You are viewing 1 of your 1 free articles

Shared ownership buyers confused about tenure, research shows

The majority of residents in shared ownership schemes are unaware that they can move between properties and are put off increasing their stake in a home by high costs, according to a new survey.

The survey, which was carried out by housing association Aster Group and YouGov, asked 200 people who own homes through shared ownership schemes what they thought of the model in a bid to ascertain why take-up could be stifled.

Just 14% of those surveyed said they had received information about shared ownership via the government, with most learning of schemes through housing associations.

More than half weren’t aware that they could move between properties, and of those who did know, 27% were unsure of the process to do so.

Meanwhile only 10% had increased their equity stake, a process called staircasing, with 63% of people who hadn’t saying that affordability was the main barrier.

When asked what would make the process easier, 40% of those who had staircased said lower or no stamp duty on the higher ownership thresholds. A further 25% said a simpler mortgage application and 25% said a better understanding of staircasing.

But despite any concerns, 62% said they would recommend shared ownership to friends and family, while 59% said they thought there should be more shared ownership properties in their area.

The report also found that among the people who wouldn’t recommend the process, 59% said they found housing associations difficult to deal with and just under half (49%) said there were unexpected fees associated with buying and living in a shared ownership home.

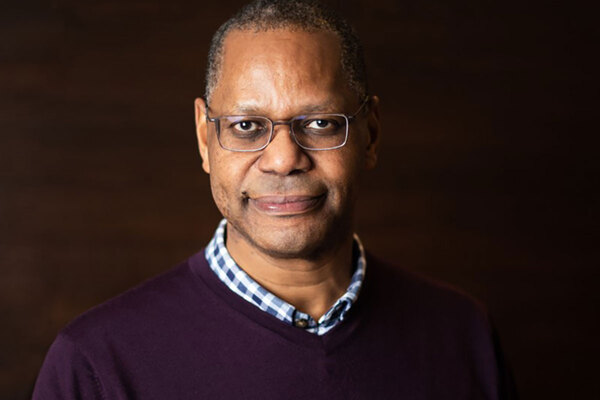

Bjorn Howard, chief executive of Aster, said: “It is wrong to simply view shared ownership as a kind of housing limbo. It offers people long-term security, a meaningful equity stake in the property market and the flexibility to make housing choices to suit their lifestyles.”

He said that the government and the housing industry needed to do more to help residents understand the potential of shared ownership schemes.