You are viewing 1 of your 1 free articles

Government needs to iron out kinks in Universal Credit roll-out

The government should not overlook the lessons that can be learnt from the roll-out of full-service Universal Credit, says Nick Atkin

The past few weeks have seen a welcome shift by the government in its approach to housing.

The rent settlement, the announcement of additional funding to build new homes and the Housing Summit at 10 Downing Street are all positive signs of just how significant a role housing must play as we enter into very uncertain economic times.

Another big step forward has been the removal of the Local Housing Allowance cap, both for supported housing and just as importantly for under-35s. This all gives a renewed confidence to push forward and make the supply of much-needed homes a reality.

But there remains one dark cloud and significant risk looming. This won’t take any additional money to resolve. It just needs some common sense to prevail. It’s the impact full-service Universal Credit is having on many of the people who live in our homes, and how this could affect our ability to build more homes.

“We are using our experience and understanding over the past 15 months to call for improvements and a slowing down of the roll-out process until these problems have been resolved.”

Most people I speak to support the overarching principle of Universal Credit. For our customers, it removes the previous myriad of benefits and confusion over what they were able to claim. However, what has become clear is that the reduced benefit cap, coupled with the fundamental systemic flaws in the design and subsequent application of full-service Universal Credit, need to be addressed as a matter of urgency.

As social landlords, we cannot sit back and watch as our customers and advice teams suffer with an ill-thought-out system and roll-out plan that is only set to get worse. Some of the anecdotal case studies I hear from the team are truly frightening.

We are using our experience and understanding over the past 15 months to call for improvements and a slowing down of the roll-out process until these problems have been resolved.

So what can you expect when the roll-out comes your way?

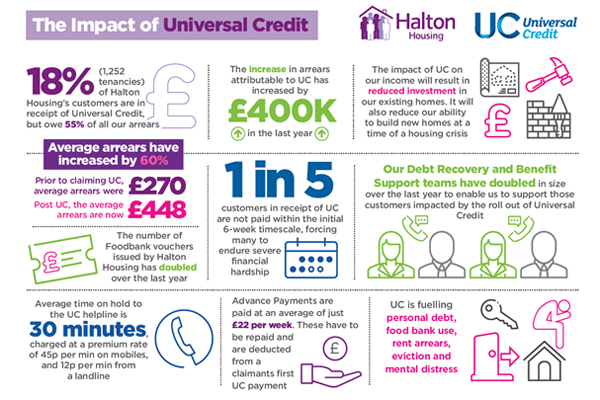

Well, the first of our summaries paints a pretty bleak picture, especially if you take a few moments to contemplate what similar figures would mean for your customers and your business plan.

Claimants receiving Universal Credit as part of ‘in work’ benefits continue to struggle, as their fluctuating income can lead to money management issues, compounded by a high incidence of incorrect Universal Credit payments being awarded and inaccurate or missing information provided by the Department for Work and Pensions (DWP).

As a landlord that has been at the forefront of the roll-out of full-service Universal Credit, we have also developed a concerted campaign to highlight and share these concerns more widely.

This is in direct response to the major financial pressures and hardship our customers are now being forced to endure unnecessarily.

We have made four evidence-based submissions to the Work and Pensions Select Committee to inform their ongoing inquiry into Universal Credit.

These submissions have included five recommendations:

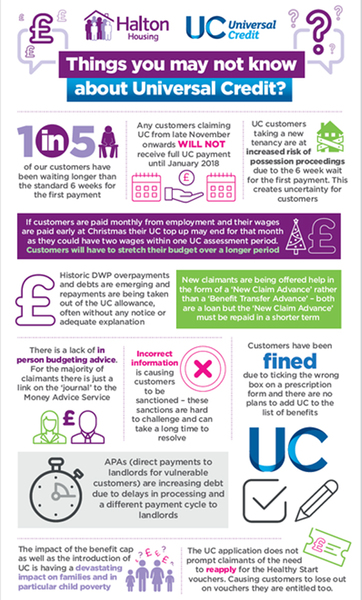

Beneath the headlines, there are also some other unexpected and unwelcome surprises lurking. We’ve tried to capture these in the following summary:

One of the most disappointing elements of Universal Credit has been the delay in payments being made to landlords under alternative payment arrangements (APAs). These were designed for vulnerable customers to help them sustain their tenancy. Instead, they are increasing debt, due to processing delays averaging eight weeks by the DWP and subsequent payments being made to landlords.

These delays are in addition to the initial six-week period. We also have cases where deductions have been made from the Universal Credit claim, but the payment has not then been made to the landlord.

“One of the most disappointing elements of Universal Credit has been the delay in payments being made to landlords under alternative payment arrangements.”

APAs become problematic for landlords and customers alike as Universal Credit is paid over 12 monthly payments each year, but the APA schedule is produced on a four-weekly basis (13 per year).

This means that on one of the schedules in each year, the customer’s payment will not be included.

It is unclear when this payment will be omitted. This leads to confusion as to whether it is a planned missed payment, or the claim has been cancelled and/or an APA has been suspended.

Recent announcements have demonstrated a willingness by government to listen.

Let’s just hope this continues and there is an opportunity to get some common sense to prevail.

After all, it’s in everyone’s interest for Universal Credit to be made to work, rather than penalise.

Nick Atkin, chief executive, Halton Housing Trust