You are viewing 1 of your 1 free articles

'Failure to implement Right to Buy could be regulatory breach'

Housing associations have been warned they will face regulatory pressure if they are not ready to implement the Right to Buy when it is introduced.

Matthew Bailes, executive director for regulation at the Homes and Communities Agency (HCA), said that regulatory standards demand housing associations comply with all relevant law.

Therefore, if the government legislates to introduce Right to Buy discounts for tenants it will also become a regulatory requirement, with landlords facing potential governance downgrades should they fail.

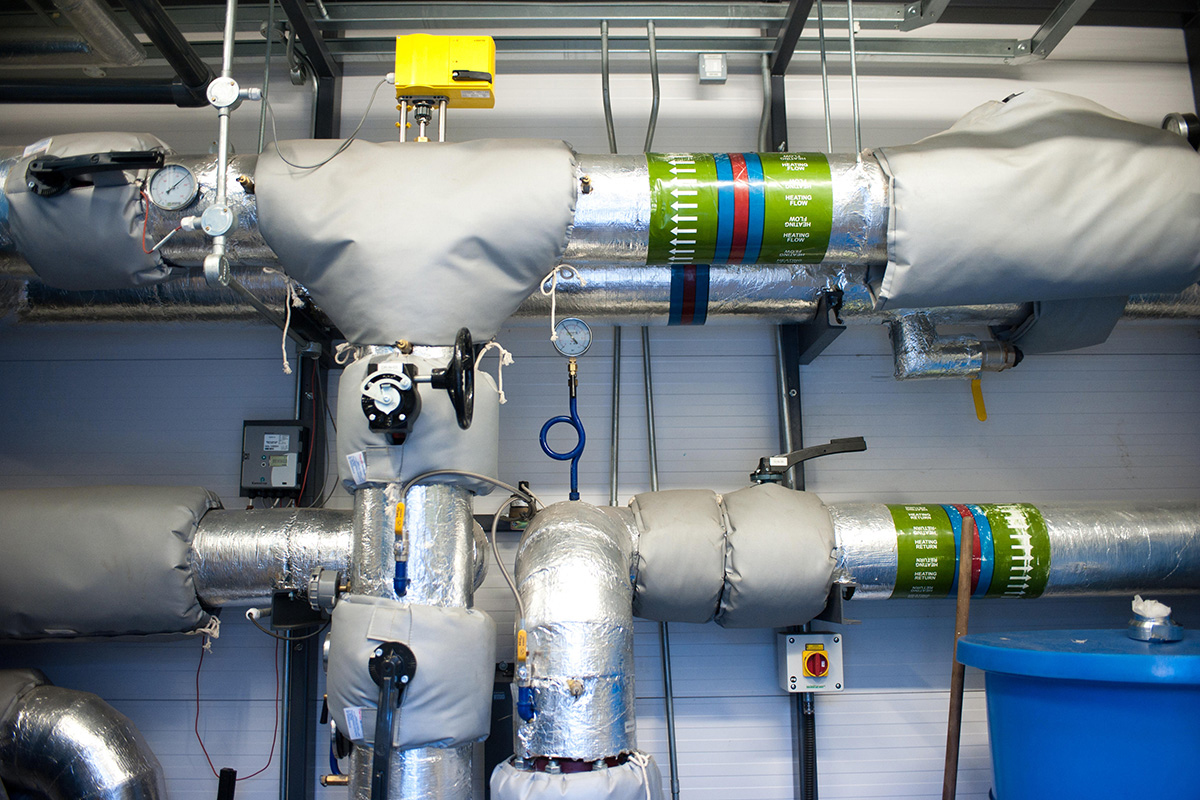

Mr Bailes also stressed that landlords must ensure they have capacity to build replacement homes if required, and understand the impact on loan covenants.

‘Associations are required to meet legal requirements as a regulatory standard, so being ready to implement [the Right to Buy] will be important,’ he told delegates at the Chartered Institute of Housing (CIH) annual conference.

‘I suspect there will be some expectation to replace sold stock, so associations need to know if they can do that within whatever time scale is set.

‘If the stock sold is security for loans, you will need to be able to find replacement security, and have a pipeline to do that without upsetting covenants.’

The government is preparing to extend Right to Buy discounts of up to £103,900 to housing association tenants, a policy which has sparked anger among many sector figures.