For-profit housing providers to own 113,000 homes within five years

For-profit affordable housing providers have grown exponentially over the past decade and will own 113,000 homes within five years, new research has revealed.

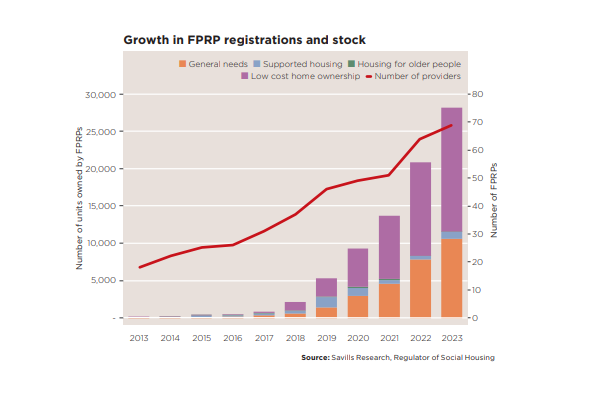

Savills Housing Consultancy has today published a report into the growth of ‘for-profit’ providers which shows that the sub-sector has grown from just 18 organisations owning 187 homes in 2013, to 69 owning 28,164 today.

The consultancy surveyed for-profit providers about their growth plans for the report, predicting that the sector will grow by 9,300 homes by the end of 2023 and reach a total of 113,000 homes by 2028, with 100 providers in the field.

The growth has accelerated in recent years, and has more than doubled since March 2021, driven by a 131% increase in the number of general needs rented homes owned.

The providers continue to own a small proportion of stock, just 0.7% of total affordable stock in 2021/22, but have increased their share of the market by three times in the three years to 2021-22.

Three providers currently own 77% of all the stock owned by for-profit providers, the report said, but the sector is set to diversify as other new entrants build up their pipelines in coming years.

Shared ownership makes up 59% of total for-profit stock now and is projected to be 63% in five years’ time, the report said. The remainder is general needs rented housing, with a small proportion of supported housing.

Despite fears that the new providers might seek to cash in by selling the stock, Savills said that 90% of for-profits have no plans to exit the sector in the next 20 years.

The survey also found signs of increasing collaboration between traditional ‘not-for-profit’ housing associations and the ‘for-profit’ sector.

A survey of traditional housing associations revealed that 89% of housing associations would consider a partnership with a for-profit and 43% are already working with them in some way.

“Partnerships between [for-profits] and [traditional housing associations] are beneficial for both sides. [For-profits] have significant volumes of capital to deploy and seek strong ESG characteristics but lack operational and development capabilities,” the report said.

“On the other hand, [housing associations] have the in-house operational and management expertise but require access to investment capital to invest in existing stock whilst maintaining their development programmes.”

Recent deals have included tie-ups between L&G Affordable Homes and Metropolitan Thames Valley and Optivo and Sage.

“The greatest appetite amongst [for-profits] remains for newer, more energy-efficient stock but there is growing interest in acquiring older legacy stock too,” the report added.

For-profit providers include businesses established by house builders, keen to keep hold of the affordable housing they develop in private market schemes as a result of planning laws (known as Section 106 homes).

Others are backed by large institutions, such as Sage Housing – which is owned by Blackstone, one of the largest private equity firms in the world – or L&G Affordable Homes, which is backed by Legal & General.

In 2008, the Labour government at the time introduced legislation that paved the way for profit-making providers to enter the market.

But growth had been slow until the late 2010s, when major investors such as Blackstone entered the market.

Sign up for our development and finance newsletter

Already have an account? Click here to manage your newsletters