You are viewing 1 of your 1 free articles

UK’s largest insurer lobbied against cladding crisis measures which would ‘deprive residents of institutional landlord’

The UK’s largest insurer lobbied the government against solutions to the cladding crisis which would “deprive leaseholders of the benefits of an institutional landlord” in a letter seen by Inside Housing.

Aviva, which manages pension funds owning dozens of buildings caught up in the cladding crisis, wrote to ministers in November setting out its views on the Building Safety Bill.

The letter, released to an Aviva resident under the Freedom of Information Act and shared with Inside Housing, warned against measures which “make it unviable for institutional investors to remain in the private property market”.

Sent by Colm Holmes, chief executive of general insurance at the firm, the letter did not set out which potential measures it was objecting to.

Ministers have faced pressure to introduce protections against billing the costs of repairing fire safety defects to residents and introduce tougher enforcement measures, such as the loss of properties for building owners who do not comply.

Leaseholders in affected Aviva blocks who spoke to Inside Housing disputed the idea that they benefit from an institutional landlord, with one saying “we would not be deprived of anything by not having them as our landlord”.

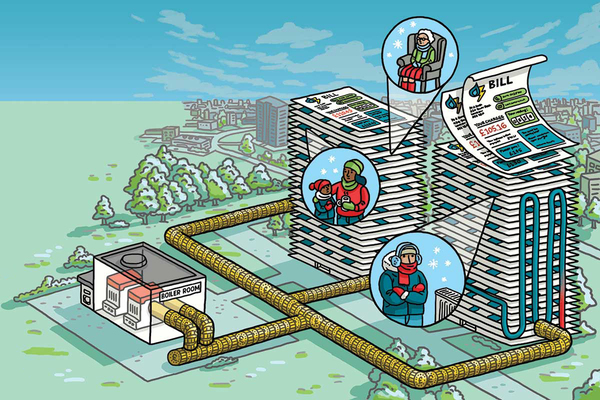

Aviva’s asset management business, Aviva Investors, manages a fund which owns around 1,000 residential apartment buildings across England and Wales, comprising around 40,000 apartments. It collects the ground rent income from these properties to pay around 350,000 investors in its pension funds.

It said it is these pensioners that ultimately own the buildings, rather than Aviva itself.

Like many purpose-built blocks of flats around the UK, fire safety issues have been uncovered at many of these buildings since the Grenfell Tower fire, with leaseholders unable to sell and expected to cover the enormous cost of repairs in many cases.

The fund uses Mainstay to manage the properties, with leaseholders reporting that their queries are diverted to this managing agent rather than addressed by Aviva.

One resident at a block in south-east London that is too short to benefit from government funding but is currently assessed as requiring works, which will cost each resident a five-figure sum if carried out, said: “It’s a lie. There are no benefits to having a freeholder. I pay £300 a year ground rent, some people pay more. Imagine if we were putting that money back into the building what we could do. There are zero benefits to having a freeholder.”

Another resident at a block in Bristol added: “Aviva are as hands off as it gets. They collect the ground rent and that’s it. The general consensus among us is that we would not be deprived of anything by not having them as our landlord.”

Inside Housing is aware of a Facebook group comprised of around 200 residents of blocks owned by the Aviva fund with fire safety issues. A recent survey showed that 93% are expecting to receive bills for the remediation works if they are carried out.

Aviva made an operating profit of £3.1bn in the year to December 2020.

A spokesperson for Aviva said: “The fund acquired its interest in the buildings after they had been constructed and let to leaseholders, inheriting the building’s existing lease structures. Like leaseholders, the fund was assured that the buildings had been constructed in compliance with the prevailing building regulations when purchased.

“On higher-rise buildings with identified fire safety issues where the fund is the ‘responsible person’ for fire safety under the existing lease structure, it is pursuing various options to fund required remedial works.

“For these directly controlled buildings, this includes progressing applications for available funding under the Building Safety Fund and Waking Watch Relief Fund and exploring potential routes of alternative funding, including claims against developers.

“For these directly controlled buildings, leaseholders are periodically informed of the progress of these steps among other issues via updates sent by the fund’s asset managers, Mainstay, with input and support from the multidisciplinary fire safety team appointed by the fund.

“For indirectly controlled buildings, where there is a management company or where leaseholders have elected the right to manage, responsibility for and communications on, fire safety matters rests with those entities rather than the fund.”

The spokesperson added that the firm was supportive of the measures being bought forward in the Building Safety Bill.