You are viewing 1 of your 1 free articles

Council housing rent arrears rise significantly, survey finds

Four in five council landlords are seeing significant rises in rent arrears, a survey has found.

The study, conducted by council housing organisations the National Federation of ALMOs (NFA) and the Association of Retained Council Housing (ARCH), surveyed 28 local authorities and ALMOs across England that together manage 294,000 homes, close to a third of the sector.

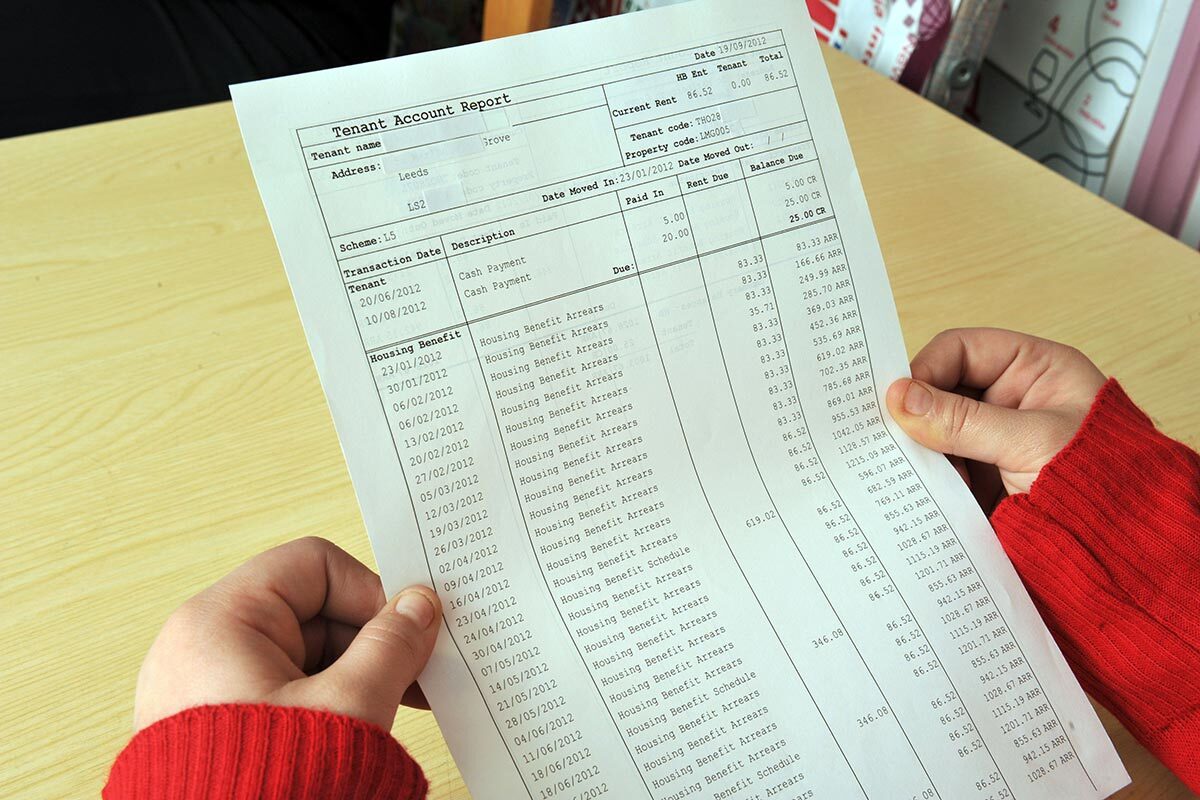

It found that 85% of landlords reported higher rent arrears among their tenants. The number of households in arrears has risen 4% in the past year, from 97,220 to 101,203. Meanwhile, the amount these households owe has risen by 11% to more than £60m.

The average amount owed by each household in arrears rose from £427 to £527, up 23% – about an additional week’s rent.

Nearly three-quarters of landlords reported increased pressure on local homelessness and housing advice services.

Just over a third of households in council housing receive Universal Credit, the study said, and the same proportion receive housing benefit.

For many, this will cover their rent payments, but some people face a shortfall including those who pay an underoccupancy charge, those whose benefits are capped and those with non-dependent deductions.

Nationally, 1.8% of households on housing benefit or Universal Credit are capped, rising to 4.5% in London. They are primarily lone parents with young children.

The organisations called on the government to increase the basic Universal Credit element, stop paying Universal Credit in arrears, improve benefits for those in short-term employment and set a minimum level of benefit.

Lisa Birchall, lead policy officer at the NFA, said: “Income managers are very clear about the causes of this increase.

“Many households in the sector are battling poverty, despite two-thirds of council tenants being in work. A welfare system that was already not fit-for-purpose or funded sufficiently before the cost of living crisis hit has made matters considerably worse.”

Chloe Fletcher, policy director at the NFA, said: “Even tenants with some of the lowest rents in the country are really struggling to make ends meet. Our members house some of the poorest and most vulnerable families in the country and our officers are telling us they are the ones being hit hardest by the current cost of living crisis.

“Fundamentally, people need more money in their pockets at this incredibly difficult time.”

Paul Price, chief executive of ARCH, said: “We can already see that fuel costs during this coming winter will leave many juggling difficult choices between eating and heating. This just cannot be right, and government needs to provide sufficient support for these families so that they can survive.”

Sign up for our Council Focus newsletter

Already have an account? Click here to manage your newsletters