You are viewing 1 of your 1 free articles

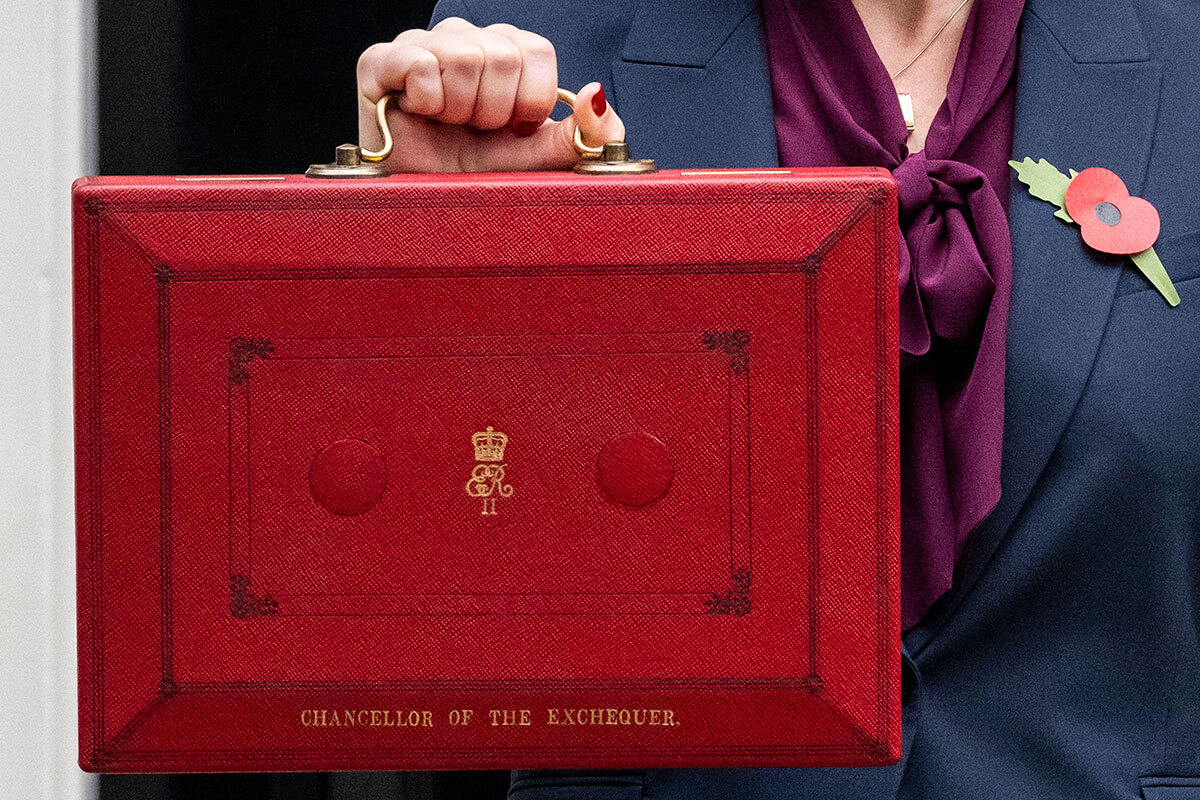

Autumn Budget 2024: Key takeaways for the sector

The Labour Party’s first Budget in 14 years was set out by chancellor Rachel Reeves during a raucous session in parliament on Wednesday. Inside Housing runs through the key takeaways

Despite the Conservatives decrying the Budget as a “borrowing spree”, it is one that suggests Ms Reeves is listening to the sector and lays the foundations for further changes to come.

Most of the key housing announcements had been trailed before the chancellor delivered her speech in the House of Commons, however Inside Housing has poured over the Budget document and rounded up the key takeaways below.

No surprises

As confirmed on Monday, an extra £500m will be ploughed into the Affordable Homes Programme (AHP) to keep development going until 2026, while £50m will go into planning departments to help recruit 300 new planners.

The news was a boon for developers, with shares in Vistry jumping 3.2% and Barratt Redrow shares up 3% after Ms Reeves’s speech.

Yet, £500m for the AHP will only translate into 5,000 new affordable homes. That is just 0.3% of the government’s target to build 1.5 million homes in five years.

Elsewhere, Ms Reeves confirmed a five-year rent settlement of the Consumer Price Index (CPI) plus 1% for social housing providers. This is a big win for the financial health of the sector, although no doubt many landlords would have hoped for a longer-term guarantee.

Right to Buy discounts will be reduced and councils will be able to keep the full receipts of Right to Buy sales, which could be a powerful incentive for them to build new homes. It is estimated that local authorities are expected to save nearly £1.2bn by 2029-30 as a result of the changes.

New funding

There was £233m of additional funding announced for homelessness prevention in 2025-26, but no detail yet on how it will be allocated.

Two cost of living benefit schemes, the Household Support Fund and Discretionary Housing Payments, have been extended until the end of March 2025, at a total cost of £1bn.

Ms Reeves promised another £1bn to remove dangerous cladding over the next year. The big question is whether these new funds will be made available for social landlords, which are currently unable to access the Building Safety Fund.

Inside Housing understands that the eligibility of current funds is unlikely to change, but expect more clarification on this very soon.

Next, the Warm Homes Plan. The chancellor confirmed an initial £3.4bn over the next three years towards decarbonisation, which she said would improve 350,000 homes. This includes £1.8bn for fuel poverty schemes, helping 225,000 households reduce their energy bills. Some of the new cash will be used to increase the Boiler Upgrade Scheme, which subsidises heat pumps, for this year and the next. The funding will also be used to grow the heat pump manufacturing supply chain.

It is currently unclear how this £3.4bn interfaces with the Warm Homes: Social Housing Fund (SHF), previously known as the Social Housing Decarbonisation Fund (SHDF). The previous government set aside £1.2bn for Wave 3 of the SHDF, but Labour will confirm how big it will be as part of the Spring Spending Review.

There was an intriguing announcement of £3bn worth of support in guarantees to boost the supply of homes and support small house builders. The Budget document revealed that this would go to SMEs and the build-to-rent sector in the form of “housing guarantee schemes to support the private housing market”.

Plus, the Disabled Facilities Grant will see an £86m increase to support adaptations to homes for those with social care needs.

Around 7,800 homes are expected to benefit from the increased funding, which aims to reduce hospitalisations and prolong people’s independence.

Carole Easton, chief executive of the Centre for Ageing Better, said: “We welcome the announcement of increased spend on Disabled Facilities Grants, a lifeline for many low-income, disabled, older people.

HRA borrowing rate extended

The government will extend the discount on the Housing Revenue Account (HRA) rate for the Public Works Loan Board (PWLB), which provides loans to councils, to March 2026.

The current HRA rate sits at 0.4% above gilt yields, while the PWLB standard rate is the gilt yield plus 1%.

HRAs are ringfenced for housing-related spend, and the extension aims to “support local authority financing of capital expenditure on social housing”.

The government estimates the cost to the Treasury will be £45m between 2024 and 2030. The idea is that the discounted rate will lead to local authorities spending more by recycling the savings from lower borrowing costs. This equates to a cost to the exchequer as payments to central government decrease.

In the Spring 2023 Budget, the government introduced a 40 basis point discounted rate for local authorities for one year, and this was extended in November 2023 to 30 June 2025. The new rate is intended to mainly support new housing delivery.

Over the summer, a group of more than 100 councils called on the government to reduce new PWLB borrowing costs for HRAs to the previous rate of 0.15% above central government’s borrowing costs.

SDLT reform to raise £1.2bn by 2030

The government’s increase in the higher rate of stamp duty land tax (SDLT) is expected to raise £1.22bn between 2024 and 2030. The rate on the SDLT surcharge for second homes, known as the higher rate for additional dwellings, will increase from 3% to 5%.

The change is aimed at helping first-time buyers and target those looking to buy second homes, and will make it more difficult for investors and speculators to expand their property portfolio. The document said this will help ensure that first-time buyers have “a comparative advantage over second home buyers, landlords and businesses purchasing residential property”.

The increase also aims to tackle the problem of homes sitting empty in areas where people are struggling to find affordable housing.

The higher rate will apply from 31 October and cover purchases of second homes, buy-to-let residential properties and companies purchasing residential property

Ms Reeves said she expects the change to support 130,000 extra transactions over the next five years for people buying their first home or moving home.

Will National Insurance rise put housebuilding plans in danger?

Ms Reeves announced a rise from 13.8% to 15% on the amount employers will have to pay on their National Insurance contributions from April 2025.

She also lowered the £9,100 threshold employers start paying national insurance on employees earnings to £5,000.

Ms Reeves said: “This will raise £25bn per year by the end of the forecast period. I know that this is a difficult choice. I do not take this decision lightly.”

Lee Bloomfield, chief executive of Bradford-based Manningham Housing Association, said the rise “will not only add to the costs faced by housing associations”, it will “also impact on all other elements of the supply chain which will be expected to deliver the many new homes so desperately required”.

Sign up for our daily newsletter

Already have an account? Click here to manage your newsletters