Surplus drops £37m at Southern due to project delays and rising costs

Southern Housing’s surplus dropped by £37m in 2023-24 due to delays in the completion of schemes and higher costs, as it stops committing to new developments altogether.

Its annual surplus before fair value movements was just £3m for 2023-24, compared with £40m the previous year, which it said was “below expectations”.

A reduction in investment property fair value triggered by “different assumptions and changes in yields” led to an overall loss before tax of £28m, according to its results for the year that ended on 31 March 2024.

“Despite these results we have significant headroom against banking covenants, with modest gearing, low financing risk and strong liquidity,” Southern said.

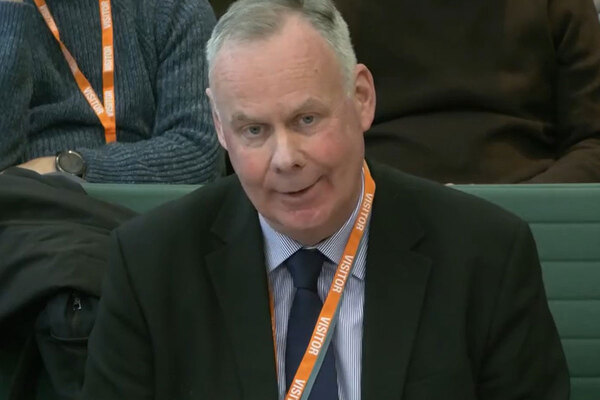

Paul Hackett, chief executive of Southern, said in a statement that the results were affected by “a difficult contractor market” that delayed the completion of projects and affected expected rent and sales income.

“With a number of contractors going into administration, we’ve reassessed several schemes, writing off abortive costs and increasing the impairment provision,” he said.

He said the board had decided to “stop making commitments on new developments” in order to “significantly de-risk the business and focus on core social housing activities” instead.

Southern said its results were adversely affected by costs totalling £24m, including £14m related to contract termination on developments, impairment costs and costs for two schemes with “significant build defects”.

There was also a £4m buyout of a Local Government Pension Scheme, £4m from increased spending on complaints, compliance and repairs and maintenance staff, and £2m extra spending on fire remediation works.

Starts in 2023-24 fell by almost two-thirds, to 348, and completions were also down compared with the previous year, falling by 28.7% to 776.

New sales receipts dropped significantly, decreasing by 65.4% to £44m.

In May, Southern confirmed it had taken “the difficult decision” to make a number of roles in its development team redundant as it prioritised spending on existing homes.

Southern’s results are the first full-year accounts since its merger with Optivo.

Its focus on investment in existing stock in 2023-24 saw spending increase by 33%, to £247m, compared with the previous year. Investment this year has ramped up by £23m.

Mr Hackett said: “We’ve increased resourcing in a number of frontline teams, including compliance, repairs and maintenance and complaints, and we’ve created a dedicated team to tackle damp and mould.”

Southern increased its spending on repairs to existing homes by £12m during the period, reaching £74m.

Turnover fell 5%, to £609m, while the landlord’s operating surplus also dropped, falling from £136m to £108m.

Southern’s operating margin fell by two percentage points to 12%.

Earlier this year, the Housing Ombudsman released a special investigation report into Southern Housing, finding a “lack of ownership within the landlord’s complaint-handling culture”.

Optivo and Southern Housing Group merged to form Southern Housing in December 2022.

Sign up for our development and finance newsletter

Already have an account? Click here to manage your newsletters