Social landlords fear for tenants amid energy price surges

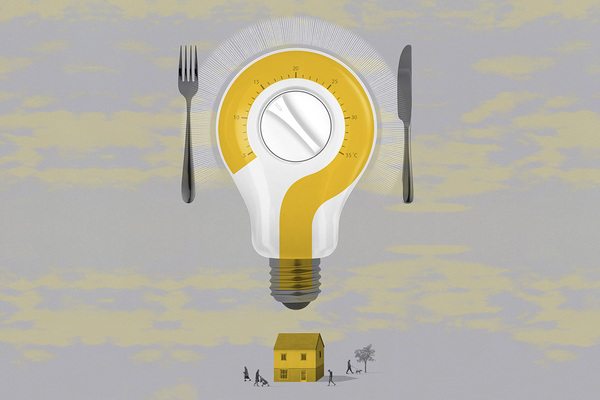

Social housing providers and sector bodies have urged the government to reconsider the cuts to Universal Credit and step up support to tenants who could face the stark choice between heating their homes or eating, due to soaring energy prices.

A spike in wholesale gas prices is leading to rising electricity and heating costs, with many small energy providers likely to go bust as they face losses on their contracts.

Ofgem, the UK energy regulator, has agreed to allow the price cap for bills to rise from 1 October to £1,277 per year, affecting approximately 11 million households.

It will come as the furlough scheme ends and Universal Credit and working tax credits are set to be cut by £20 a week, in what has been described as the biggest overnight reduction in social security benefits since World War II.

Laura Courtney, head of policy and external affairs at Community Housing Cymru, said: “The rise in energy costs is a serious cause of concern for social housing residents in Wales, and risks making the cut to Universal Credit even more damaging to people’s well-being.

“To cut this lifeline, at a time when energy prices are soaring, will mean many in Wales will be forced to choose between heating and eating this winter.

“It is not acceptable and we’re again calling for the UK government to maintain the £20 uplift to Universal Credit to ensure no one has to make the choice between putting food on the table or heating their home.”

Housing associations told Inside Housing they would try to support affected residents.

Kerry Starling, head of social and economic investment at Hyde Group, the large London-based housing association, said: “We are concerned about the prospect of higher utility costs for our customers.

“Many of our customers are living with low or fluctuating incomes and even a small increase in energy cost can make a difference in their ability to cover essential living costs. We are, however, very confident in the support we have in place for our customers who struggle financially.

“Through our in-house specialist team we offer free debt and welfare benefit advice to around 2,000 customers every year. We’re also able to issue fuel vouchers, and can refer customers directly affected by any increase to specialist energy advice providers.”

Phil Miles, director of Clarion futures said: “The imminent cut to universal credit and the expected increase in energy prices will impact many of our residents. We know from our most recent resident survey that 29% of people living in Clarion homes only have enough money for the essentials, so we expect they will be very vulnerable this winter [...]

"We recently expanded our money Gguidance team to reflect the anticipated increase in demand. Last year we also expanded our existing partnerships to support residents, and are working with organisations like Charis Grants and the Trussell Trust to offer emergency food and fuel vouchers to households engaged in our support services."

Fellow G15 member L&Q noted that tenants could be adversely affected by the price rise.

A spokesperson for the 118,000-home landlord said: “The safety and welfare of residents are our number one priority.

“For any residents who are impacted by rising energy bills this winter, our Pound Advice service, which offers help and support for our residents in financial difficulty, is available.

“Pound Advice offers registered debt advice so our suppliers can negotiate with residents’ creditors, including energy companies, if they’re in debt, as well as help with things like switching tariff.

“Our employment support team and tenancy sustainment team for vulnerable residents are also available to offer support.”

Business secretary Kwasi Kwarteng warned yesterday that some households face a “very difficult winter”.

But prime minister Boris Johnson later played down the issue, saying that the energy price surges were a “short-term” issue and that people should not worry about putting food on the table.

Brian Robson, the Northern Housing Consortium’s executive director for policy and public affairs, said the government needed to take the issue of poorly insulated homes in the UK seriously as part of plans to tackle soaring energy bills.

He said: “Our latest Northern Housing Monitor shows that over one million households across the North already live in fuel poverty. The sustainable solution to this challenge is to reduce energy use by upgrading homes to make them more energy efficient.

“Two-thirds of the North’s homes don’t yet meet the government’s minimum energy efficiency target. The chancellor must use the forthcoming spending review to kickstart progress by confirming promised investment in green home upgrades. That would cut bills, cut carbon and create jobs across the Red Wall.”

Sign up for our daily newsletter

Already have an account? Click here to manage your newsletters