New guidance published to cut EWS need for ‘half a million leaseholders’

The Royal Institution of Chartered Surveyors (RICS) has published new guidance aimed at significantly reducing the number of buildings that require external wall system (EWS) fire safety checks, in a bid to unstick large parts of the flat sale market.

RICS has today set out new parameters on which buildings need the highly controversial checks required by banks and building societies before issuing a mortgage. The government has claimed that the new rules could make sure 500,000 leaseholders no longer need to go through the process.

The parameters include removing the need for EWS checks on all buildings of four storeys or below, as long as they are not clad in aluminium composite material (ACM), other metal composite materials (MCM) or high-pressure laminate (HPL).

It also states that buildings that are five or six storeys high will not need to be checked if they do not have ACM, MCM or HPL present, and if the cladding that is present on the block covers less than 25% of the building. These buildings must also not contain balconies that are stacked vertically above each other and have decking constructed with combustible materials, such as timber.

The confirmation of the guidance comes after a two-month consultation period with valuers, leaseholders, lenders, fire safety experts and government over initial proposals put forward in January by RICS. RICS is now working to ensure that stakeholders fully implement the new guidance by 5 April.

RICS took the action as a result of thousands of flat sales being held up or falling through because of lenders refusing to issue mortgages on multi-occupancy buildings without the seller providing an EWS form to prove a check has been carried out.

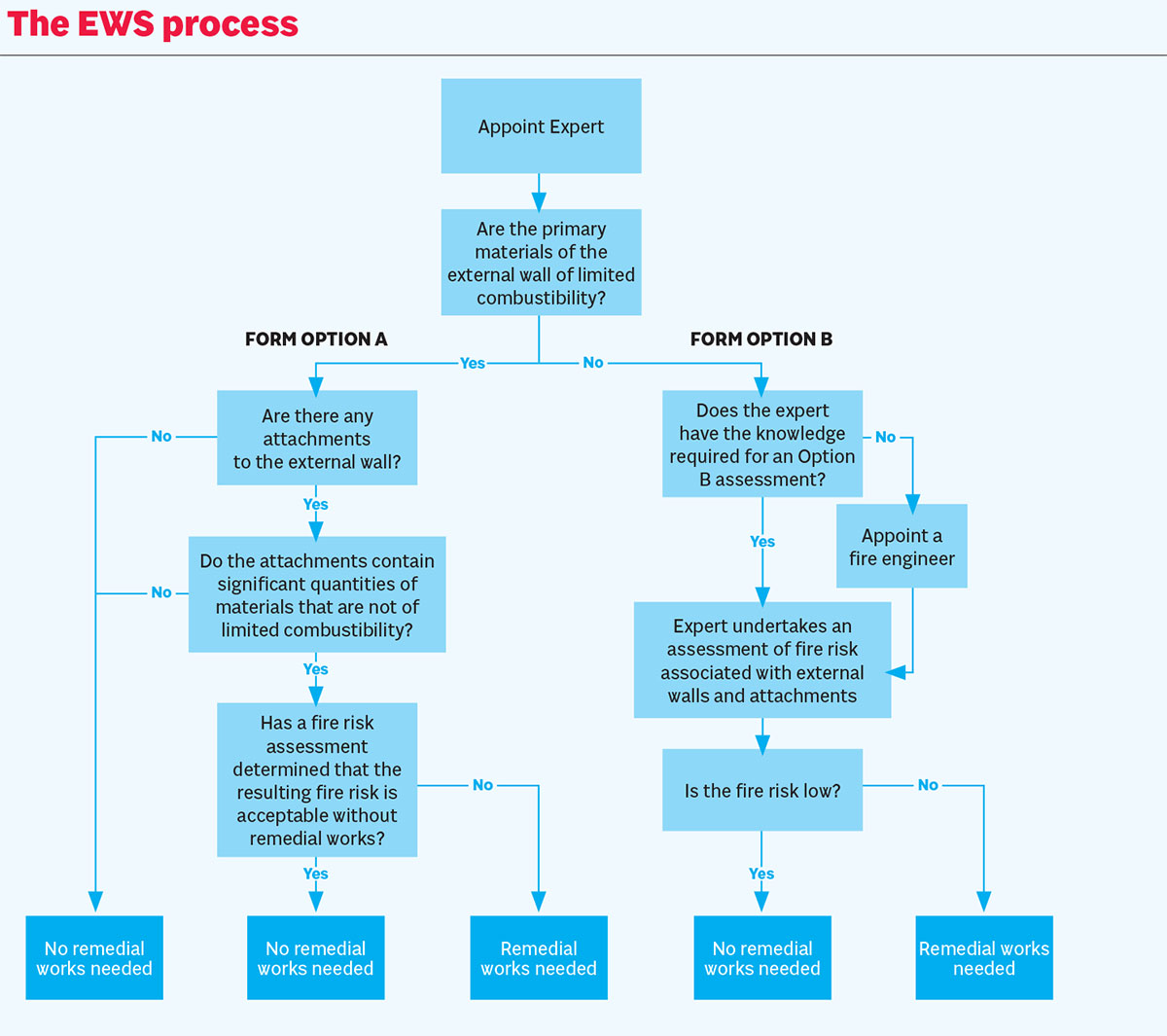

The EWS process, which was launched by RICS in December 2019, requires a qualified professional to inspect a building’s external wall and sign a form that rules whether flammable materials are present on the external wall of a building, meaning it requires remedial work, or whether no remedial work is needed and a sale can progress.

A high demand for EWS checks coupled with a small pool of inspectors able to carry out the work means many leaseholders have had to wait long periods to secure a check.

This has been a particular issue for smaller buildings, which are deemed to pose a lower risk and are therefore said to be less urgently in need of an EWS check by landlords when compared to taller buildings. In some cases, those in blocks of four storeys or fewer have been told they could have to wait several years.

The new guidance, which is intended to be used by valuers and mortgage lenders, is aimed at providing consistent advice on when EWS forms should be requested and, if adhered to by the lending market, could bring hundreds of buildings out of scope.

The guidance also moves away from using metres to measure the height of a building, instead opting for the more easily measurable number of storeys in a building.

The criteria for which buildings require EWS forms according to the new RICS guidance are as follows:

For buildings over six storeys, an EWS1 form should be required where:

- there is cladding or curtain wall glazing on the building, or

- there are balconies that stack vertically above each other and either both the balustrades and decking are constructed with combustible materials (eg timber) or the decking is constructed with combustible materials and the balconies are directly linked by combustible material

For buildings of five or six storeys, an EWS form should be required where:

- there is a significant amount of cladding on the building (for the purpose of this guidance, approximately one-quarter of the whole elevation estimated from what is visible standing at ground level is a significant amount), or

- there are ACM, MCM or HPL panels on the building, or

- there are balconies that stack vertically above each other and either both the balustrades and decking are constructed with combustible materials (eg timber), or the decking is constructed with combustible materials and the balconies are directly linked by combustible materials

For buildings of four storeys or fewer, an EWS form should be required where:

- there are ACM, MCM or HPL panels on the building

Responding to the move, housing secretary Robert Jenrick said: “I welcome RICS’ new guidance, which will mean nearly 500,000 leaseholders will no longer need an EWS1 form – helping homeowners to sell or remortgage more quickly and easily.”

However, the guidance is not statutory and its success will rely on the adoption by lenders when providing mortgages or remortgaging flats.

UK Finance, the body that represents the country’s banks, and the Building Societies Association, which represents building societies, said in a joint statement that they welcome the news and anticipate that many lenders would implement the guidance.

But they did say that it would be the decision for each lender to make based on their own risk appetite.

The joint statement added: “Those buying a flat should understand that a decision made by a valuer not to require an EWS1 inspection under the new guidance is no guarantee that fire safety remediation works will not be required in the future.”

The initial guidance did not include the need for checks on buildings with HPL under four storeys or buildings of five and six storeys with HPL covering less than a quarter of the building, but that has been changed following evidence provided during the consultation.

A spokesperson for the End Our Cladding Scandal campaign, the group representing victims of the building safety crisis, said that it welcomed the move by RICS to bring clearer guidance and said it would bring further certainty to the market.

They said: “However, the RICS guidance itself will not free up the first rung of the property ladder – lender and PI insurance provider buy-in is also necessary and we hope that this has agreed ahead of this release.

“We also remain concerned that whilst the Advice for Building Owners of Multi-storey, Multi-occupied Residential Buildings (the consolidated advice note) remains in place, it is entirely possible that buildings of any height could require remediation and this will, inevitably, affect the markets for sales and lending on flats.”

They also added that the EWS certificate was only one part of the national building safety crisis and would only identify issues within the external wall, and this would not help those with internal fire safety issues.

This is the latest attempt by the government and other stakeholders to try to end the building safety crisis that is currently impacting hundreds of thousands of leaseholders across the country.

Last month the government announced that it would be providing an extra £3.5bn to remove dangerous non-ACM cladding from buildings taller than 18m and set up a loan system for leaseholders living in buildings under 18m tall to remove cladding.

The move was criticised by campaign groups and politicians, who said that the measures do not go far enough in protecting leaseholders in all buildings from historic fire safety costs that are not their fault.

The government is also providing £700,000 in funding to support the training of 2,000 new assessors to carry out the EWS check by the end of the year. There are currently 453 assessors being trained.

Commenting on the new measures today, Ben Elder, global director of valuation at RICS, said: “This guidance provides a framework for consistency across the mortgage valuation sector as to when an EWS1 form is required. We are pleased to see, from the consultation responses, that many believe that the guidance will reduce the number of EWS1 forms requested.

“We have reached our final position following very careful consideration of the evidence to ensure that buildings at higher risk of remediation work are appropriately investigated in the valuation process, to support reliable advice by valuers to their lender clients.

“With the majority of lenders in support of the guidance, we now call on all UK lenders to support the guidance and work with their valuation providers to implement it.”

Sign up for our fire safety newsletter

Already have an account? Click here to manage your newsletters