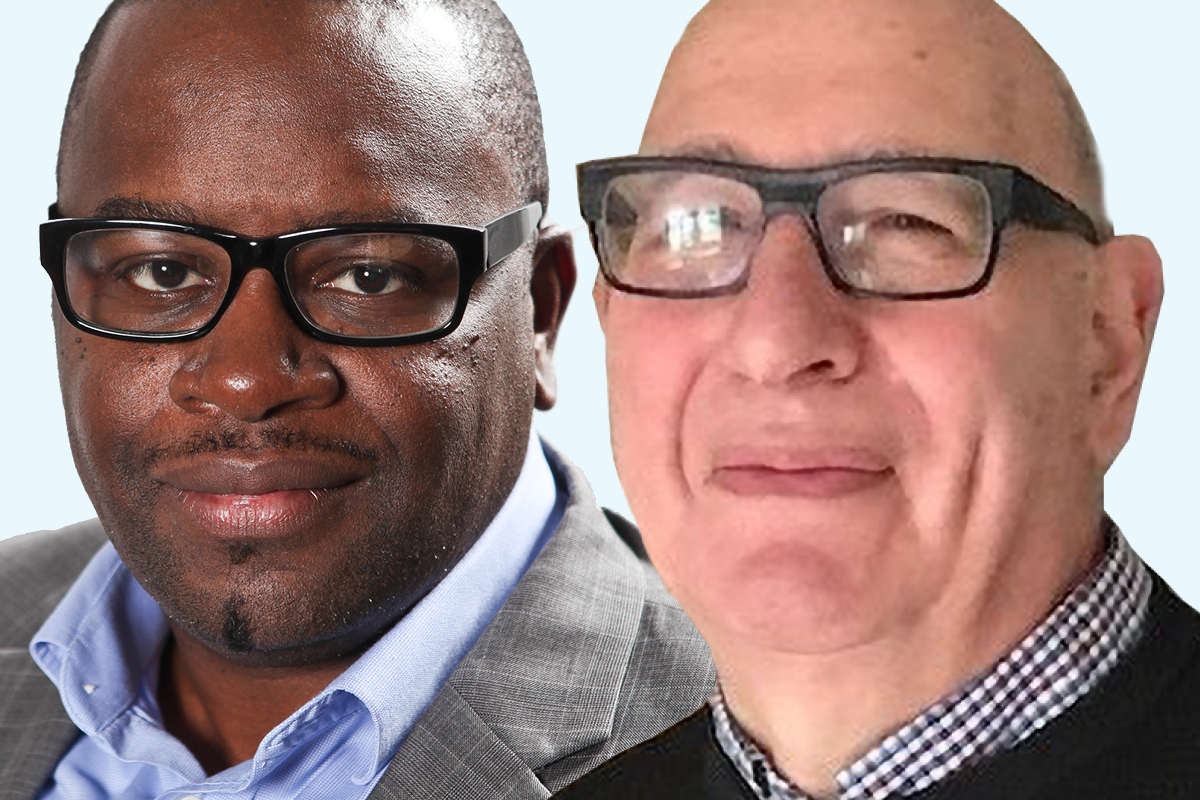

Waqar Ahmed is group finance director at L&Q

The pound is under fire and interest rates are up. What does this mean for housing associations like us?

Waqar Ahmed considers how the turbulent economic times are affecting social landlords and how finance directors can respond

The market reaction to chancellor Kwasi Kwarteng’s “fiscal event” was swift and harsh. The pound hit record lows against the US dollar, the FTSE tanked, and UK bond yields soared.

With pension funds under threat and the mortgage market in chaos, the Bank of England was forced to step in and, at least for now, steady the ship.

All of this comes amid soaring inflation and a cost of living crisis, with social housing residents, many of whom are at the bottom of the income spectrum, disproportionately impacted.

For housing associations, this comes at a time when we are facing tough choices about how to prioritise spending during a building safety crisis, housing supply shortages and with the urgent need to decarbonise our homes.

Against the backdrop of a challenging operating environment, what does this mean for the sector?

The inflation picture is full of complexities, particularly for social landlords – with rising costs most keenly felt through our repairs and development activities. Shortages of construction materials and labour are putting upward pressure on prices, which currently stand at around 12%. Add in the increased cost of moving materials and the development of homes becomes even more expensive.

The causes of the current high-inflation environment have been well documented: a perfect storm of the conflict in Ukraine, COVID and Brexit. While these factors are outside our control, prompt and decisive action will help us manage and mitigate risks.

At L&Q, we are looking at ways to make cost-saving efficiencies by using technology and negotiating contracts.

Our development colleagues are partnering with house builders to tap into their procurement advantage. Our maintenance department is seeking to introduce new suppliers to deliver our programmes. Business transformation and IT are other areas where savings can be made, with team members exploring ways that we can work smarter and more collaboratively.

Within finance, we are seeing how we can bring in new funding partners to reduce our risk and borrowing costs.

High inflation means we are now entering an era of higher interest rates. L&Q has £6bn of loans and our interest bill is nearly £180m per year. A 1% increase could add £60m a year to this bill – an outcome we are working to avoid in three ways.

“The government is consulting on a rent cap for social tenants, with the consequences likely to be long-term. There is no easy answer, and a balance must be struck between the needs of our residents and our viability as a business”

First, we have fixed two-thirds of our loans, which means interest rate increases only impact a third of our debt.

Second, we are working with staff to manage our cashflow forecasts better so that we can carry less cash in the bank to meet our day-to-day requirements.

Third, we are looking at introducing new lenders and equity investors into our development projects so that we do not have to fund the full costs ourselves.

We always ensure we have enough cash to meet our needs for the next 18 months. This means we can fund our entire investment plans in our existing homes and development pipeline without having to borrow more money.

Higher mortgage costs will make the aspiration of owning a home less likely for many, and we are looking at new products and government initiatives to help get people onto the ladder.

At L&Q, we pride ourselves on providing good-quality homes to all income groups, whether this be through social rent, market rent, shared ownership, or market sales. This affords us the ability to change the tenure of our new build homes if we see a slowdown in any category.

The government is consulting on a rent cap for social tenants, with the consequences likely to be long-term. There is no easy answer, and a balance must be struck between the needs of our residents and our viability as a business.

Inflationary pressure means our residents are enduring significant price rises as food and fuel costs surge. At the same time, in order to fulfil our investment requirements in fire safety, decent homes and environmental improvements – all of which are subject to mounting costs – we need to increase rents.

We are having proactive conversations with the government about next year’s rent increases alongside the National Housing Federation and G15. We are committed to maintaining affordability for residents and are modelling various scenarios to find a balance between these concerns.

“The cost of living crisis has pushed money worries to the forefront of everyone’s minds, and we are not shying away from the impact it will have on our employees”

In the meantime, on top of the work we are doing to bring down people’s energy bills by improving the energy performance of our homes, we are actively engaged in supporting residents and local community organisations through the L&Q Foundation. This includes supporting free or low-cost food services, providing access to fuel poverty and foodbank vouchers, and using community centres to provide warm spaces for those in need.

Our Independent Lives services are providing emergency support to vulnerable residents in crisis, helping residents reduce their debts and outgoings, and maximising benefits for those who need them and getting people into paid and secure work.

The cost of living crisis has pushed money worries to the forefront of everyone’s minds, and we are not shying away from the impact it will have on our employees.

As we look at our budgets for next year, we’ll be taking the time to review all the benefits available to colleagues, including our annual pay review. We also have an Employee Assistance Programme, which our staff can use to speak to a trained counsellor 24/7, and a confidential helpline that can advise on budgeting, money worries and debt management.

While today’s market challenges may be unique, they are not insurmountable. The sector has displayed remarkable resilience in the past – from the financial crisis of 2008 to the operational difficulties imposed by COVID and Brexit. I’m confident we can ride out this potential economic storm if we plan for and manage circumstances appropriately.

Waqar Ahmed, group finance director, L&Q

Sign up for our development and finance newsletter

Already have an account? Click here to manage your newsletters