L&Q posts record-breaking surplus

London landlord generates huge surplus on back of booming market

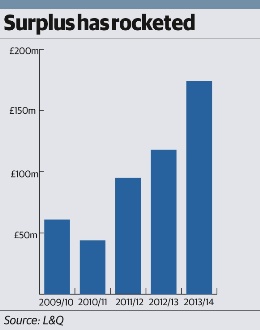

London housing association L&Q may double its development pipeline to 4,000 homes per year after it generated a £174m surplus, beating the sector record it set last year.

Video:

Waqar Ahmed, finance director at L&Q

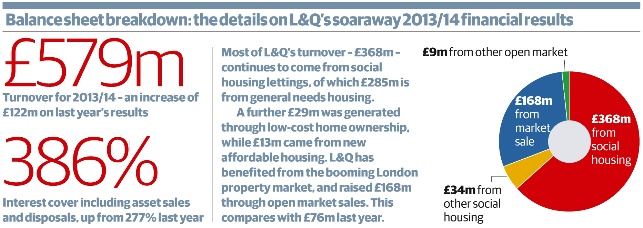

Its 2013/14 financial report, published this week, showed a turnover of £579m, up from £457m last year.

The results are among the first to be published this financial year, and are expected to lead a trend of London landlords reporting surpluses on the back of a soaring property market in the capital.

Last year 70,600-home L&Q became the first housing association to pass the £100m barrier with an annual surplus of £118m. It invested more than £300m in developing homes, completing 1,000, of which 300 were for open market sale.

It expects to complete a further 2,000 in the next financial year and has a pipeline of 13,000 homes planned over the next five years.

Waqar Ahmed, finance director at L&Q, said: ‘Based on our capacity, we have a £2.3bn development programme, which broadly equates to 2,000 homes per year. But we are generating surpluses so that capacity is increasing. We can expect that capacity to double over the next five years, so that 2,000 homes per year could become 4,000.’

£50m was invested in existing properties, and £100m on repairs.

The landlord sold 965 homes in the year, generating £40m of surplus, and its gearing ratio, which measures debt against assets, fell to 52% from 56%. Its interest cover - its ability to service debt from cashflow - rose to 386% from 277% last year.

Mr Ahmed said the landlord will raise debt through bonds and banks ‘if the need arises’, and has a system in place to allow it to access the capital markets within eight weeks.

Chief executive David Montague’s pay rose 4.6% to £246,000, while chair Turlogh O’Brien received £30,000 - a rise of £9,000 on last year. Total non-executive board remuneration was £137,000.

Mr Montague said that considering L&Q’s performance as a business since the recession, it was ‘responsible in its approach to pay’. He said the organisation had created a ‘sustainable housing model that can thrive without government funding’ remained ‘absolutely, completely committed’ to its social purpose.