You are viewing 1 of your 1 free articles

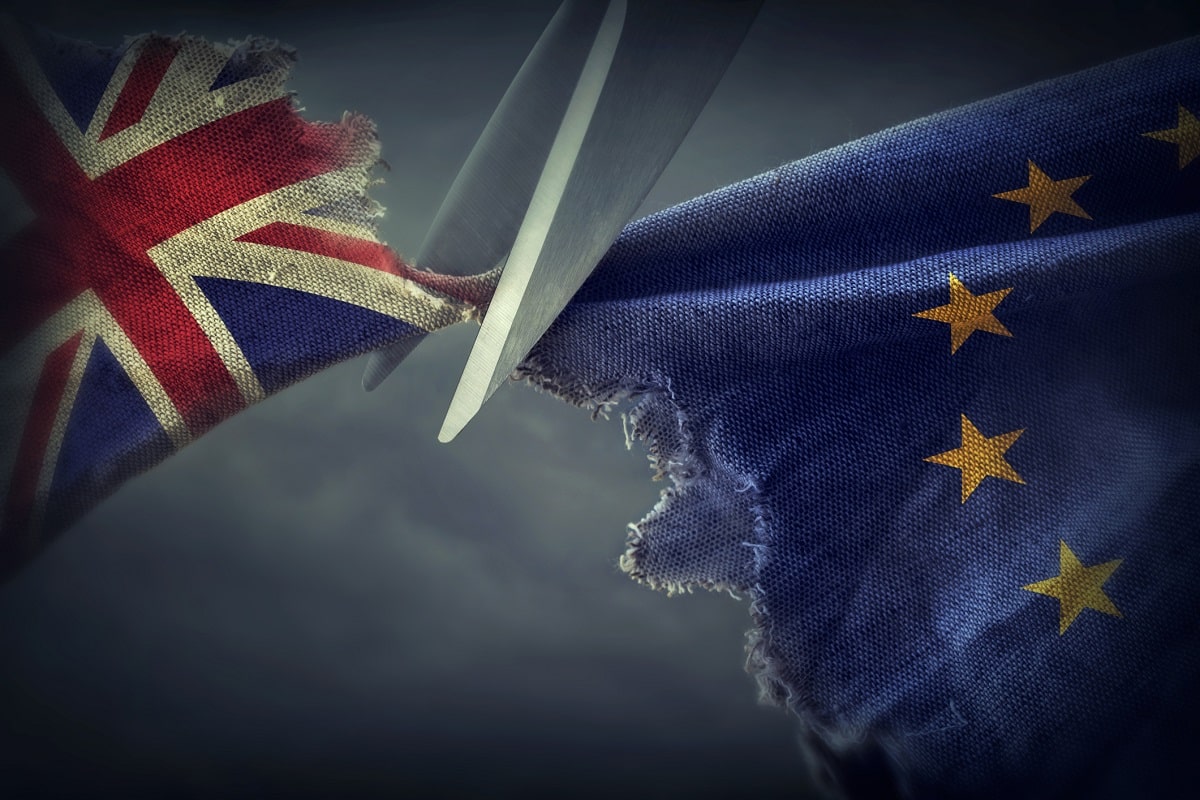

Housing association borrows £50m to insure against Brexit

A housing association has borrowed £50m, partly as insurance against a post-Brexit downturn.

Housing Solutions, praised by prime minister Theresa May in her September speech at the National Housing Summit, secured a £50m revolving credit facility (RCF) from the bank Santander.

The 7,500-home association took out the facility, which will last five years and can be drawn down and repaid as it likes over that time, as an “insurance policy”, it said.

Andrew Robertson, finance and resources director at Housing Solutions, told Inside Housing: “The RCF gives us a potential cash bridge in the event that capital markets got tighter or pricing got more expensive, what with Brexit going on at the moment.

“We may not be using it on day one. It’s there as an insurance policy. Obviously, we have to pay commitment fees while it’s undrawn but we think that’s sensible.”

Housing Solutions already has a £30m facility with another bank but with increased uncertainty and the association’s growing development programme, it decided to secure the extra cash.

Parliament will vote on Ms May’s Brexit deal next week, with the government widely expected to lose thanks to a predicted Conservative rebellion.

As Inside Housing reported last week, larger housing associations are also putting in place contingency plans ahead of the UK’s scheduled departure from the European Union in March.

Some associations are understood to be giving themselves extra liquidity to cope with the potential fallout of the UK leaving the EU without a withdrawal agreement in place.

This week, credit ratings agency Standard & Poor’s said that in the event of a no-deal Brexit, it will downgrade half the housing associations it rates.

Earlier in the year, Housing Solutions restructured £135m of debt so that its covenants are tied to the housing association’s net debt per unit, rather than balance sheet valuations, like most of the sector.

Mr Robertson said: “[That] was related to the rent cut. But also where we operate because it’s a relatively high-value area, as soon as we’ve completed a project, if you don’t compare that with the present value of the rental stream, you end up with a reduction.

“If we were to go down the cost route, which other housing associations go down, we’d be potentially locking up impairment. We’d have an impairment risk and we didn’t really want that either.”

Click here to read more about social landlords’ preparations for Brexit