Leaseholders could be trapped in homes for years as housing associations struggle to cope with scale of EWS crisis

Leaseholders could be left unable to sell or remortgage their homes for years as housing associations struggle to cope with the scale of the external wall system (EWS) crisis currently afflicting the housing market.

Inside Housing has spoken to dozens of leaseholders and shared owners who have been unable to secure dates from their housing associations for when crucial fire safety checks, also known as EWS assessments, can be carried out to satisfy mortgage providers.

Other associations have said that homeowners could be waiting for several years or even up to a decade for checks to be completed, with the largest landlords having to arrange investigations for thousands of buildings.

It comes as an increasing number of banks are requiring leaseholders to have completed EWS checks for their blocks before being willing to provide mortgages on individual flats.

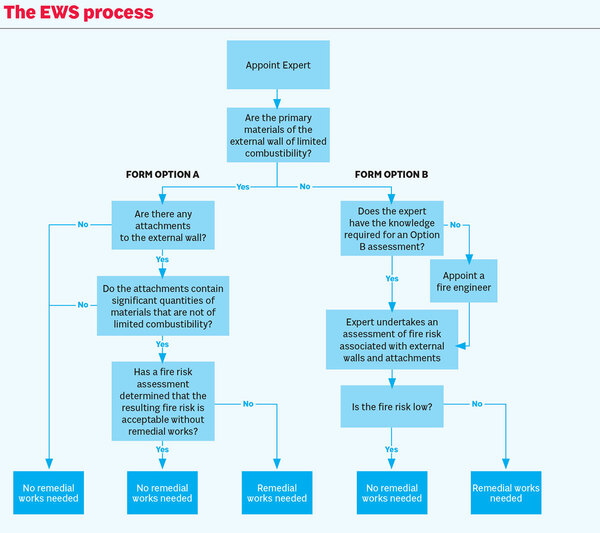

The EWS form was originally set up by the Royal Institution of Chartered Surveyors (RICS) for buildings taller than 18m, but mortgage providers are now demanding the forms for buildings well below that height, in some cases as low as 8m.

If a completed EWS form gives a building a clean bill of health, then a mortgage provider will lend on the building. However, if it deems that remedial works are needed, leaseholders could be unable to sell for months or even years until the work is completed.

Inside Housing is aware of a number of instances in which associations have told leaseholders that they will be unable to carry out the checks on their blocks because of the costs.

In a letter sent to one leaseholder living in a block in Willesden, north-west London, G15 landlord Catalyst said: “In the case of existing buildings, to evidence that a building meets government advice, building owners would need to undertake complex and intrusive inspections on all of their buildings.

“It would take a lot of time and resource, and as so, this means that many building owners, including Catalyst, cannot provide the forms.”

Catalyst has told Inside Housing that in the case of the Willesden building it was under 18m and predominantly made of brick and so it would not expect lenders to require this form. It added that its customers’ safety was of utmost priority and that it is prioritising the remediation of taller buildings before starting work on the rest of its blocks.

RICS created the EWS form in December to try to unlock the housing market after hundreds of leaseholders living in blocks taller than 18m were unable to sell or remortgage because of potentially dangerous cladding.

However, in January the government brought out new advice on combustible materials that called on building owners to assess and manage the risk of external fire spread to buildings of any height.

This has resulted in mortgage providers requiring EWS forms for nearly all multi-occupied residential blocks, to minimise the liability they would have on a property if it required major remediation work.

This mortgage impasse has led sector groups such as the National Housing Federation (NHF) and the G15 to put pressure on the government to come up with new guidance to overcome the current crisis and allow sales to proceed.

In some cases, associations are holding off carrying out the checks until government guidance is made clearer.

In correspondence between Hyde and one leaseholder living on the Packington Square Development in Islington, the housing association said it was waiting for the government to clarify what will be legally required before carrying out inspections on all of its buildings. It added that the reason for holding off was to protect leaseholders from the costs of these works.

Neal Ackcral, chief property officer at Hyde, told Inside Housing that there is “an issue between mortgage lenders and government that is beyond our control” but that it “totally sympathise[s]” with leaseholders and will support them “in any way we can as part of their sale or staircase enquiry”.

In an increasing number of cases Inside Housing has come across, housing associations are now looking to pass the costs of the checks and potential remediation works on to leaseholders.

In one explanation to a leaseholder living at the Richmond Hill development in Salford, landlord Irwell Valley Homes said that the possibility of leaseholders incurring costs was the reason it was not carrying out the EWS checks.

Irwell Valley Homes told Inside Housing that a chartered fire engineer’s assessments of the block led it to believe that there was no need for intrusive checks.

It added: “Carrying out costly work that is not necessary and which leaseholders pay for, to satisfy mortgage lenders, is not the answer.”

L&Q, the country’s biggest housing association developer, has told its leaseholders that it will not be able to share the timescales for inspections of its 191 buildings taller than 18m until September.

For its buildings under 18m, which L&Q estimates could number well over 1,000, it has said the earliest it can provide a timetable for checks is April 2021. Completing these checks is still likely to take several years after that.

Peabody, which estimates that it has more than 2,000 buildings taller than 11m, has told leaseholders that it could take up to 10 years for all buildings to be checked and made fully compliant, at a cost of more than £100m to the housing association.

In a letter sent to one leaseholder living in a Peabody block, the landlord explained that one EWS check could cost around £40,000 with an additional £57,000 needing to be paid just for the scaffolding to be erected if intrusive checks were needed.

A spokesperson for Peabody said that working through all of its EWS assessments is a “complex and lengthy process” and that it understands “the deep frustration and anxiety felt by the thousands of people who are in this difficult position through no fault of their own”.

The delays to the checks are further exacerbated by the lack of qualified engineers able to carry out the checks.

In a written answer published last week, housing minister Chris Pincher revealed that there were only 291 chartered fire engineers who are available to carry out EWS assessments.

According to a tweet by Southern Housing, it is currently taking fire safety consultants between eight and 12 weeks to complete an EWS form on one building.

As a result of these time pressures, most associations are prioritising the highest-risk buildings first, which are often based on height.

This means many of the smaller buildings could be those waiting the longest for checks to be finished.

In answer to a written parliamentary question earlier this month, Mr Pincher said that mortgage providers would be holding a round table with the government to discuss the issue and were reviewing their policies and guidance to valuers on the use of the form.

Victoria Moffett, head of building and fire safety programmes at the NHF, said that at the heart of the EWS issue is systemic failure of the building regulatory systems and while associations are checking buildings, it is a long and complex process.

“We’re working with the government and the wider industry to resolve the issues around EWS1 requests.

“In the meantime, we’re calling for the government to further increase capacity for conducting remedial works, and to consider how it can further support people to move home safely and confidently.”

Housing association responses in full

A Catalyst spokesperson: “Like other housing associations, Catalyst and our leaseholder customers have faced unexpected delays and costs brought about by the introduction of the EWS1 form.

“We are trying our best to resolve these problems however, this is a sector wide issue and currently there is no quick fix. The form was intended to speed up sales in blocks over 18m, but it is now being asked for by lenders as a requirement in a significant number of blocks that are under 18m and made from brick and block construction.

“In this instance, we were sorry to hear that our customer was facing difficulties caused by the lender’s requirement of an EWS1 form. As the block is under 18m and predominately made from brick, we would not expect lenders to require this form. We have provided information on the building’s construction and as-built drawings to prove that the building is safe and it is unfortunate that lenders have not found this sufficient.

“Our customers’ safety is our utmost priority and we are prioritising the remediation of our taller buildings before carrying out a programme of works for the rest of our blocks.”

Claire Griffiths, executive director of growth, development and assets for Irwell Valley Homes said: "This is a difficult situation and we feel for the many leaseholders who are affected by this across the country. The safety of residents is our number one priority. We carry out regular fire inspections and work with accredited fire risk assessors and chartered fire engineers, who carry out fire risk assessments and investigations on our behalf. None of these assessments at Richmond Hill have led us to believe that we should be carrying out any further intrusive and costly works. As a landlord we adhere to the advice of these specialists to effectively manage fire safety and provide value for money for residents.

"Not all mortgage providers stipulate an EWS, but where they do this leaves sellers in a difficult situation and we understand their frustration. Housing associations have a duty to provide value for money for their tenants and leaseholders. Carrying out costly work that is not necessary, and which leaseholders pay for, to satisfy mortgage lenders is not the answer. This issue is not going away and as a sector we need to collectively address this and work with the other professionals involved to find a solution. We are trying to drive this forward through our peer groups and engagement with government bodies, but we need to work collectively to move out of this 'stale mate' position which is causing uncertainty and frustration for leaseholders."

Neal Ackcral, chief property officer at Hyde, said: “Our customers’ safety is of paramount importance to us and we continue to focus on our Safer Homes programme to address the issues that we have identified from our intrusive fire inspections.

“However, there is an issue between mortgage lenders and government that is beyond our control and that needs to be resolved sensibly.

“We totally sympathise with our leaseholders and will continue to support them in any way we can as part of their sale or staircase enquiry.”

A spokesperson for L&Q said: “Like many housing associations, L&Q owns a large number of buildings affected by the new building safety guidance, so we're not able to inspect, test, and then carry out works on them all at once. Instead we must prioritise our existing buildings based on risk. Our highest risk buildings, defined by height, occupancy and building materials, among other factors, will be inspected first.

"We are currently in the process of assessing all of our buildings and prioritising them for inspection. We will be able to share timescales for the inspections of buildings that are 18 metres or higher with our residents in September. We expect to complete this exercise for our remaining buildings by April 2021 and will be able to inform residents about their schedule for inspections at this time.

"We recognise that this may be disappointing news for residents whose buildings fall into the second category and we apologise for this. Along with our partners in the sector we are continuing to call on Government to alleviate the stress that this situation is causing by working with mortgage lenders to help them relax their stance and begin lending on these properties again.”

A Peabody spokesperson said: “We understand the deep frustration and anxiety felt by the thousands of people who are in this difficult position through no fault of their own. We’ll do anything we can to support residents, including making representations to valuers or lenders where possible and discussing whether leaseholders can temporarily sub-let the property on a case by case basis.

“We are working through a very large number of buildings and have to prioritise on the basis of safety and risk assessments. Unfortunately, EWS1 assessments cannot be carried out quickly like a homebuyers building survey. It is a complex and lengthy process which is exacerbated by lenders and valuers asking for EWS1 forms on buildings that are out of the scope envisaged by RICS and the government. We understand that they are working with the professions and mortgage lenders to try and resolve these issues for leaseholders in lower-rise, lower-risk buildings and we hope this can be achieved in the near future.”

Sign up for our daily newsletter

Already have an account? Click here to manage your newsletters