Back from the brink: how First Priority is attempting to rebuild

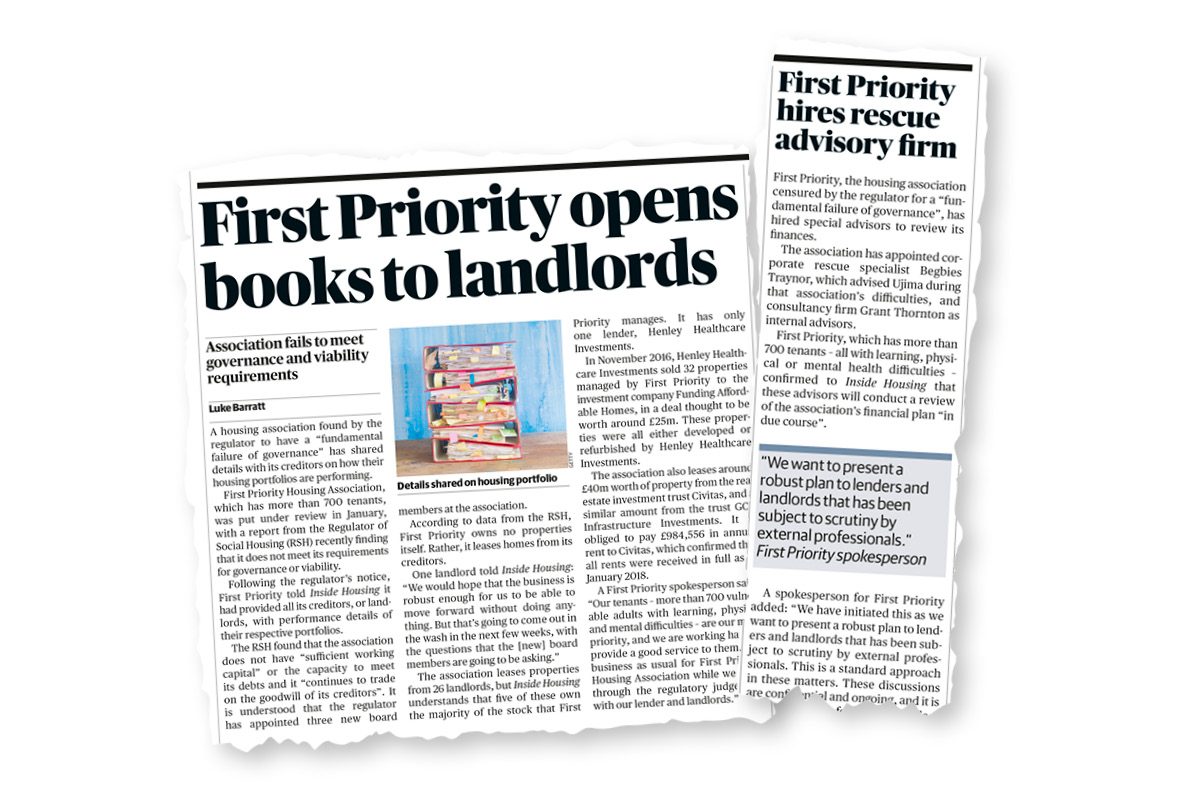

Supported housing provider First Priority can be seen as patient zero for the regulatory issues which have hit lease-based housing associations in recent years. Nathaniel Barker meets the provider to see how it is looking to rebuild and what lessons it has learned. Illustration by Nate Kitch

Usually when a small housing association gets into difficulty, the phone at the sector regulator rings off the hook. Larger housing providers keen for growth are quick to offer a takeover.

But when First Priority Housing Association was declared non-compliant in February 2018, nobody called.

The business model it operated was at the centre of the Regulator of Social Housing’s (RSH) concerns. It involved leasing all its homes from investors – meaning no assets were up for grabs to a would-be suitor. First Priority’s finances were in dire straits, with uneconomic lease deals and stock sitting empty, causing the organisation to haemorrhage money. Things had gotten so bad that it was on the brink of collapse, and an insolvency specialist was appointed.

First Priority can be seen as patient zero in the regulatory issues which have afflicted housing associations operating a similar model over the past three years.

Since its censure by the RSH, no fewer than 15 providers operating some form of the lease-based set-up have been declared non-compliant by the RSH, with more under investigation.

The way back to compliance for all these organisations remains unclear. In April 2019, the RSH said it was “hard to see” how lease-based providers could meet its standards.

To find out what hope the sub-sector has of changing the regulator’s mind, Inside Housing spoke to First Priority about the changes it has made three years on.

The lease-based model typically works as follows: a specialist developer, or aggregator, buys an ordinary home and adapts it for use as specialist supported housing (SSH). This is a niche tenure principally for adults with learning difficulties, brain injuries or mental and physical disabilities that can command high rent paid through housing benefit. The aggregator strikes a lease deal with a small housing association for a package of SSH homes, which requires the association to make monthly, inflation-linked payments over around 25 to 30 years. Then it sells the SSH and accompanying lease deal to an equity investor at a profit.

The housing association will seek to fill the stock with tenants via commissioning bodies – such as councils – and partner with care providers to deploy the necessary support.

Proponents of the model argue it represents an innovative way to fund much-needed housing for some of the UK’s most vulnerable people at less than the cost of a care home.

But there are problems which appear to plague several of the housing associations involved.

The leases shunt virtually all the risk onto the associations in exchange for costly monthly payments which are potentially unpredictable due to being tied to inflation.

The clear profit incentive for certain parties is fertile ground for conflicts of interest to arise in some cases, with instances of individuals involved who work for both the housing association and the aggregators that broker the deals.

Importantly, the model is associated with extremely rapid growth for the housing associations involved – in First Priority’s case, from around 50 units to 1,000 in just four years. That means management standards can easily slip, so services suffer while voids shoot up. Once this happens, the tricky task of meeting the monthly payments to head landlords quickly becomes impossible.

That is what happened to First Priority in early 2018, as detailed in a previous Inside Housing investigation.

First Priority timeline

2011

Entrepreneur Omar Al-Hasso sets up First Priority

2015

The association begins entering lease deals with Henley Healthcare Investments (HHI), which was also set up by Mr Al-Hasso in 2012

2016

First Priority strikes its first lease deal with new real estate investment trust Civitas, and agrees other similar deals

2017

It asks HHI for a £2m loan, followed by another £2m after replacing its management company

2018

The board realises it would not be able to afford some leases even with all properties filled. The regulator sends an enforcement team. A company voluntary agreement is reached with investors

2019

First Priority overhauls its board as it gets to work on a “pathway to compliance” action plan

Today, the organisation claims to have improved dramatically.

“It’s like night and day,” says Iain Sim, who became chair of First Priority in January 2019. “Financially we’re more sustainable. We have a better relationship with the regulator. And there are no conflicts of interest, which was previously an issue.”

The board was overhauled, having been subject to statutory appointments from the regulator in 2018. Mr Sim is positive it now has much better oversight regarding matters such as the performance of its care providers and voids. The organisation acknowledges that tenants were not always previously receiving the right level of support, but says it is confident these issues have been sorted out.

Voids, Mr Sim says, are now “under control” and monitored “really quite intensely at every meeting”. In early 2018, First Priority’s void rate was around 27%. By February 2021 it was 15% – a marked improvement, but still high.

“We have made significant inroads, but it does take a lot of time,” notes chief executive John Higgins, who joined First Priority around the time its problems were emerging in 2017.

“It’s not straightforward like for general needs housing, because we have commissioners and care providers that we need to work in partnership with.”

The central component of First Priority’s journey since 2018 was the company voluntary arrangement (CVA), a process which allows an insolvent business to request that it pays creditors – in this case, the lease head landlords – only what it can afford for a fixed period of time.

“The CVA was a one-show chance to solve the finances,” recalls Mr Higgins.

Investors were asked to agree new lease terms with First Priority that distributed risk more evenly. Rather than fixed monthly payments, the return for landlords is now based on the performance of its portfolio – that is, how much money is coming in through rent. This arrangement puts it in a different position to most other lease-based providers that are still tied to fixed payments.

Not all landlords were satisfied with the altered lease deals. Of its five landlords in 2018 – Civitas Social Housing, Funding Affordable Homes, Supported Living Infrastructure Limited, Henley Secure Income Property Unit Trust and Equitix – only the last two remain. The rest decided to transfer their leases to other housing providers. As a result, First Priority’s stock shrank from just over 1,000 units to around 400. It would like to grow again, Mr Sim says, but with a “more cautious” approach than before.

After the CVA, First Priority agreed a “pathway to compliance” action plan, which it delivered last year. It has also done other work aimed at proving itself as a well-run organisation that provides the right services to tenants.

In numbers

400

Units First Priority manages now, down from more than 1,000

36

Risks First Priority does not believe it is currently in a position to manage effectively

15

Providers operating some form of the lease-based set-up that have been declared non-compliant by the regulator

In October 2019, it commissioned its first tenant satisfaction survey using face-to-face interviews, with 82.6% reporting being happy in their homes and 100% saying they felt safe. However, only 55.6% felt informed or engaged. The association is working to set up regular tenant feedback forums, to try and improve engagement.

Other lease-based SSH providers have been censured by the RSH for potentially overcharging rents due to a failure to prove their stock meets the government definition for the tenure. First Priority says a comprehensive review of its own rents, submitted to the regulator recently, did not throw up any significant concerns.

With the action plan completed, First Priority says it is having discussions with the RSH on a monthly basis about being returned to compliance.

“We’re working towards the position where we can say that we’re compliant,” says Mr Higgins. “I like to think the regulator quite likes what we have managed to do.”

Lease-based provider experts agree that First Priority has made considerable progress in the past three years and will be of much less concern to the RSH than some other organisations, but whether that is enough to be regarded as compliant is a different question.

Last year, Inclusion Housing took the unprecedented step of trying to overturn its non-compliant regulatory grading in the High Court. It failed. In his ruling, the judge appeared to give the RSH carte blanche to downgrade any housing association “whose business model is judged to involve too much risk”. In that context, is it even possible for any organisation operating the lease-based model to maintain compliance?

“Theoretically it is possible, but I think it’s very hard,” answers Jonathan Walters, deputy chief executive of the RSH. “So much reward often goes to the head landlord that there is very little money left in the business.”

In addition, it is worth remembering that most non-compliant lease-based providers have not had the opportunity to improve their circumstances like First Priority has been able to do through the CVA process. The regulator has a policy of not commenting on individual cases, but Mr Walters adds the following observation: “We have seen in many other sectors that CVAs change the relationship between landlord and tenant or freeholder and leaseholder, so we shouldn’t be surprised if that happened in this sector.”

First Priority knows it remains vulnerable to turbulence. In a six-page document identifying specific risks to the association, it has listed 36 issues it does not believe it is currently in a position to manage effectively, even with the post-CVA leases. These range from the “relatively straightforward” to the “more problematic”, Mr Higgins says, and include long-term demand for its housing, the possibility of rule changes over how much housing benefit it is allowed to claim and exposure to risks at its partners, such as care providers.

“The model is overengineered financially,” he concedes. “And when it comes to managing those risks, we don’t have that option to sell assets if it gets too much. REITs [real estate investment trusts] want us to take on all that risk for what is effectively a management fee, which is not something I’m prepared to do.”

Margins are still tight. Notwithstanding extraordinary items relating to the CVA, First Priority edged a £33,000 surplus in 2020 – having taken a £3.1m loss in 2019 – and expects a similar out-turn this year.

Mr Higgins draws a comparison between First Priority and a petrol station. “Selling petrol is a single-figure margin, so petrol stations make most of their money from selling sweets, snacks etc in the shop.

“The difference is, with petrol you’re pretty much guaranteed sales, with lower risk, but we’re not guaranteed occupancy and selling other services to our existing tenants isn’t an appropriate option. We have looked at whether we can take on other activities to increase our margin, but we don’t have a massive amount of reserves, so not much appetite for risk.”

First Priority is clearly keen to change its image. “It is frustrating when you do all this work and people’s perceptions don’t move on,” says Mr Higgins. On the right terms it remains open to all options, including a merger.

The association will hope that the improvements it has made since 2018 will be enough to convince the regulator it should be compliant. But with the regulator still steadfast in its wariness of the lease-based model, changing the necessary minds will be no mean feat.

Sign up for our regulation and legal newsletter

Already have an account? Click here to manage your newsletters