You are viewing 1 of your 1 free articles

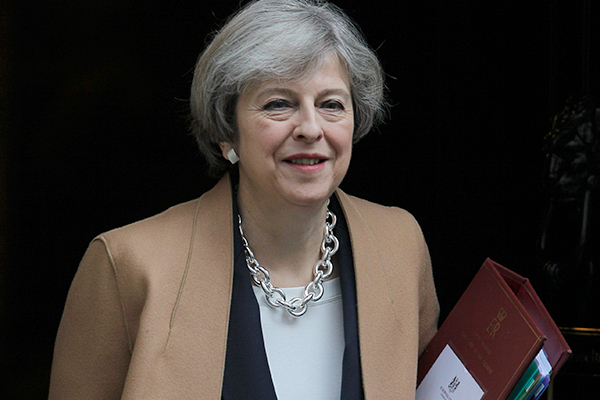

PM announces £10bn boost for Help to Buy

The prime minister has announced a £10bn boost for Help to Buy in an attempt to win over younger voters.

The government will extend its Help to Buy scheme to a further 135,000 new buyers.

However, the extension of the scheme has prompted criticism from some who say it only serves to stoke demand without boosting supply, leading to higher house prices.

The right-wing thinktank The Adam Smith Institute said the policy is like “throwing petrol onto a bonfire”.

It added: “The property market is totally dysfunctional because supply is so tightly constrained by planning rules, and adding more demand without improving the supply of houses is just going to raise house prices and make homes more unaffordable for people who don’t qualify for the Help to Buy subsidy.”

Under Help to Buy, first-time buyers only need a 5% deposit with a 75% mortgage and the government lends the remaining 20% towards the cost of the house.

In London the government increased the size of the loan to up to 40% because of higher property prices in the capital.

Chancellor Philip Hammond said: “Young people are worried that life will be harder for them than it was for their parents – owning a home is a key part of that. This government understands that for many people, finding a deposit is still a very big hurdle.

“That’s why we will invest an extra £10bn in our Help to Buy Equity Loan scheme to help a whole new generation of young people, across the UK, with the upfront costs of homeownership. We’re able to do this because of our balanced approach to the economy – dealing with our debt, while still investing in the future.”