You are viewing 1 of your 1 free articles

Midlands Voluntary Right to Buy pilot extended

The large-scale pilot scheme giving housing association tenants the Right to Buy has been extended, Inside Housing can reveal.

The Ministry of Housing, Communities and Local Government (MHCLG) confirmed that the Midlands Voluntary Right to Buy (VRTB) pilot will now finish at an undecided date later this year.

Sales through the scheme were previously expected to complete on or around 31 March.

MHCLG would not disclose the reason for the move.

Figures seen by Inside Housing show that as of 18 March, 1,526 sales had been completed through the pilot and £99.4m had been spent on funding discounts.

That is only half the £200m set aside for the VRTB pilot by ministers, who had expected around 3,000 homes to be sold.

Demand for the scheme was lower than anticipated – particularly for the offer of “portability”.

Portability refers to tenants’ ability to use their VRTB discount – equivalent to the Right to Buy markdowns available to council tenants – to purchase a housing association home they do not currently live in.

It is intended to allow tenants whose homes are not eligible for sale, often due to planning rules, to still benefit from the scheme.

On 26 March – days before the Midlands pilot was due to end – the government effectively froze the housing market by advising people not to move home in order to avoid breaking social distancing rules intended to limit the spread of coronavirus.

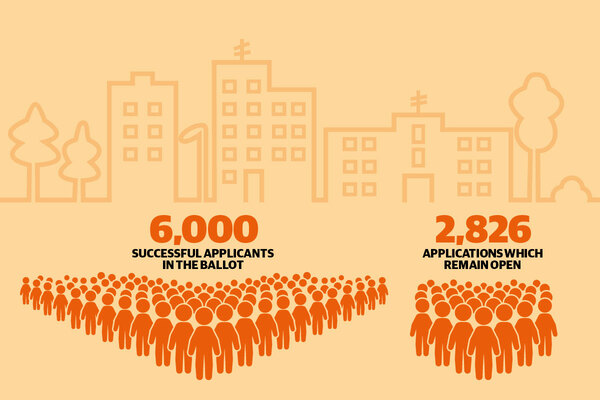

The pilot was run through a ballot system launched in August 2018. Unique reference numbers (URNs) were then randomly allocated to 6,000 tenants, which enabled them to apply for the VRTB.

As of 18 March, 1,933 tenants awarded URNs who applied had either cancelled their application or had it terminated by their housing association.

Ahead of the December general election, the Conservatives made a manifesto commitment to “evaluate new pilot areas” for the VRTB.

Ministers also have plans to introduce a separate Right to Shared Ownership policy for housing associations, allowing tenants to purchase an equity stake in their home.

The Voluntary Right to Buy explained

- Discounts for eligible HA tenants are at the same rates as local authority tenants in the statutory Right to Buy scheme (between 35 and 70 per cent of the value of the property, to a maximum of £80,900 – whichever figure is lower)

- Eligibility is determined by the government, with discounts funded by the government’s £200m pilot scheme

- HA boards have the final decision over which homes to sell, with the presumption that they will sell a tenant their current home if possible

- Where they decided not to do so, the government compensates HAs to apply the discount to an alternative property – known as ‘porting’

- ‘Flexible one-for-one’ replacements are incorporated, meaning for every Voluntary Right to Buy sale, a new affordable property will be built – overall, meaning some HAs will replace at a ratio greater than, and some lower than, 1:1

Sign up for our daily newsletter

Already have an account? Click here to manage your newsletters