You are viewing 1 of your 1 free articles

More than 1,250 housing association mortgages in London on hold as EWS falters

London’s biggest housing associations have seen more than 1,250 sales, staircasing attempts and remortgage applications put on hold as a result of the mortgage crisis currently hitting leaseholders living in high-rise blocks, a figure that has nearly doubled in just over three months.

Data given to Inside Housing by the G15, the body that represents London’s largest housing associations, revealed that a total of 1,255 deals had been put on hold because of mortgage lenders being unwilling to strike deals with leaseholders as a result of fears about the cladding on buildings.

The latest data shows the growing issues afflicting the sector. The number has risen from the 647 deals on hold recorded by the G15 in November 2019.

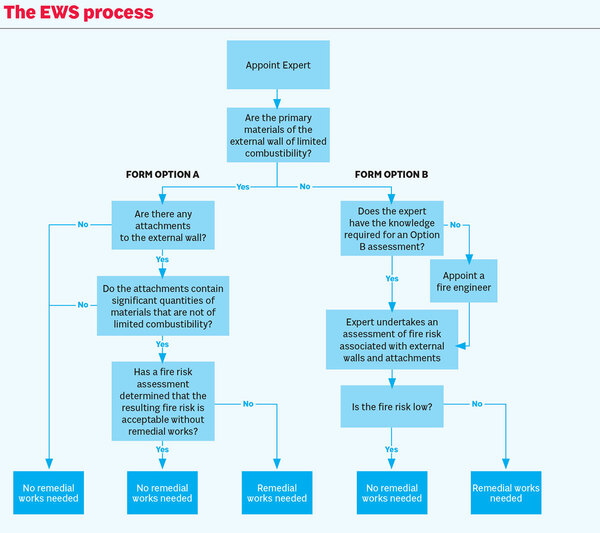

The data from the G15 also reveals that the attempts to fix the cladding crisis through the EWS1 (External Wall System 1) process, a system set up by the Royal Institution of Chartered Surveyors (RICS) to unstick the property market, is not yet working. It was also supported by UK Finance, the national body that represents the banking and financial sectors.

Across all the G15 landlords, which own thousands of blocks, the EWS1 process has been completed on just 26 of these blocks.

The EWS1 form was set up by RICS in mid-December after hundreds of leaseholders were unable to get a certificate to show that their buildings’ cladding adhered to the government’s Advice Note 14 guidance.

The new process was aimed at giving building owners a form that could be signed off by a competent inspector, which would either give the building a clean bill of health for mortgage providers to lend on the properties, or recommend that remedial works take place.

Helen Evans, chair of the G15 and chief executive of Network Homes, told Inside Housing that the process is not working smoothly and there is confusion about its application and validity.

The number of people available to carry out these inspections is also limited, causing delays to testing on many blocks. This is further exacerbated by inspectors being unwilling to take the liability for checks and facing difficulties in accessing professional indemnity insurance cover so they can carry out the work.

Inside Housing has also spoken to inspectors who have said work to check just one block can take between two weeks and a month in some cases.

There are also concerns that the majority of buildings owned by housing associations will require some form of remedial works even after the EWS1 process is complete.

The G15 has previously estimated that 3,321 of its blocks could require remedial work, with the total bill as much as £6.9bn.

Last week, the government announced plans to set up a £1bn Building Safety Fund for private and social housing landlords to remove dangerous cladding of all types, not just Grenfell-style aluminium composite material.

However, it is largely felt that this will not be able to cover the full scale of the work.

Commenting on the EWS1 process, Ms Evans said: “The RICS-led group valiantly came up with the EWS process and as it beds in I’m sure that it will help many more leaseholders to get on with their lives.

“It is clear that the process is not yet working as smoothly as it could, with low numbers of forms being produced and confusion in terms of their application and validity.

“Government must now provide equal support to leaseholders in the private and social sectors whose lives are on hold to unstick the mortgage market.”

A spokesperson for the Ministry of Housing, Communities and Local Government said: “It is unacceptable some residents have found themselves unable to sell their home. Building owners have requirements to make sure all residential buildings are safe and any risks should be fixed as a matter of urgency.

“We have supported an industry-led solution to manage valuations of high-rise residential buildings and RICS are working with lenders to ensure the process works. Residents’ safety remains our utmost priority.”

UK Finance declined to comment. RICS has been contacted for comment.

Sign up for our daily newsletter

Already have an account? Click here to manage your newsletters