Jules Birch is an award-winning blogger who writes exclusive articles for Inside Housing

Five points from the Autumn Statement

The Autumn Statement is a mixed bag. Jules Birch takes us through some of the details that have received less attention, from a welcome increase in the benefit cap to an underwhelming announcement on energy efficiency

Eight weeks after Liz Truss and Kwasi Kwarteng shrank the economy with their growth plan, chancellor Jeremy Hunt completed his reversal of almost all of their plans in his Autumn Statement.

He was speaking against a backdrop of dire forecasts of recession, unemployment, falling living standards and rising taxes that spoke of bad news to come for housing and tenants and landlords alike.

The complete rewrite of the Autumn Statement leaves a long list of tax increases and spending cuts in its wake, even if many of them will not take effect until after the next election and so may not happen. However, there was still a little hope amid the gloom.

Here are five points I picked up from the statement itself and the background documents.

The cap and the freeze

Perhaps the most surprising thing about the statement – with a nod to expectations management by the Treasury – is that there is also some good news. The announcement that the government will stick to previous pledges to increase benefits (as well as pensions and the minimum wage) in line with prices was not completely unexpected, but will still come as a relief to tenants and landlords alike.

“The main thresholds for families will now increase to £22,020 a year outside London and £25,323 in the capital”

But Mr Hunt’s decision to increase the overall benefit caps by the same amount is much more of a surprise. Without this, thousands more households faced being capped as their benefits rose to hit thresholds that have been frozen since they were cut in 2016.

The main thresholds for families will now increase to £22,020 a year outside London and £25,323 in the capital. The cost is estimated at £315m in 2023-24 and almost £2bn over the next five years.

"If confirmed, freezing Local Housing Allowance rates for private renters will inevitably be rising rent arrears and homelessness"

Yet, these are still far below the average earning figures that were misleadingly used to justify the cap in the first place. And they leave people who are already capped facing rent increases with no extra income to pay for them.

Finally, buried deep in the background documents is more gloom: the assumption that Local Housing Allowance (LHA) rates for private renters will remain at 2022-23 levels, which have been frozen since April 2020. This despite rapidly rising rents.

If confirmed, the result will inevitably be rising rent arrears and homelessness.

Rents, rents, rents

Mr Hunt confirmed that the increase in social rents in England will be capped at 7% in April.

That is good news for social landlords when compared with the government’s favoured option of 5% in the consultation, and it means that they will not take as much of a hit to their rental income as they feared.

However, it is still a real-terms cut in that income, which will put pressure on investment in their stock and services as well as on staff pay.

At the same time, the value of the Affordable Homes Programme funding is being squeezed by inflation and even bigger increases in construction prices.

“The rent settlement is bad news for tenants who are not on housing benefit, since they will now face a larger increase than they might have hoped, even if it not the full 11.1% implied by the rent formula”

Capital spending plans at the Department for Levelling Up, Housing and Communities remain as they were in the Spring Statement, but a £1.2bn underspend last year has not been carried forward. After 2025, capital spending will only be increased in cash terms.

The rent settlement is bad news for tenants who are not on housing benefit, since they will now face a larger increase than they might have hoped, even if it not the full 11.1% implied by the rent formula. Landlords should bear in mind that the cap is ‘up to’ 7%.

Tenants on housing benefit are in less danger of being benefit capped thanks to the above decision, but the higher rent increase means the Department for Work and Pensions will now save less in housing benefit.

Curiously, the Treasury’s estimates of the savings from a 7% cap are far less than those that accompanied the consultation. The Autumn Statement background documents estimated them at £630m over the next five years, whereas the impact assessment estimated £3bn in savings over the same period.

Some of the difference could be down to some more good news for registered providers – their supported housing will be exempted from the 7% cap and they will be allowed to raise their rents by the full Consumer Price Index plus 1%.

Finally, it was not part of the Autumn Statement as such, but there was good news for shared owners shortly afterwards as the National Housing Federation announced that housing associations will also cap their rent increases at 7%.

Without this, many were facing increases of double that under leases linked to higher Retail Price Inflation.

Housing market fears

Two Autumn Statement announcements suggest that the Treasury has already priced in a significant housing market downturn over the next two years.

First, the supposedly permanent cut in stamp duty announced by Mr Kwarteng will now be temporary. The increases in the thresholds will now only run until the end of March 2025, saving almost £4bn over the subsequent three years.

“One borrower who contacted me on Twitter said that it only covers £160 of their monthly mortgage interest payments, leaving them to find £350 out of their benefits”

By contrast with the permanent cut, this at least makes some kind of sense and reverts to the familiar playbook of a stamp duty holiday supporting the market during a downturn by bringing transactions forward.

There was also some help for homeowners who will struggle with their mortgage repayments. Support for Mortgage Interest (SMI) loans will now be available after three months rather than nine, and the government will abolish the zero earnings rule to allow them to continue receiving help while working and on Universal Credit.

However, that help only goes so far. In previous downturns, SMI was a benefit rather than a loan and it is still paid on a standard interest rate of 2.09%, which is far below actual mortgage rates. One borrower who contacted me on Twitter said that it only covers £160 of their monthly mortgage interest payments, leaving them to find £350 out of their benefits.

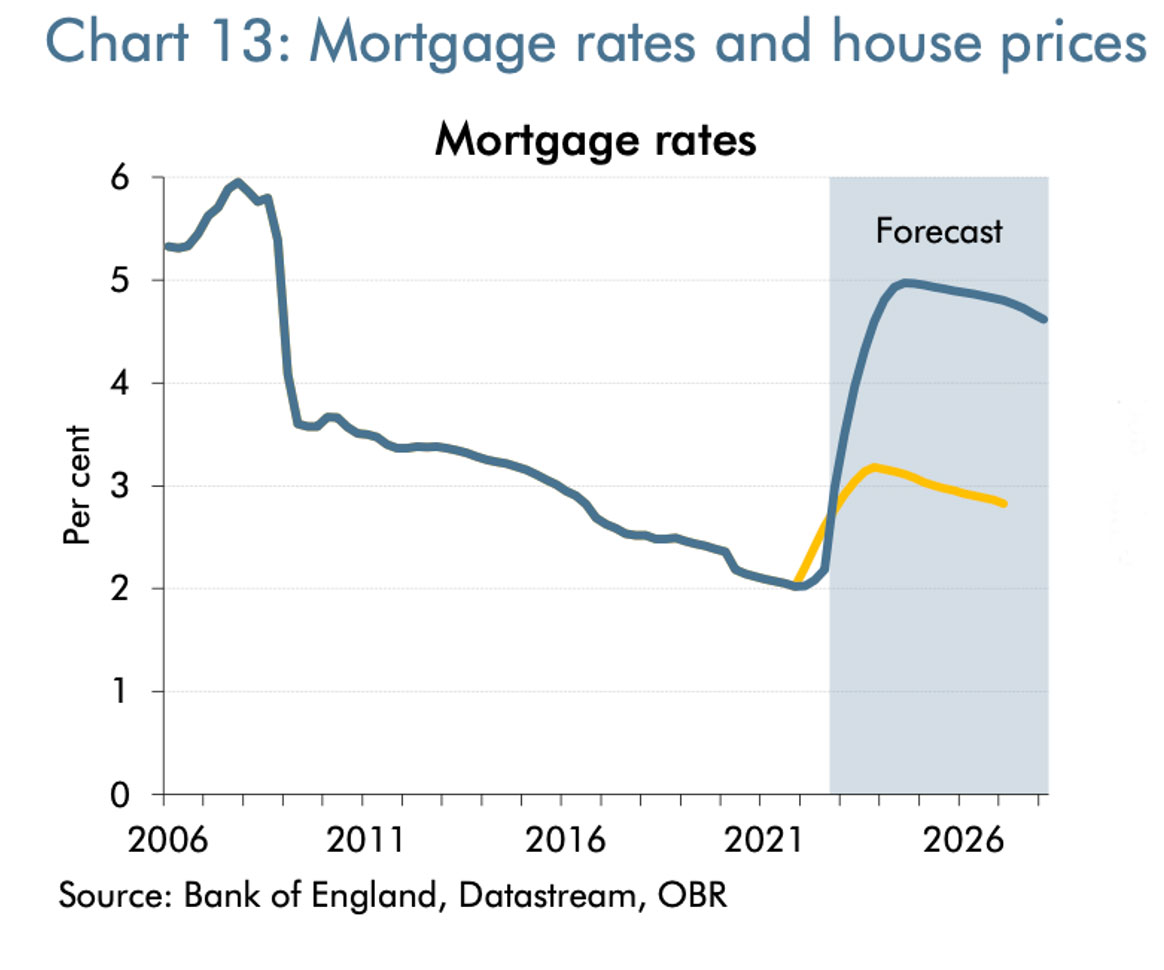

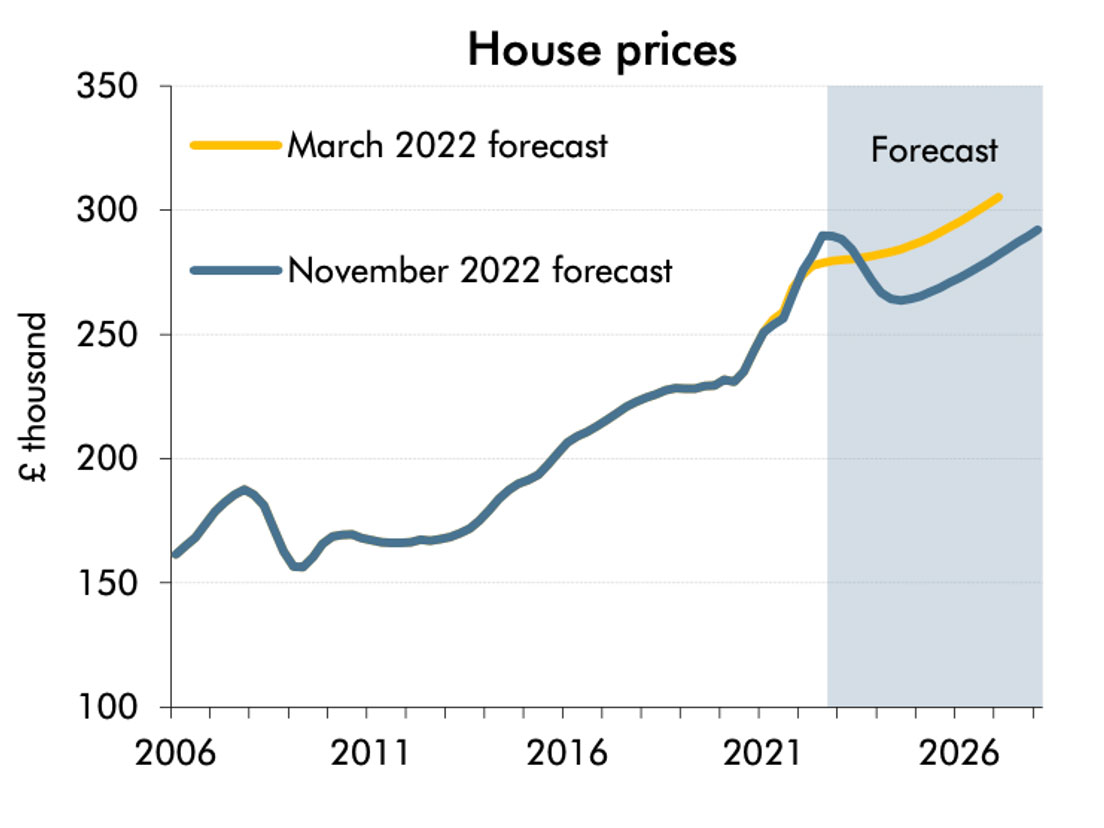

The Office for Budget Responsibility has forecasted that house prices will fall by 9% over the next two years. Given that it is also forecasted far higher mortgage rates than in March alongside a recession, living standards falling at the fastest rate on record and the highest tax burden for more than 70 years, this seems a surprisingly small decline. It is less than half of the increase in house prices seen since the start of the pandemic, for example.

“Rents are almost certainly not the bills that are worrying tenants most”

However, as former No 10 special advisor Toby Lloyd highlighted on Twitter, it also points to a depressing conclusion for first-time buyers: homes will not get much cheaper and mortgages certainly will get more expensive. Even if a downturn presents an opportunity for some, it will not last very long.

Needless to say, the tax increases did not include any of the reforms of property taxation that I trailed in my pre-Autumn Statement column that might have helped to improve a system that seems rigged against younger people without access to family wealth at the same time as they raised revenue.

Mind the cliff-edge

Rents are almost certainly not the bills that are worrying tenants most.

Under the reduced energy price guarantee, a typical household will now pay £3,000 a year rather than £2,500 from April, saving the government £14bn.

This will be accompanied by a renewal of support for the most vulnerable households, including a £900 cost of living payment for households on means-tested benefits, £300 for pensioners, and £150 for people on disability benefits.

However, many vulnerable people will still be left out in the cold. National Energy Action pointed out that those not receiving the cost of living payments face an effective increase of 40% since the energy bill support scheme paid to all households this year is not being renewed.

That leaves many households facing a cliff-edge in support as they lose all help once they earn £1 more than what qualifies them for means-tested benefits and cost of living payments.

Many of them will also be social tenants facing the full 7% rent increase and private tenants whose LHA does not cover their rent.

Insulate, insulate, insulate

Some hope on energy bills came from the chancellor’s announcement of a target to cut energy usage by 15% by 2030, which is to be masterminded by a new Energy Efficiency Taskforce and new funding of £6bn from 2025 to 2028.

At first sight, this is a welcome sign that the government is taking energy efficiency seriously at last. Yes, it is long overdue, given the slump in home insulations since green energy schemes were cut in the 2010s, but at least it represents progress.

A report on Bloomberg suggested that millions more households in homes on council tax bands A to D will soon qualify for insulation grants in a signal of further announcements to come.

However, at second glance, it is more underwhelming: there is an urgent need for homes to be made more energy efficient now, not 2025, and the funding merely continues what we have seen in this parliament. There is also no sign of the urgent and comprehensive plan that the Climate Change Committee called for in a letter to the chancellor recently.

Jules Birch, columnist, Inside Housing

Sign up for the IH long read bulletin

Already have an account? Click here to manage your newsletters