How can housing providers get back to building homes post Brexit and COVID-19?

As housing associations play catch-up with development during unprecedented times, Catherine Andrews and Stefan Harris-Wright of law firm Birketts explain what landlords need to look out for legally

In association with:

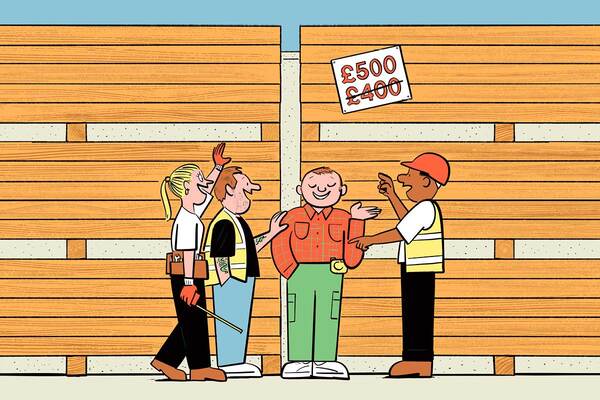

The double-whammy of COVID-19 and Brexit has caused widespread disruption to the sector – either through delayed schemes, construction labour shortages and soaring costs. Many housing associations reported a fall in completions in their last financial year and are having to grapple with rising costs and shortages as they catch up. But what has this meant from a legal perspective for social landlords? Catherine Andrews and Stefan Harris-Wright of leading law firm Birketts assess the situation.

What have been the implications of construction material and labour shortages on the sector?

Stefan Harris-Wright (SHW): From the viewpoint of legal advisors, the impact has been tangible. We act for a wide range of clients in the development sphere, from housing associations, house builders and local authorities, to developers, contractors and subcontractors. We are finding that clients are regularly having to re-evaluate development appraisals to take account of increased construction costs, caused largely by material and labour shortages.

These factors originate in the supply chain, so contractors and subcontractors are grappling with the same uncertainties. That said, there is still huge housing need in the UK – a demand which, when coupled with factors such as the Help to Buy, low-interest rates and (formerly) reduced stamp duty, seems to be ensuring that demand continues to outstrip supply.

Catherine Andrews (CA): The supply chain is being squeezed by a ‘perfect storm’ of unforeseen commercial factors. Whether it’s Brexit, COVID-19, fuel shortages or the skills gap, we are finding that contractors and subcontractors, in particular, are finding themselves tied into contracts which are becoming less and less commercially viable. This applies to new build contracts and contracts for maintenance.

I am regularly being asked to advise clients in the supply chain on how they can get out of contracts which were entered into before the recent turmoil in the market around construction materials and labour.

What are you seeing on the ground specifically involving housing associations? How significantly is it affecting development timetables?

SHW: Unlike mainstream house builders, housing associations often tend to procure new development via single main contractors rather than through a network of trade contractors. Main contractors are having to manage the current plethora of market uncertainties by increasing prices and extending construction programmes to manage the risk profile of their development programmes. Housing associations are often having to value engineer agreed designs to reduce costs and specify materials which are less likely to suffer from delays due to shortages.

Contractors are seeking advance payments more often than I have seen in the past, in order to provide cash flow to pay for materials before they are delivered to site, thereby providing increased programme certainty. Advanced payments are an established way for contractors to de-risk the possibility of late material deliveries, but prior to the current market uncertainties, they were more often the exception than the norm. I have seen that trend gradually being reversed over the past six to 12 months or so.

Inevitably, contractors and builders are looking to build additional flexibility into their construction programmes to mitigate the potential impact of market uncertainty on development timetables. Contractors are reticent to take the risk of these factors, for fear of incurring often significant damages for delayed completion due to unpredictable factors outside of their control.

Catherine Andrews is a partner in the construction and engineering team at Birketts. She specialises in construction disputes, working for main contractors, subcontractors, developers and other construction professionals, and for both public and private sector clients. Ms Andrews has experience of all the standard form construction contracts, including JCT and NEC.

Stefan Harris-Wright is head of the construction and engineering team at Birketts. He acts for housing associations, local authorities, developers, funders, contractors, subcontractors and consultants. He is familiar with all of the industry standard form construction and engineering contracts, and related bespoke amendments.

What should associations look out for at the moment when negotiating construction contracts? In this context, how has the bargaining position changed?

CA: Building contracts are obviously a key tool for clients in effective risk management of development projects, and housing associations are no exception. My experience is that the majority of direct procured capital projects in the affordable housing space continue to be procured via one of several commonly used industry standard forms of building contract, such as JCT (Joint Contracts Tribunal), NEC (New Engineering Contract) and PPC2000 (Project Partnering Contract for a single project). These contracts can provide some protection to contractors in relation to increased costs and delays caused by issues related to labour and materials. For example, JCT contracts include a right for a contractor to claim an extension of time if the works are delayed by ‘force majeure’ [a contract clause which can change the obligations and/or liabilities of parties when an unforeseeable or extraordinary event occurs].

Our experience is that housing associations, like any developer, are having to enter into negotiations with contractors on matters which, as little as 12 months ago, were unheard of. It continues to be the case that the parties will often include bespoke amendments to these forms of building contract, rather than relying upon the risk profile set out in the standard contracts. The majority of development projects continue to be procured on the basis of amended versions of popular and established industry standard form contracts.

What impact has the COVID-19 pandemic had in regard to negotiation of contracts?

CA: Our sense is that many contractors and subcontractors were left ‘holding the baby’, so to speak, when it came to absorbing the increased costs of reduced efficiency and unproductive working time caused by the pandemic. Naturally, these factors would have been most acutely felt on schemes which were in contract and on site during 2020 and early 2021.

Developers generally took the view that the pandemic was an unprecedented situation and were sympathetic when it came to granting extensions of time. However, cost increases were another matter and the supply chain was left to absorb these costs as best it could.

As with labour and material shortages, contractors are now aware of the need to manage risk by effective negotiation of their contracts in respect of COVID-19-related risks. We are finding that contractors will routinely insist upon their own bespoke clauses being included in contracts in order to address these risks.

What are we likely to see with this situation in the medium to long term?

SHW: Time will tell, but for now it seems as though the prevailing market conditions relating to labour and material shortages will continue for some time. In particular, the labour problem is not something that can be fixed overnight. The skills shortage in construction was well documented even before the double-whammy of COVID-19 and Brexit loomed onto the horizon.

While the demand for new office and retail space has declined, our sense is that the construction sector continues to be buoyed by the significant growth in areas such as residential, infrastructure, logistics and light industrial. We anticipate that the supply chain will continue to insist on bespoke contractual protections until we see the market returning to something like normality, whenever that may be.