media users were invited to sign up for an £899 training course to become sales representatives and market investment opportunities on their own social media for a cut of each deal.

The company had two UK-based employees, around 25 staff members in the Philippines and an editor in Pakistan.

According to its most recent published accounts on Companies House, as of March 2023, the company had £2.2m of assets. Its accounts for 2023-24 are overdue.

It was not regulated by the Regulator of Social Housing. Much emergency accommodation does not meet the legal definition of social housing, which is let at sub-market rates.

Social Housing Holdings and Clearsprings Ready Homes declined to comment for this article.

A Serco spokesperson said: “Serco can confirm that Social Housing Group provides Serco with a small number of houses to accommodate asylum seekers.”

The other company being investigated, Citygate Housing, offered annual returns of 20%. It was registered with an address in St Pancras Way, London and advertised itself on Facebook as an “ethical investment”.

Its sales brochure said its model was “a win-win scenario, providing stable rental income and higher rent yields for clients, while also tackling the urgent housing needs of vulnerable populations”.

The minimum investment was £13,500, which Citygate claimed would buy a share in a property that would generate 36 monthly payments of £600: a total return of £21,600.

The company has not had any directors in post since September. Its website and social media pages are no longer online.

Inside Housing understands that the Regulator of Social Housing is neutral on where housing providers source their accommodation from, so long as it meets its standards around quality, viability and governance. It expects all providers to look at the terms of any lease agreement to make sure it is a viable offer.

Sign up for our regulation and legal newsletter

Already have an account? Click here to manage your newsletters