You are viewing 1 of your 1 free articles

Taking the development reins: a move away from Section 106

Many housing associations have been looking to develop out land rather than buying up Section 106. Peter Apps examines the state of play and what it means for the future. Illustration by Kev Gahan

“Rather than simply acquiring a proportion of the properties commercial developers build, I want to see housing associations taking on and leading major developments themselves. Because creating the kind of large-scale, high-quality developments this country needs requires a special kind of leadership. Leadership you are uniquely well placed to provide.”

It has been less than two years since then-prime minister Theresa May spoke those words from the podium of the National Housing Federation’s ‘Sector Summit’ in central London in September 2018.

It feels as though it has been a lot longer given the way the world and political landscape have transformed, but the message she delivered tapped into a trend which was already growing in the sector and has continued to since.

Namely, a move away from ‘developing’ homes by buying the affordable housing private developers are ordered to provide under Section 106 of the Town and Country Planning Act 1990 and towards acting much more like developers: buying packages of land, taking them through planning and delivering schemes with a mixture of housing tenures.

New data compiled by Inside Housing reveals the current state of play. The 108 housing associations which responded to our Biggest Builders Survey had built 48,183 new homes in 2019/20. Of these, 19,261 came from Section 106 agreements (40%).

Good historic figures to demonstrate this trend are hard to come by.

Our data shows that this year’s figure is relatively similar to 2017/18 (when Ms May spoke), when 16,464 homes of a total of 39,488 (41.6%) were delivered through Section 106.

Our data shows only a relatively small proportional shift from 2017/18 (when Ms May spoke), when 16,464 homes of a total of 39,488 (41.6%) were delivered through Section 106.

But certainly the anecdotal evidence is that many housing associations, including smaller and medium-sized organisations, are moving away from a reliance on buying from builders and increasingly taking the reins of their own development programmes.

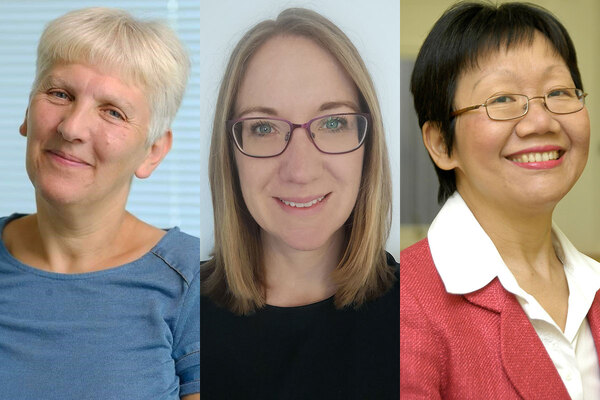

Inside Housing has spoken to a number of key players about what is driving this trend and what it means for the shape of the sector in years to come.

The move away from Section 106 is better viewed at an organisational level. Take Network Homes for instance, a 20,000-home London-based housing association that built 279 homes of all tenures last year and started 590.

In 2017/18 it made 758 starts, with 360 of these under Section 106. But in 2019/20, all of its 590 starts were land led and in the next two years just 96 (5%) of the 1,745 homes it plans to start will be Section 106.

Matt Bird, new business and partnerships director at Network Homes, says: “It’s not something that has happened by accident. Moving away from Section 106 gives you more control: the number of homes, where they are and the quality of them.”

This is a familiar theme. With the increased focus on build quality and building safety after Grenfell in particular, housing associations are fed up with being lumbered with mistakes made by private builders on assets they will own for decades.

This goes beyond fire safety, it is also about the design of the scheme. There have been high-profile examples of measures to exclude the social housing residents from amenities in recent years – with separate exits, separate gyms and restricted playgrounds. Build your own scheme and you can avoid all of this.

“If you receive a Section 106 and find out your residents don’t have access to a playground, you are stuck with that situation,” says Fiona Fletcher-Smith, group director of sales and development at L&Q. “That’s not what we wanted to be about.”

She adds that some private builders simply do not design with social housing in mind. Their focus on the sales market means they do not necessarily plan for families. “They just can’t cope with the child density, for example,” Ms Fletcher-Smith says. “I went to one recently and the kids were knocking holes in the walls, taking their bikes down the stairs because they were just too narrow.”

Carbon reduction is another driver. What is the value to a housing association of buying a home from a builder it will need to expensively retrofit, when it could build one to a high standard of environmental efficiency to begin with?

The other push away from Section 106 is increased competition. Large investors such as Sage Housing (backed by huge private equity firm Blackstone) have entered the market, as well as institutional investors, such as Legal and General (L&G), and housing associations registered by developers, such as British Land, to keep the Section 106 homes they develop in house.

“Competition for Section 106 has been very, very strong and the for-profit [providers] have been coming into that, too,” says Helen Collins, head of the Affordable Housing Consultancy at Savills.

“In recent times the investors, such as L&G, have come into this market with a bang,” adds Sara Bailey, managing partner at law firm Trowers & Hamlins.

While figures from these new entrants are not part of Inside Housing’s data, Sage in particular is making waves. It struck deals for 541 homes, worth £116m, in May and says it is in contract for around 10,000 units of some 20,000 it is targeting – this is a big slice of the pie.

Despite having much deeper pockets than traditional housing associations (Blackstone is the world’s largest property investor with assets worth more than $400bn – larger than the GDP of Ireland), it is not necessarily outbidding them. It is understood that the firm and other for-profit providers apply a tight criteria for bidding necessary for it to turn a profit on the homes. Nonetheless, more competition means less opportunity for the traditional sector – especially where a for-profit provider strikes an up-front deal with a house builder to take a large chunk of their product.

Finally, a move away from Section 106 insulates against a market downturn. When overall housebuilding dips, so does Section 106.

“The rationale behind doing less Section 106 is that you are less reliant on market forces,” says Joe Reeves, executive director of finance and growth at 33,000-home Midland Heart. “In a downturn, if you were purely reliant on Section 106 and they weren’t coming through, you would have nothing.”

He explains there has been a particular push for associations in the Midlands, where the Voluntary Right to Buy scheme is being piloted and housing associations are obliged to replace those homes but cannot use the cash to buy Section 106. So everyone selling Right to Buy must embark on at least a modest land-led programme.

So what does this shift mean for the business? The first is that a new skillset is required: an ability to understand and navigate the land market and the associated risks with buying something based on the money you will make from it years down the line.

“If you are carrying out mixed-use schemes, you need to ensure you understand the private residential market,” says Ms Bailey. “This is not about skillset in terms of technical expertise but commercial expertise.”

At L&Q, the development team has doubled to more than 650 members in recent years, with many of the new additions coming in from the private sector and bringing their commercial experience (and contacts) with them.

“We look for people who understand the commercial nature of what we do, but also the fact that we’re a charity and the ultimate goal is providing affordable housing,” says Ms Fletcher-Smith.

Mr Bird, on the other hand, says Network Homes has mainly recruited from within the sector, picking up employees who have built up knowledge of the land market at other housing associations.

A particularly challenging part of the land-led model for housing associations is that they often need to buy land without planning consent. Land promoters, organisations that purchase land without consent and then sell options to developers to purchase it once consented, will often price in the lowest amount of affordable housing possible.

This is within the commercial nature of what they do, but it tends to price out a social landlord seeking to maximise affordable housing. The answer is to buy the land unconsented, but that brings risk.

“One of the big things is if you are buying a site without planning permission, you need to understand the local planning policies and what the authority is likely to ask for. Then you need to know the local ecosystem and the local market to have an idea about what is going to sell and to who. There is risk all along that process,” explains Ms Fletcher-Smith.

“Where higher levels of affordable housing have been ruled out, these are effectively ruled out for us,” says Mr Bird. “It’s pushing us more and more to look at land that isn’t consented. The planning process is always a challenge. We are always learning and having to improve our knowledge.”

Nonetheless, the simple mathematics of the cost of land and the relatively low grant rates available mean that a proportion of market sale – or at least shared ownership – is required to make the schemes stack up.

In numbers

49%

Percentage of all affordable homes in England delivered through Section 106 in 2018/19 – demonstrating that it remains a key element of affordable housing delivery, even if some associations are backing away

19,261

Homes built through Section 106 by 108 developing housing associations last year

48,183

Total number of homes built by these organisations (so 40% Section 106)

47.5%

Housing association Network Homes’ new development starts that were through Section 106 in 2017/18. Over the next two years, just 5% will be through this mechanism

650

Headcount of L&Q’s development team after it remodelled its business to focus more on developing land-led schemes

13 of 108

Housing associations for which more than 80% of completions in 2018/19 came through Section 106

Source: Inside Housing and MHCLG

This risk is compounded by an operating market which has never been more uncertain. While several housing associations report a boost in immediate demand due to the time-limited stamp duty cut, the longer-term future is more uncertain. Question marks over what will happen to the housing market if the coronavirus-induced downturn turns into a prolonged recession abound, as do uncertainties about supply chains and materials.

“We do quite a lot of work with boards to understand the market they are entering and the risk they are taking on. It’s crucial for the board to have the right skills to manage that,” says Ms Collins.

Not all organisations are driving as fast in this direction however. PA Housing, for example, took 91.6% of its 276 completions through Section 106 last year.

Chris Whelan, executive director of development and sales at PA Housing, explains that the organisation operates a closer model with the house builders than simply bidding on the homes at auction.

“We have over a number of years built some strong relationships with private developers,” he says. “We get involved quite early and we will, for example, bid jointly with Taylor Wimpey for sites.

“To all intents and purposes, [it is] a genuine partnership. We have input to design detailing, finishing and means of access. And we have a strong technical team, a clerk of works and we put a lot into the technical side of things.”

In some ways this is the best of both worlds for the housing association: control over the end product and the experience of a listed house builder to make the call on risk.

Nonetheless, PA Housing does have a land-led operation and in future years more of its development will come via this route.

As is often the case in housing, none of this is new. Section 106 is a relatively new addition, having been added by amendment in the early 2000s. Before then, all housing association development was land led.

“People developed out sites for 100% affordable. That was the business model for housing associations,” says Ms Collins. “I worked at Bromford when I started out in the sector and that’s what we did: land-led development with grant.

“The sort of sites associations were able to access were the smaller end of the market, where you could compete with grant funding and build fully affordable.”

Twenty years on, this is still the change that has most radically reformed the housing association sector – the reduction in grant rates.

They must now compete in the land market with the big boys and somehow still turn out something which serves a social good. However, many are finding a way.

Sign up for our development and finance newsletter

Already have an account? Click here to manage your newsletters