You are viewing 1 of your 1 free articles

Housing association rent arrears rise 8.4% to record high of nearly £800m

Unpaid rent owed to housing associations hit a record high of just under £800m after a huge spike last year, Inside Housing can reveal.

The Regulator of Social Housing (RSH) recorded the 8.4% rise – the highest single year jump since before the coronavirus pandemic – from the £736m the year before in its annual entity account published late last year.

Industry bodies and housing campaigners have called for reforms to the sector in light of the findings.

Between and 2015 and 2018, gross arrears – the total amount of unpaid rent – owed by housing associations stayed largely stable between £500 and £600m.

But in the years since, it has steadily increased, to £629m in 2019, then £658m in 2020, £689m in 2021 and £736m in 2022 before finally hitting £798m last year.

The £798m figure equated to around 5.3% of housing association tenants not able to pay rent.

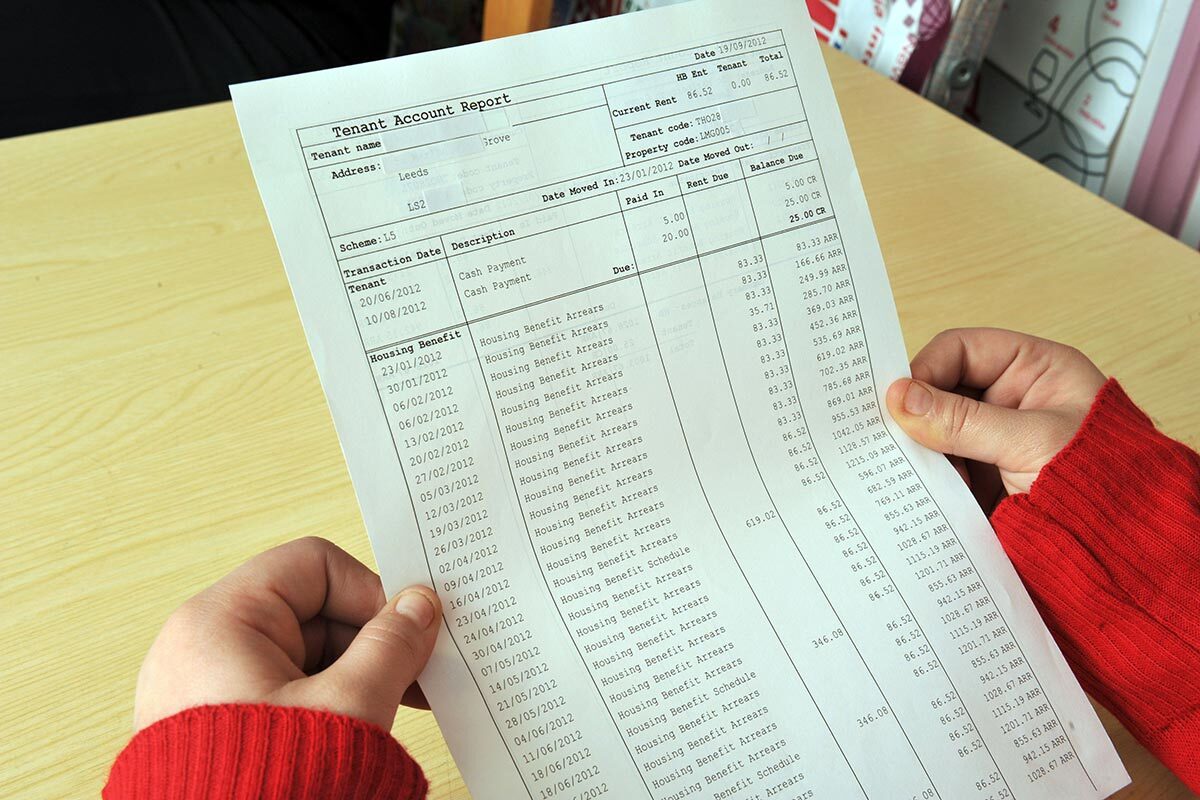

Hannah, who asked to use a pseudonym, first fell into arrears after she unexpectedly lost her job. Despite applying for Universal Credit, the five-week delay in receiving payments meant she missed paying rent.

After going into debt, she faced constant pushes from the housing association to pay the money, including eviction threats.

“It is a pressure, because they text you and ring you and send you letters. And it’s an unnecessary stress because you’re already trying [to solve it],” Hannah explained.

The issue was made worse as payments into her rent account have started going missing in recent months. This prompted an internal investigation by her housing association, but it has not stopping the calls and messages from her landlord asking her to send more money.

Given the number of ongoing issues with disrepair that the housing association has not properly dealt with, Hannah said the constant pushing when she fell into arrears felt unfair. The landlord also rarely responded to emails about the problems, meaning Hannah often had to get her local MP involved before any action was taken.

“They’re not social housing anymore, they’re a business,” Hannah said. “As a resident, I just feel like a cash cow.”

The latest news comes as the sector has faced growing scrutiny for its handling of serious disrepair in properties, sparked in the aftermath of the mould-related death of toddler Awaab Ishak in December 2020.

Last year, The Guardian reported that the number of social housing tenants in England complaining of damp and leaks doubled in the years since his death.

Housing associations have also been facing increased financial pressure in recent years thanks to high borrowing costs and inflation, with many posting significant drops in their recorded surpluses.

The RSH found that housing associations had increased their expenditure by 12% last year to try and meet the rising level of reported disrepair in their homes.

Suzanne Muna, secretary at the Social Housing Action Campaign, said: “The cause of the rise in arrears is the cost of living crisis. It’s been pushing people over a financial cliff face.

“People are thinking, ‘Do I build up arrears, which might cause me a problem later down the line, or do I stop eating now because I don’t have money for both?’ They’re going to choose to eat and just allow their arrears to grow.”

Ms Muna added that the situation has been worsened by rises in social rents – 7% last year and inflation plus 1% the years before – which were “far higher than benefits rose and far higher than average salaries rose” and left many impoverished residents enable to afford their rent.

“That’s just putting a huge pressure on people’s budgets and so the amount of arrears will grow,” she stated. “This is a totally unsustainable model.”

Ms Muna is not alone in calling for change.

Alistair Smyth, director of policy and research at the National Housing Federation, said: “Rising costs have affected all sectors, including the social housing sector, and to balance affordability for residents with ensuring they can continue to deliver quality homes and services now and in the future, housing associations consider any decisions about rents very carefully.”

“We continue to call on government for a long-term rent settlement for the social housing sector as part of a broader long-term plan for housing,” he added. “This approach would provide stability and certainty for residents and social landlords, allowing them to plan for the future.”

Mr Symth also stressed that “housing associations have tailored support in place to help any residents” in financial difficulty and that the sector had committed to ensure “no tenant will be evicted because of financial hardship”.

A spokesperson for the RSH said: “The majority of providers report that their level of rent arrears is within their business plan assumptions and that, while tenants are being affected by cost of living pressures, overall arrears are in line with cyclical trends.

“Providers must have a firm understanding of arrears and manage all financial risks carefully, particularly in the current economic climate where there is limited headroom.

“We continue to monitor the arrears data that providers submit to us, along with other financial returns. When there are issues of regulatory concern, we will follow up in line with our normal approach.”

Inside Housing reported the findings of a survey in August which revealed that four in five council landlords were seeing significant rises in rent arrears.

Sign up for our daily newsletter

Already have an account? Click here to manage your newsletters