You are viewing 1 of your 1 free articles

Homes England’s Peter Denton: investors will support temporary accommodation

Investors would be “perfectly happy” to support temporary accommodation if local authorities led the process, the chief executive of Homes England has said.

Mr Denton told Inside Housing that the maths of investment in temporary accommodation was “compelling” and that it “can work for everyone” if done properly.

His comments came after the leader of the Royal Borough of Kensington and Chelsea said last month that London councils were seeking the “holy grail” of pension fund investment in temporary accommodation, but “none of us can quite unlock it”.

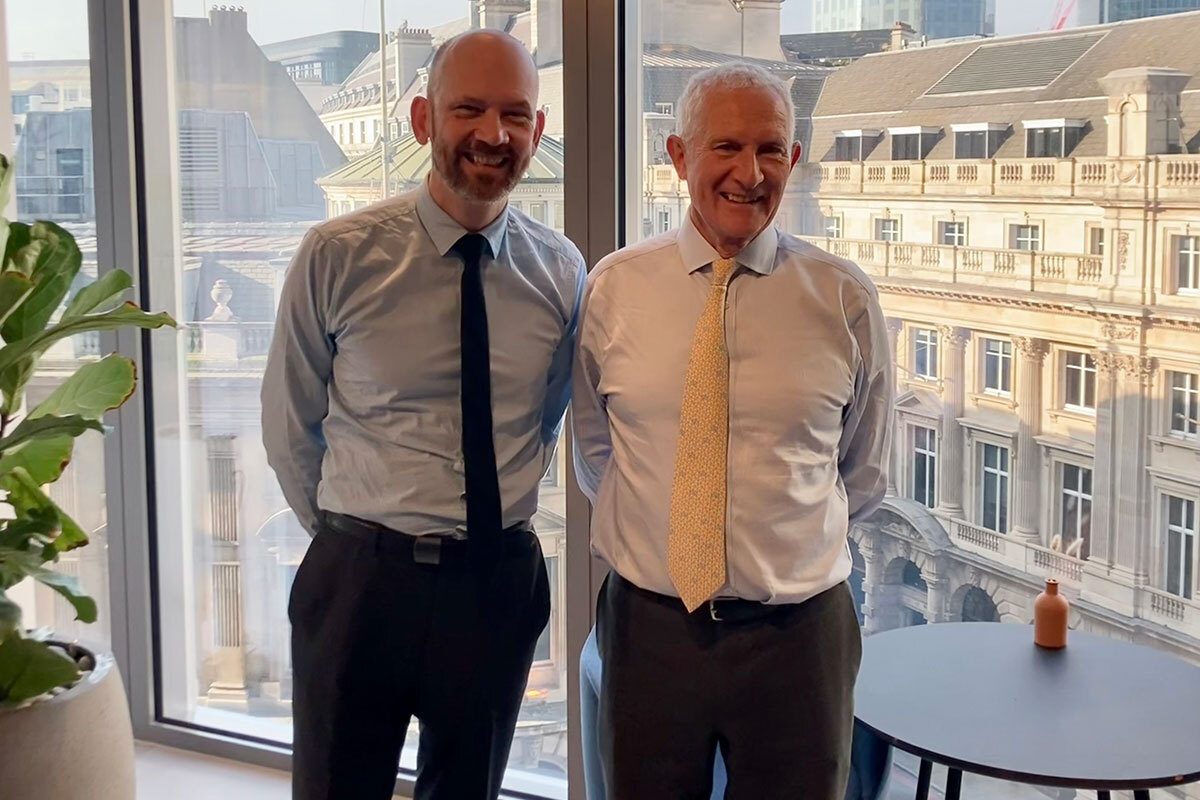

Mr Denton was speaking to journalists at the Homes England Investment Symposium in London on 4 November, alongside Peter Freeman, chair of the government’s housing and regeneration agency.

Asked if Homes England would encourage investment in homelessness accommodation, Mr Freeman said it “depends on the quality of the management”.

Mr Denton added: “It’s also the wraparound services that matter… Homelessness is a very specific intervention that the agency supports on, but it’s much more the [Ministry of Housing, Communities and Local Government] than us.”

He continued: “I don’t think investors are wary of this area, if done correctly. If local authorities were there leading the charge on managing the temporary accommodation situation, I think you’d find investors were perfectly happy to support that.”

He said Lloyds Bank was already working with Bristol City Council through its social housing initiative on projects in this space.

Investment in homelessness accommodation took a reputational hit over the past few years after the high-profile failure of Home REIT, an investment trust that is now in the process of winding down.

Mr Denton said Home REIT was “a terrible example” of how to manage investment in temporary accommodation. “A really good example would be a process led by a local authority that investors can get behind and support,” he said.

“The maths of this area is so compelling… it can work for everyone. Government can get a better outcome and save money. Those people [living in temporary accommodation] can certainly get a better experience, and investors can find a way that our pension funds can support it.

“I don’t think there’s anything negative or derogatory or difficult by good old-fashioned, long-term institutional money supporting this ambition, if done correctly,” he added.

Inside Housing also asked Mr Freeman about his role as head of the Cambridge Growth Company, which was given £10m in last week’s Budget to develop a plan for housing and infrastructure in the city.

Mr Freeman said he was embarking on a “25-year programme”, but within two to three years, “we [will] know exactly how it’s going to be done”.

“We must create an infrastructure menu, which is water, power, schools, parks, playground, the environment… If it’s not really good, Cambridge won’t get the growth, because people who want to [work in] life sciences could go to Milan or Paris or Boston. So it’s got to be a fabulous place. And working out what the infrastructure is, and working out how you finance it, is critical.”

One barrier to new housing in Cambridge has been a lack of water supply. Mr Freeman said the solution was two-fold. “One is increasing supply, and that’s a couple of reservoirs further out into Cambridgeshire and a water transfer scheme… The other is trying to get the use down from 120 litres a person a day to 80. And we’re working on both ends.”

Sign up for our development and finance newsletter

Already have an account? Click here to manage your newsletters