Jules Birch is an award-winning blogger who writes exclusive articles for Inside Housing

Does MMC have a future?

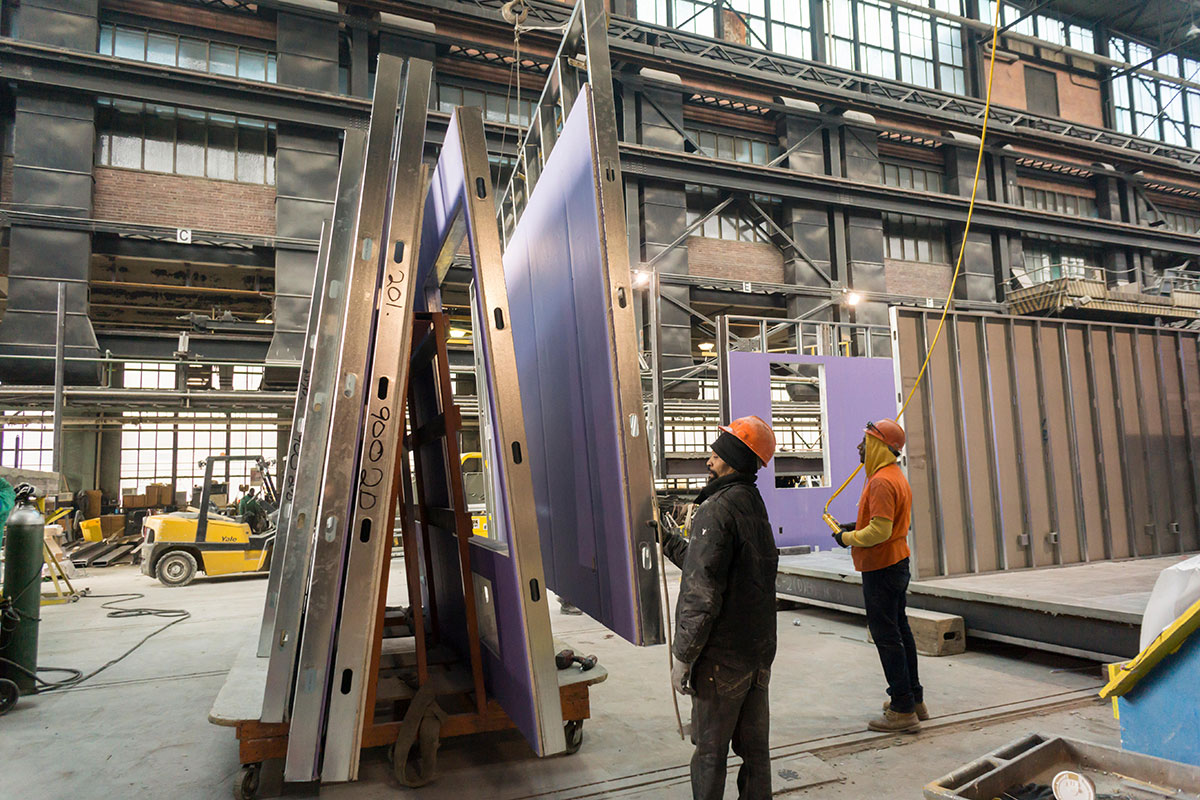

With Legal & General the latest to step back on MMC, Jules Birch asks: what exactly could make factory-built housing viable?

If Britain’s biggest institutional investor can’t make it work, who can?

Not a medium-sized housing association, that’s for sure. Or a leading partnership house builder. Not even a combination of England’s trendiest developer and Japan’s biggest house builder with support from the government’s housebuilding agency.

I am, of course, talking about modern methods of construction (MMC) deployed at scale to build new homes.

The shock announcement by Legal & General Modular Homes that it is ceasing production at its factory near Leeds is just the latest in a series of blows to the sector.

From the role that MMC played in what went wrong at Swan, to Countryside’s closure of its modular factory, to the collapse of House – the joint venture between Urban Splash and Sekisui House backed by Homes England – via a series of other bail-outs and closures, it’s becoming a depressingly familiar story.

The theoretical case for MMC and modular and offsite construction remains as strong as ever: factory-built homes should be able to produce homes of better quality with fewer carbon emissions and lower energy bills than is possible by traditional means. Once delivered to site they can be built more quickly and should offer a way to mitigate against skills shortages in an ageing construction workforce, and they should challenge a house builder model that rations output to maximise profit margins.

That traditional model relies on finding a site, building houses and selling them as you go along. With flats, off-plan sales are an important way to finance construction in advance. Both also rely on buying land at the right price, which makes land trading an important (arguably the most important) part of the business of being a house builder.

However, I’m exaggerating for effect here and the contrast between traditional and modern is more mixed than I made it appear.

First, the ‘modern’ bit of MMC is growing a bit long in the tooth now. The same arguments have applied to all the building systems used for housing since World War II, including the industrial methods imported from Scandinavia that were used for council housing in the 1960s and 1970s.

“Housebuilding factories are major capital commitments that rely on steady and predictable demand for their products”

I used the word ‘should’ advisedly in my summary of the advantages above, since many of them were a disaster, culminating in May 1968, when one corner of Ronan Point collapsed like a deck of cards just two months after it opened.

‘Modern’ methods rose again in the timber frame housebuilding boom of the 1970s and 1980s before a TV documentary in 1983 exposed safety and quality problems that effectively killed off the market in England for 20 years.

Second, many components of a ‘traditional’ house that would once have been built on site – windows and roof trusses, for example – are already built in factories and delivered as modules to site.

For all that, the case for modern methods continues to be compelling: 300,000 homes a year may not be possible, let alone 300,000 built to the Future Homes Standard, without them – and the building safety scandal has underlined the importance of quality only too clearly.

Which brings me back to Legal & General, Swan, Countryside, Urban Splash, Sekisui House, Homes England and all the rest.

The circumstances may be different in each case – Legal & General blamed planning delays and COVID – but they all appear to have one problem in common: housebuilding factories are major capital commitments that rely on steady and predictable demand for their products.

As Bill Hughes, chair of L&G Modular Homes, put it: “Without the necessary scale of pipeline, it is not sustainable to continue producing more modules.”

Quite where that leaves the five-year joint venture with Vivid that was announced less than six months ago remains to be seen.

The same is true even at one of the most high-profile modular survivors.

Top Hat Industries, backed by giant investment bank Goldman Sachs, insurance company Aviva and house builder Persimmon, boasts that it is “at the forefront of the revolution in housebuilding” and has opened a second factory to boost its capacity to 4,500 new homes a year.

However, it lost £19.4m in 2021 and £21.3m in 2020, and in its latest accounts “acknowledges that the administrative cost base of the company is sized for future growth and not for the existing operations”.

For all that, modular construction and MMC remain an essential part of the solution to the problem of how to build enough homes within skills constraints while meeting net zero targets.

“The steady demand the sector needs is unlikely to come from the unstable and pro-cyclical ‘for sale’ market and a construction business model based on passing down risk”

An international evidence review was published by the UK Collaborative Centre for Housing Evidence last month. A key lesson was the importance of the state and the market working together, with the state introducing regulations that facilitate the wider use of MMC in the market.

It also warned about the dangers of promoting it as a quick-fix solution to supply problems and argued that one of the factors holding back MMC is a tendency to see it solely in terms of methods of construction, rather than of the development process as a whole.

The steady demand the sector needs is unlikely to come from the unstable and pro-cyclical ‘for sale’ market and a construction business model based on passing down risk.

As a major report on the construction labour force argued in 2016, that demand can only come from homes for rent. Some of this can be for private rent via build-to-rent, but most will be for affordable and social housing.

That will clearly not be enough on its own, but if leaving it to the market can’t make MMC work, what can?

Jules Birch, columnist, Inside Housing

Sign up for our development and finance newsletter

Already have an account? Click here to manage your newsletters