The case for flooring to be included when social homes are let

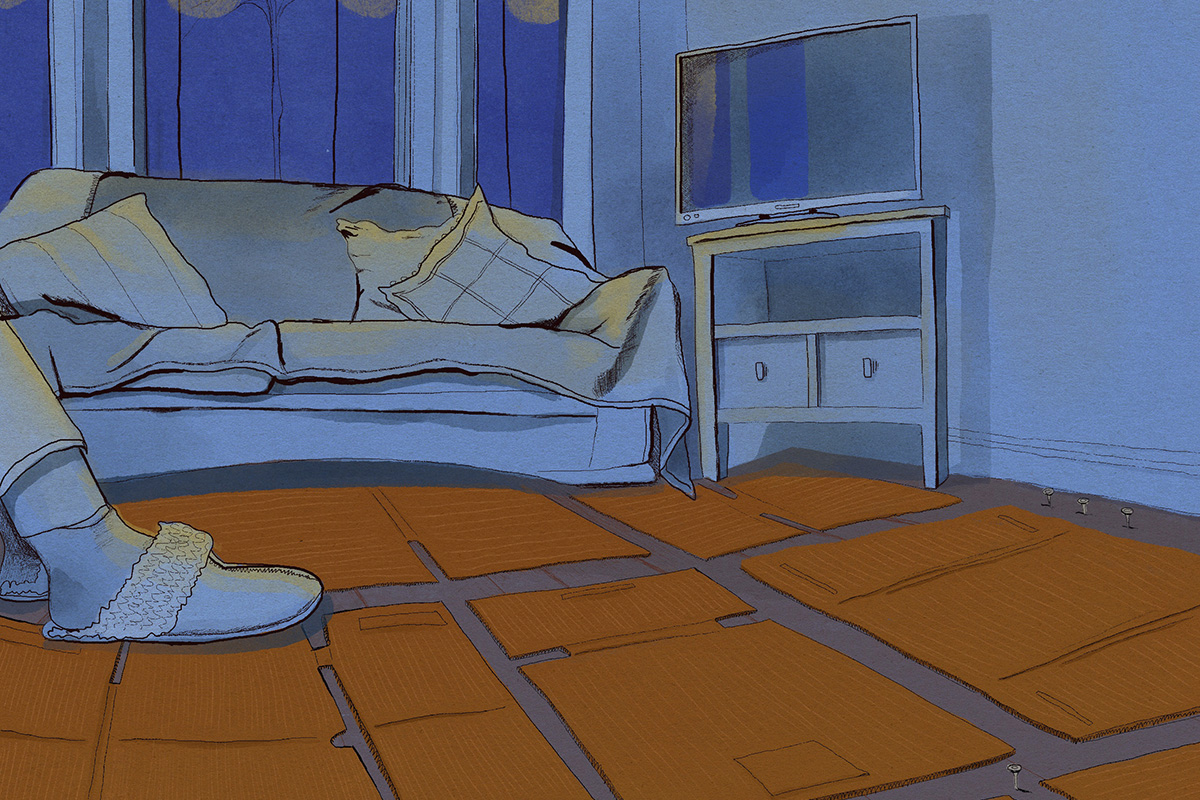

Wales has just passed regulations that new social lets must come with flooring included. But with hundreds of thousands of families across the UK still living in social homes without carpet and flooring, should English and Scottish social landlords follow suit? Katharine Swindells reports. Illustration by Laurel Molly

It has been more than a year since Gemma and her four children moved into their home in Evesham, Worcestershire, but there are still cardboard boxes everywhere – no longer full of belongings, but laid flat to cover the exposed floorboards. The unvarnished wood has large gaps between the planks, with splinters and metal nails sticking out.

“It’s so cold upstairs it feels like the windows are open,” she says. “When you put your hand to the cracks you can feel the cold air coming through.”

Gemma’s family moved into the social rented home after being evicted from their private rental of almost a decade. The mould in their previous home was so bad that much of their furniture had to be thrown away, and their new home came with nothing included. Their first priority had to be a fridge-freezer and mattresses, put straight on the floor to sleep on until Gemma got bed frames.

Every month there seems to be something else that needs paying for, meaning the carpets have to wait. But Gemma worries constantly that her children might hurt themselves on the nails and splinters, or that food will fall down the cracks and grow mould or attract vermin.

Getting a housing association property was supposed to be Gemma’s fresh start, but a year on she still feels unable to settle while the property feels cold, dirty and not like home.

Stigma and shame

Research this year by End Furniture Poverty found that 1.2 million UK adults are living without flooring in their home, of whom almost two-thirds – or 760,000 adults – are social housing tenants.

The new Welsh Housing Quality Standard (see page 50) will mandate that all social lets must include flooring, but it remains to be seen whether Scotland or England will follow suit. Standard practice across most of the social rented sector is not to include carpet or flooring in new lets, and many rip out flooring from previous tenants. Many new tenants are taking on debt to pay for it, or else living in cold, unwelcoming homes. But when those in social housing are among the country’s poorest, why is flooring not included with new tenancies, and how is this lack of provision affecting people?

A survey conducted in late 2022 by consultancy Altair with the Longleigh Foundation found that just one in 10 social landlords across England, Scotland and Wales provide flooring (beyond the kitchen and bathroom) in all of their properties. And 42% do not provide flooring in any of their properties.

A survey by Resident Voice Index in summer 2023 found that half (49.6%) of the UK’s social tenants said there were no floor coverings in their home at all when they moved in, and a further 27.5% said it was only “partially” equipped with floor coverings, meaning

no flooring in the bedrooms, living room or hallway.

This lack of flooring provision can have significant impacts, not least the financial burden – which Altair estimates at an average of £920 a home. A quarter of tenants who did not have floor coverings when they moved in took out a loan to fund it. And for those who simply cannot afford it, a lack of flooring means the house is harder and more expensive to keep warm, dirtier, less safe and more likely to cause noise issues for downstairs neighbours.

Moreover, a lack of flooring can contribute to stigma, “feeling poor” or struggling to settle in. Two-thirds of tenants said they felt ashamed to invite people over.

To those outside the social housing sector, says Claire Donovan, head of policy, research and campaigns at End Furniture Poverty, it seems “a wasteful, bonkers thing” that housing for the people on the lowest incomes in the country does not come with flooring included. But Ms Donovan says that in the sector, it is “a long-standing tradition that social [housing] comes with nothing in it”.

When asked why they do not provide flooring to new tenants, landlords cite a number of key reasons and barriers. Some mention liability for trips and falls, or concerns about dirt or fleas, although Ms Donovan says there are simple solutions to “deal with all that”. She adds that another “big excuse” is that tenants do not want pre-owned flooring. But, she notes: “For someone fleeing domestic violence or coming from homelessness, if the choice is between flooring with marks on it, or nothing at all, you’re going to take the flooring.”

Anne-Marie Bancroft, who led the research into floor coverings by Altair, says: “The majority of people we speak to are bought into the moral case, they just don’t believe there’s a business case.”

Altair’s survey found that the leading barrier cited was financial cost to the organisation, followed by unnecessary delays to the void process and the ongoing maintenance of the floor coverings.

But there is a 35,000-home housing association in the North East that has made the business case more than stand up. “All the challenges we’ve had, all the ‘what ifs’ – there’s always an answer,” David Ripley, Thirteen Group’s executive director of customer services, tells Inside Housing, as we walk around two freshly carpeted re-lets in Middlesbrough. “But there’s got to be that real commitment.”

In 2018, Thirteen piloted an enhanced standard for empty homes and applied it to 100 properties. It found that those tenancies performed markedly better across key metrics such as re-lets, arrears and reported

repairs. On exploration, Thirteen found that flooring and paintwork were the most valued elements, so rolled that out as standard across its portfolio.

Where carpets and flooring are in good enough condition from the previous tenant, they are kept or replaced in part, while around 60% get new carpet and flooring across the whole property and fresh paintwork, Mr Ripley says.

Thirteen spends around £1.5m a year on carpets, which is matched by the amount it saves from the reduction in voids: now down from 3,500 a year to around 2,300, and fewer repairs due to the tenants taking better care of the property. The cost of doing this work is much lower for the landlord than it would be for the tenants, because they were able to buy from direct retailers and negotiate with local fitters.

“My job was to make the financials stack up, but actually what we needed to start with was that moral buy-in,” Mr Ripley says, as we walk around an empty property in North Ormsby, which is among the top 1% most deprived wards in England. The home smells of fresh paint, the plush grey carpets are newly fitted and large French doors open out onto neat communal gardens. All the properties surrounding the gardens are Thirteen’s, and they are all brought up to this standard before they are re-let.

Other housing providers have not gone so far, but are finding other ways to fill the gap, such as introducing a policy to leave old flooring in when it is in good enough condition, or partnering with local charities for donations of pre-used flooring. But Thirteen is one of the few across the country that has committed to the investment across its portfolio.

Holistic view of budgets

Other landlords in different parts of the country might not achieve the same savings if they copied Thirteen, but Ms Bancroft says housing associations need to have a more holistic view of their budgets to understand the financial impact. “The void allocations budget sits separately from money advice, tenancy support and tenancy sustainment budgets, so you might not be able to see that it’s worth it,” she says.

Of course, it may be that at some point the housing associations have no choice. In October, the publication of the Welsh Housing Quality Standard set out requirements for social landlords to provide flooring, either new or left over from previous tenants. End Furniture Poverty is calling for England and Scotland to introduce the same standards, and to move towards offering at least 10% of social housing stock fully furnished.

Another option is for landlords to help tenants with the cost of flooring, such as offering no-interest loans and grants. There used to be far more options like these, says Ms Donovan, but the cost of living crisis means demand is higher than ever, and charities are having to focus on food, fuel and bare essentials. She says: “The support for flooring is really, really limited… if you can’t get it through your housing provider, you’re pretty much scuppered.”

Gemma told Inside Housing that after five months, her housing officer applied for a grant for flooring for her from her housing association Rooftop Housing Group, but then said the application was rejected as the rooms were deemed too large, and so too expensive to carpet. Gemma also claims that she asked if it was possible to receive a grant for part payment, but that was also denied. Rooftop Housing says that an application was never made, and that Gemma instead received support in purchasing an oven.

So Gemma is carpeting her home one room at a time using a pay monthly scheme, spending hundreds of pounds more than if she had bought it outright. She has done the living room and is now paying off her younger children’s bedroom. Her hope is that in spring she can afford to do her older children’s room, but she knows it will be a freezing – and expensive – winter before then.

“I’m tempted to get it all done now and go into rent arrears, because it would save me so much money on my heating bill,” she says. “But I’ve not got the courage.”

Lisa Nicholls, executive director of operations at Rooftop, says: “We welcome the discussion around flooring in housing association properties.

“Currently, there is not enough government funding to enable [providing flooring] and while we always strive to ensure that our homes are rented out in a clean and safe condition, it is often necessary to remove carpets left behind by previous occupants for hygiene reasons. However, where appropriate, we will always clean and try to retain flooring ready for new tenants. We also accept applications to our Emergency Assistance Fund for carpets and flooring.

“In Gemma’s case, as soon as we were made aware of nails sticking out of her floorboards, we sent one of our repair team over to resolve the issue immediately.”

And while having decent flooring means tenants save money on energy bills, the housing association may also see the knock-on benefits: reduced demand on financial support services, fewer noise complaints and a decline in cases of damp and mould.

But even without those upsides, Mr Ripley says housing associations need to go back to their core mission. “We talk about trying to support people, but are we doing that?” he says. “Ultimately it’s about what do we stand for? Do we stand for concrete floors or not?”

Rooftop statement in full

Lisa Nicholls, executive director – operations at Rooftop Housing Group, says: "We welcome the discussion around flooring in housing association properties. Currently, there is not enough government funding to enable this and while we always strive to ensure that our homes are rented out in a clean and safe condition, it is often necessary to remove carpets left behind by previous occupants for hygiene reasons. However, where appropriate, we will always clean and try to retain flooring ready for new tenants.

“We also accept applications to our Emergency Assistance Fund for carpets and flooring. In Gemma’s case, as soon as we were made aware of nails sticking out of her floorboards, we sent one of our repair team over to resolve the issue immediately.”

Sign up to our Best of In-Depth newsletter

We have recently relaunched our weekly Long Read newsletter as Best of In-Depth. The idea is to bring you a shorter selection of the very best analysis and comment we are publishing each week.

Already have an account? Click here to manage your newsletters.