EWS crisis: homeowners face huge fire safety bills on newly bought flats despite cladding assurances before purchase

New homeowners are facing huge fire safety costs on newly bought flats despite receiving assurances that materials on their blocks were safe before completing their purchase, Inside Housing can reveal.

Inside Housing has found examples of leaseholders purchasing flats for hundreds of thousands of pounds off the back of external wall system (EWS) forms deeming the cladding to be safe, only to find out within weeks of their purchase that their building had been inspected again and that a new check has found materials on the building that must be removed.

In one case a leaseholder found out about the changed EWS rating just 34 days after they purchased their £350,000 flat, leaving them with a worthless flat and huge fire safety costs.

These costs come in the form of expensive waking watches that can cost thousands of pounds every year, as well as huge bills to remove the cladding, which can cost tens of thousands of pounds.

These examples have brought more questions around the controversial EWS form, the document required to assure banks of the compliance of a cladding system before they can provide a mortgage on a flat in a residential block.

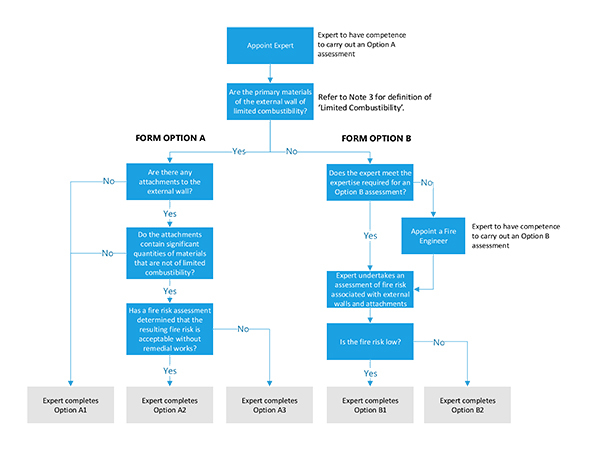

The EWS process, which was launched in 2019, requires a qualified professional to inspect a building’s external wall and sign a form that rules whether flammable materials are present on the external wall of a building, meaning it requires remedial work, or whether no remedial work is needed and a sale can progress.

If a building receives an A1, A2 or B1 rating, the building is deemed safe and a mortgage should be provided. However, if a building receives a B2 or an A3 rating (see flow chart below), banks will not lend on the property and remediation work is required before the flat can become sellable.

In one example discovered by Inside Housing, the block in question has received three different EWS ratings over the past 12 months.

Leaseholders in the 700-home Waterside Park development on the Royal Docks in east London started seeing sales fall through on their flats in early 2020, with banks requesting an EWS check for the block before purchases could go through.

The block’s management company FirstPort appointed a fire engineer to carry out an EWS check in March 2020, which returned an A1 rating.

Then in September, leaseholders were informed that a second check had been carried out by the same engineer.

FirstPort said that this was carried out after guidance around EWS checks was made clearer.

The second EWS check gave the building a B1 rating, meaning that while some combustible materials were found, the risk was low and properties could be sold.

However, in December 2020 the freeholder, Aviva Investors, told leaseholders that it wanted to verify the B1 rating and check the building’s cavity barriers. It then instructed an intrusive inspection into the external walls of the building.

On 1 April, the building receiving a B2 rating, meaning that remedial works are required. A waking watch was installed within hours, and plans for fixing the issues within the block are now being planned.

The latest rating has been met with strong criticism from leaseholders, particularly those who bought off the back of the first two EWS forms.

Rich Ashby, who bought his flat last March for £325,000 following the initial A1 grade, said that the whole process has been “shambolic”.

“Our approved EWS that’s supposed to be valid for five years was void within a few months of buying our property and completely reversed in a year,” he said.

Another leaseholder, who did not want to be named, told Inside Housing that he completed his purchase of a £350,000 flat in the block on 26 February this year, 34 days before leaseholders were informed of the B2 rating.

He said that he was not informed of any other investigation that could potentially further downgrade the rating after receiving a letter confirming the B1 back in October.

He said he felt “let down” that there was no mention of this before his purchase. He added that he was “hugely disappointed" to be facing a large potential bill that he has to pay through no fault of his own.

According to Aviva Investors, the intrusive checks were undertaken between 14 and 16 December 2020 and highlighted additional concerns that resulted in the change to the EWS rating. A draft EWS form was prepared on 15 January, which was then subject to review. The form was signed off officially on 31 March.

A spokesperson for FirstPort said: “We completely understand how difficult the uncertainty of this situation is for residents and homeowners. We are continuing to do all we can to support them with the ongoing issues they are facing.”

Aviva Investors said that it was reviewing the transactions that had taken place before 1 April 2021. It added that it had formally requested that the original developers of the block, Barratt and Taylor Wimpey, carry out the required remedial works themselves.

Inside Housing has seen another example of leaseholders buying properties off the back of an EWS form that has been changed at a later date, and in this case one was owned by a social landlord.

The Mallard Point block in Bow, owned by housing association Swan, was built in 1970 but refurbished by Swan’s construction arm.

The building (pictured above) was given an EWS rating of A1 last February, only to have that grading reversed to a B2 earlier this year.

Sales data for the block reveals that two flats were sold on the block in June and December before the new grading, for £435,000 and £484,750.

Nick Karamanlis, co-owner at estate agent Elliot Leigh, which has attempted to sell some of the flats in this block, said: “Now, not only do you have current owners in the block no longer able to sell when they could have done, but buyers that only completed a couple of months ago are now in a position where their new apartment is effectively at zero value until these works are carried out.

“Something doesn’t sit right and, once again, it is the average leaseholder that suffers.”

Swan says that the review of the EWS certification was conducted following lenders’ changing guidance on the qualifications required for the checks, adding that the previous EWS check reached a different conclusion to that of the previous survey and therefore it was reviewing the remediation measures.

Full responses

A spokesperson for FirstPort said: “We completely understand how difficult the uncertainty of this situation is for residents and homeowners. We are continuing to do all we can to support them with the ongoing issues they are facing.

“Since the initial assessment in 2020, and as greater clarity has been provided on required standards and guidance, there has been a need to reassess certain buildings, with resident safety remaining our absolute priority.

“The most recent intrusive survey was commissioned by the landlord at Waterside Park in order to comply with government advice for building owners of multi-storey, multi-occupied buildings. This was conducted by a specialist independent fire engineer following an intrusive inspection. We acted immediately on the instructions from the survey report to help keep residents safe.

“We appreciate the frustrations and difficulties for residents and homeowners in affected buildings, and we will continue to update all residents as soon as we receive more information.”

A spokesperson for Aviva Investors said: “In accordance with the MHCLG consolidated advice note, intrusive investigations were commissioned to ascertain the scope of potential remedial works that might be required.

“These intrusive investigations were undertaken between 14 and 16 December 2020 and highlighted additional concerns that resulted in a change to the EWS1 rating based on the fire engineer’s assessment.

“A new draft EWS1 form was prepared on 15 January 2021, which was then subject to a detailed holistic fire safety review. The final report and confirmed EWS1 certificate was signed off on 31 March 2021 and circulated to leaseholders on 1 April.

“Transactions that have taken place in the 12 months prior to the EWS1 certificate being circulated to leaseholders on 1 April 2021 are currently being reviewed.

“An initial scope for the remediation work required, as identified within the ‘External Wall Review Report’, has been issued to leaseholders. The landlord has engaged a professional team who are progressing the detailed design for the remediation work based on that initial scope. Alongside this, Barratt and Taylor Wimpey have been sent a formal request to step in and carry out the required remedial work themselves.

“The updates provided to leaseholders on 9 December 2020 and last week explained the background and reasons for the changes to the EWS1 form ratings.

“As explained above, the most recent review of the external wall system was undertaken to satisfy the MHCLG consolidated advice note, with the changed EWS1 form ratings being a necessary consequence.”

A Swan spokesperson said: “Swan, like other RPs, is responding to this evolving national situation and we have sought to communicate promptly and openly with residents throughout this process. We would like to reassure residents that our fire engineer’s advice is that all Swan Housing Association buildings affected by the EWS1 process, including Mallard Point, remain safe to occupy.

“The review of EWS1 certification for Mallard Point, which was built in the 1960s/70s and refurbished by NU living in 2015, was conducted following lenders changing guidance on the type of qualifications required from companies undertaking this work.

“The most recent EWS1 survey has reached a different conclusion to that of the previous survey and we are therefore now reviewing remediation measures for Mallard Point and other properties which have received a revised EWS1 and we will keep residents updated as this review takes place.”

Sign up for our fire safety newsletter

Already have an account? Click here to manage your newsletters