Almost four million low-income households in bill arrears, new study reveals

Almost four million low-income households are in arrears with their household bills, new research by the Joseph Rowntree Foundation (JRF) has found.

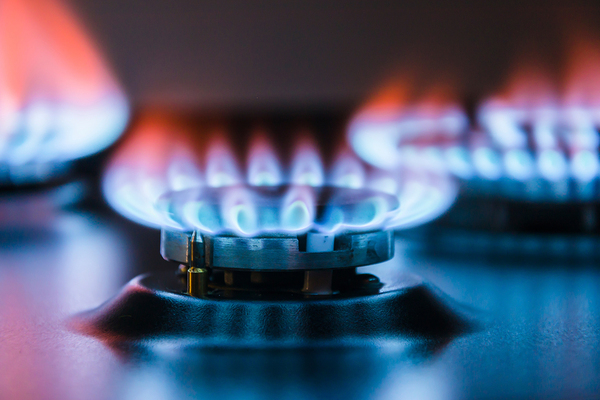

The charity has called on the government to consider reinstating the £20-a-week boost to Universal Credit in the face of a cost of living crisis this coming winter. Millions of low-income households have faced higher energy bills due to the spike in gas and electricity prices over the past few months.

The research found that prior to the pandemic, 11% of low-income households were behind on paying at least one household bill or credit commitment. However, this figure has now risen to a third of all low-income families finding themselves in arrears.

The report stated that 3.8 million low-income households (33%) are in some form of household arrears and 4.4 million (38%) have taken on new borrowing or increased their existing borrowing during the pandemic.

The JRF said there was significant overlap between these two groups. More than two-thirds (69%) of households who have taken on new or increased lending during the pandemic are also in arrears.

Almost nine in 10 low-income households who have fallen into arrears said they had previously been able to keep up with payments.

Low-income Universal Credit recipients are one of the hardest hit groups, with seven in 10 grappling with arrears even before the cut to the benefit had taken effect.

The report said: “Despite the government’s talk of shifting to a high-wage, high-employment economy, our polling found that 50% of Universal Credit recipients said they did not feel confident they could find a job or work more hours.

“A large minority (40%) was not confident they would be able to pay their bills in full and on time in future, and not confident they will be able to avoid taking on more debt (35%).”

Sign up for our daily newsletter

Already have an account? Click here to manage your newsletters