Election panel: readers back HRA reforms

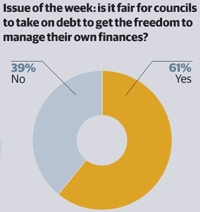

Government plans to give councils freedom to manage their own housing finances in exchange for taking a share of £25 billion of debt have been broadly backed by Inside Housing readers.

Asked if it was fair that councils should have to take on debt to manage their financial freedoms, 61 per cent of our election panel said ‘yes’ and 39 per cent said ‘no’.

The election panel is a 80-strong group of readers recruited to give their views on key policies in the run up to the general election, which will be held on 6 May.

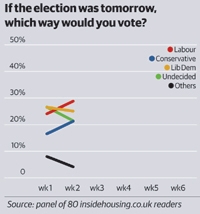

Each week we ask a topical question, and which way panel members would vote if the election was held the next day.

The results from week two of the panel reveal improvements for Labour and the Conservatives.

In week one 24 per cent of those that responded said they would vote Labour, which rose to 29 per cent in week two. The Tory vote rose from 16 per cent to 21 per cent.

Support for the Liberal Democrats and other parties declined slightly, and the proportion of undecided voters fell from 26 per cent to 21 per cent.

Comments on the debt question, which relates to the government’s proposals for reform of the housing revenue account subsidy system, were varied.

‘Anything else is unsustainable across the UK,’ said one respondent. ‘The prize for this reshuffling of debt is huge - it allows local authorities to properly plan how they manage and maintain their housing into the long term for the first time.’

Another countered: ‘I think it is utterly unfair councils should be put in a position to have to take on debt. A number of authorities have tried to be financially prudent and reduce their debt position in advance of the savings being required of them by government. It is therefore unfair to penalise them for this while rewarding more profligate councils for their failure to address their debt position.’

Other comments

‘In short, yes, but a lot would depend on what the actual effect of taking on this debt is. Will it actually affect their operation or is it just a notional figure on the books? Overall, though, it seems fair.’

‘Yes. In times of recession there is a need for councils to demonstrate a greater level of financial competence.’

‘Overall, no it is not fair. It would be more so if the debt were passed on to the councils to whom it related rather than being spread across all councils.’

‘No. It isn’t fair, but life isn’t fair. If councils want to manage their own finances but not get into debt, who are they expecting to carry the debt for them?’

‘Yes. It is ridiculous for councils to expect the debt to not be their responsibility. In return for not continuing to make a net contribution to the HRA, surely it is worth it? The only councils with a real gripe are those with small debts or who are debt-free, who may feel hard done by. But they will not be debt free because they are well run - they will be debt free because they were lucky enough to have a large stock to sell that was worth enough to reduce their debt or make them debt free.’

‘No, it’s not fair that the debt will be redistributed. However, I think that John Healy has done as much as he’s allowed by the Treasury to revamp the HRA system. This is much, much better than nothing and I think that we need to grab the opportunity and run with it, rather than fight an unwinnable fight.’

‘No, It may not be fair, but it is a reasonable, pragmatic and workable solution to an extremely complex issue. In taking on debt, councils free themselves from the inequity of negative subsidy. Without reform, the few councils who currently benefit financially from the housing subsidy system would also be paying tenants’ rents to the Treasury within a few years. All credit to Steve Partridge and others for recognising the impact of negative subsidy and initiating the debate that led to this reform.’

‘Yes – where else is the debt to go?’

‘In some respects yes as everything has a cost! In the short term there will be debt and a shortage in the provision of services but long term there is the capacity through managing their own finance to turn it around. There are always going to be winners and losers in a situation like this and so long as the outcome is favourable to people receiving those services and the level of service is sustained, it does not matter who holds the purse strings.’

‘Yes - so long as monies raised can be demonstrated to be used for the direct benefit of residents, such as in achieving decent homes and the authority can demonstrate it is able to repay.’

‘No - at the start they should all have a clean slate. Then their electorates can make an informed and clear choice about how wisely they have spent their money and what they have achieved with it. ‘

‘No. This begs the question of exactly who takes on the debt. If it is the HRA, then it is tenants who will be taking on the debt. This debt should be treated exactly the same as the debt, on government infrastructure such as bridges and roads. Social housing is a benefit to the whole of society, not just to the current tenants.’