You are viewing 1 of your 1 free articles

Judge dismisses TopHat winding-up petitions after settlement with developer

A judge has dismissed two winding-up petitions issued to TopHat after the modular house builder settled with a developer out of court.

Inside Housing was at the hearing earlier today when District Judge Shepherd dismissed both petitions at the Business and Property Courts in Leeds.

The legal actions were launched on 1 July by Yorkshire-based developer Harworth, which is a creditor of TopHat. A winding-up petition is legal action taken by a creditor of a company if they are owed £750 or more, and is regarded as a last resort to recover a debt.

Harworth had filed petitions against both TopHat Communities, which is based in Derby and responsible for development operations, and TopHat Enterprises, its Jersey-based parent company.

In court in Leeds on 13 August, Hugo Groves, the lawyer who was acting for Harworth, and Neil Berragan, TopHat’s counsel, both asked for dismissal of the winding-up petitions, with no order for either firm to pay for legal costs.

Inside Housing understands that Harworth’s dispute with TopHat concerned debts owed in relation to work undertaken on TopHat’s mothballed ‘mega-factory’ in Corby, Northamptonshire.

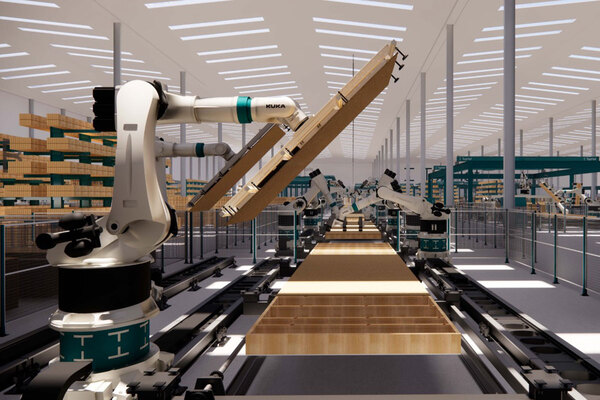

Harworth purchased the 107-acre site in December 2022 with the aim of building a 650,000 sq ft factory. It would have increased TopHat’s production capacity from 800 units a year to 4,800 units when completed.

However, in March 2024, TopHat put the factory plans on ice and local press reported that every member of the Corby team had been laid off.

TopHat has high-profile backers, including Goldman Sachs, but it has racked up significant losses since its launch in 2016.

In its last reported full year to the end of October 2022, TopHat Industries, which produces the group’s modular homes, posted widening pre-tax losses of £20.4m. Andrew Shepherd, managing director of TopHat, left the company in May.

TopHat’s other investors include FTSE 100 house builder Persimmon and Aviva. Persimmon invested £25m and Aviva £20m last year for undisclosed stakes. Goldman Sachs completed a total fundraising round of £70m. The modular firm also took a £15m loan from Homes England last year.

Last month, Persimmon revealed it had written off its £25m investment in TopHat. Persimmon told the stock market: “We originally invested in the TopHat business because of its industry-leading facade product.

“While the broader market challenges for volumetric modular manufacture has led us to take the prudent decision to write down our original investment, we continue to work with TopHat as they reposition the business to focus on the facade product.”

Last year, the Category 1 modular sector was rocked by the demise of Ilke Homes and Legal & General Modular Homes. House by Urban Splash, a joint venture between developer Urban Splash, Japan’s Sekisui House and Homes England, also went into administration in 2022.

TopHat declined to comment on the settlement. Harworth was approached for comment.

Sign up for our development and finance newsletter

Already have an account? Click here to manage your newsletters