You are viewing 1 of your 1 free articles

Chancellor announces wage protection and boost to Local Housing Allowance

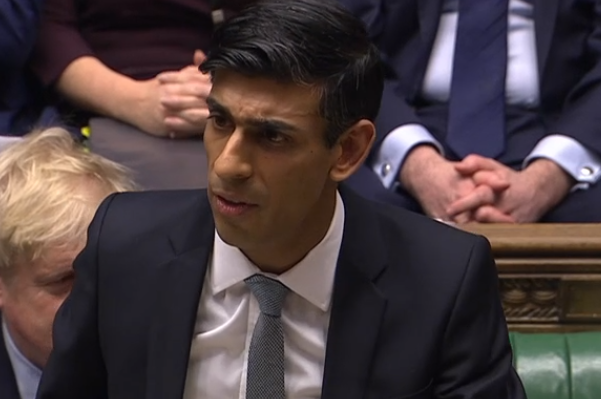

The chancellor has opened an unlimited fund to guarantee 80% of wages for “furloughed” workers, as well as boosting housing benefit in an “unprecedented” boost to the welfare state.

Appearing alongside Boris Johnson at tonight’s press conference, Rishi Sunak described the measures as “economic intervention unprecedented in the history of the British state”.

Mr Sunak also promised a reversal of the Local Housing Allowance freeze and an increase in Universal Credit by £1,000 a year. Homelessness charity Shelter said the government would need to go further on its housing benefit offer.

Mr Sunak pledged:

- A new ‘Coronavirus Job Retention Scheme’, open to every employer in the country. The scheme – to be operated by HM Revenue and Customs – will pay 80% of the salary of a ‘retained’ worker up to £2,500 a month. It will be backdated to 1 March and open initially for three months, with no limit set on its size.

- Local Housing Allowance (including for Universal Credit claimants) to be boosted to cover the lowest 30th percentile of market rents – effectively reversing the effect of George Osborne’s freeze on the benefit introduced in 2016.

- The Universal Credit Standard Allowance was boosted by £1,000 for the next 12 months with Working Tax Credits increased by the same amount. The minimum income floor for Universal Credit was suspended for anyone impacted by coronavirus, meaning it can be claimed by any self-employed people out of work at a rate equivalent to statutory sick pay.

- The next quarter of VAT payments is deferred, with businesses given until the end of the year to pay them.

- Self-assessment tax payments were deferred until January 202.

- The Business Interruption Loan Scheme was made interest free for one year as opposed to six months.

The Job Retention Scheme will open “within weeks” and be up and running by the end of April, Mr Sunak promised.

He said: “The actions I’ve taken today represent an unprecedented economic intervention to support the jobs and incomes of the British people.

“A new comprehensive job protection scheme and a significantly strengthened safety net. Unprecedented measures for unprecedented times.”

The government has already acted to ban evictions from social and private housing, but had faced calls to secure people’s income to ensure they did not simply build up arrears.

It came as the government announced the closure of shops, restaurants and bars in a bid to combat the spread of the virus – a move that leaves millions of workers in a state of uncertainty over their economic future.

Key passages from Rishi Sunak’s announcement

“Today I can announce it for the first time in our history the government is going to step in and help to pay people's wages.

We are setting up a new Coronavirus Job Retention Scheme. Any employer in the country, small or large, charitable or nonprofit will be eligible for the scheme.

Employers will be able to contact HMRC for a grant to cover most of the wages of people who are not working, but are furloughed and kept on payroll, rather than being laid off. Government grants will cover 80% of the salary of retained workers, up to a total of £2,500 a month. That's just above the median income.

And of course employers can top up salaries further if they choose to.

That means workers in any part of the UK, can retain their job, even if their employer cannot afford to pay them and be paid at least 80% of their salary.

The Coronavirus Job Retention Scheme will cover the cost of wages backdated to 1 March, and will be open initially for at least three months. And I will extend the scheme for longer if necessary. I am placing no limit on the amount of funding available for the scheme. We will pay grants to support, as many jobs as necessary.

And can I put on record my thanks to the Trades Union Congress, the CBI [Confederation of British Industry], and other business groups for our constructive conversations.

We said we would stand together with the British people. And we meant it. We have never had a scheme in our country like this before and we're having to build our systems from scratch. I can assure you that HMRC are working night and day to get the scheme up and running, and we expect the first grants to be paid within weeks, and we're aiming to get it done before the end of April.

But I know that many businesses are hurting now. I've already taken extraordinary measures to make cash available to businesses through loans, grants and guarantees.

I can announce today that the coronavirus business interruption loan scheme will not be interest free, as previously planned for six months. It will now be interest free for 12 months. And thanks to the enormous efforts of our critical financial services sector, those loans will now be available starting on Monday.”

He added:

“We will also act to protect you if the worst happens to strengthen the safety net. I'm increasing today the Universal Credit standard allowance for the next 12 months by £1,000 pounds a year for the next 12 months. I'm increasing the Working Tax Credit basic element by the same amount as well.

Together these measures will benefit over four million of our most vulnerable households.

And I'm strengthening the safety net for self employed people by suspending the minimum income floor for everyone affected by the economic impacts of coronavirus. That means self employed people can now access in full Universal Credit at a rate equivalent to statutory sick pay for employees.

Taken together, I'm announcing nearly £7bn pounds of extra support through the welfare system to strengthen the safety net, and protect people's incomes and to support the self employed through the tax system.

I'm also announcing today that the next self assessment payments will be deferred to January 2021.

As well as keeping people in work, and supporting those who lose their jobs or work for themselves, our plan for jobs and incomes will help keep a roof over your head.

I'm announcing today nearly £1bn pounds of support for renters by increasing the generosity of housing benefit and Universal Credit, so that the local housing allowance will cover at least 30% of market rents in your area.

The actions I've taken today represent an unprecedented economic intervention to support the jobs and incomes of the British people.”

More on coronavirus

To see all our coronavirus coverage to date – including the latest news, advice to providers, comment and analysis – use the link below.