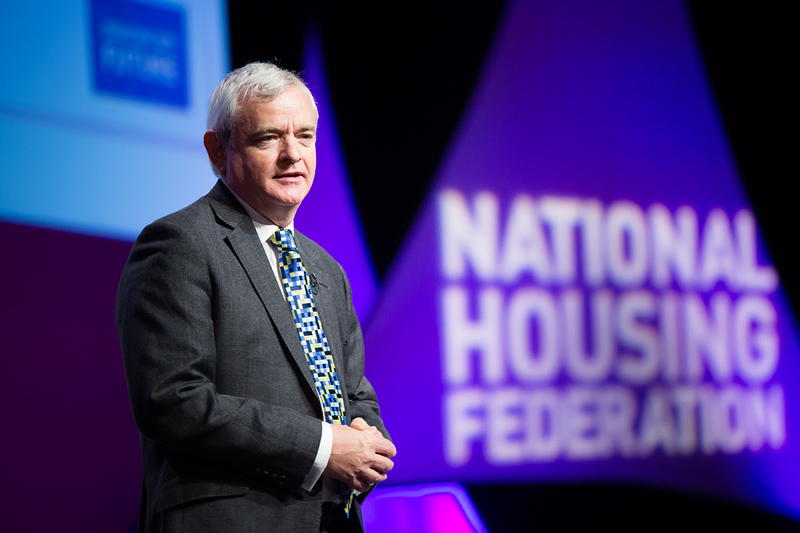

David Orr announced as chair of for-profit provider

David Orr has been appointed chair of a for-profit provider, following his retirement as chief executive of the National Housing Federation (NHF).

Mr Orr has been named chair of ReSI Housing, the housing association subsidiary of Residential Secure Income plc, a housing investment vehicle which is listed on the London Stock Exchange.

In his role leading the NHF, Mr Orr lobbied against for-profit providers being allowed to use the name ‘housing association’.

This resulted in Sage Housing, the registered provider backed by giant property investor Blackstone, dropping association from its name.

It also culminated in Greg Clark, business secretary, weighing in to ban for-profits from using the name housing association.

ReSI Housing has never used the name housing association.

Residential Secure Income plc was admitted to trading on the London Stock Exchange in July last year.

It aims to acquire portfolios of housing association stock and strike management agreements with housing associations – generating a return for investors.

Announcing his appointment today, Mr Orr said: “I believe that ReSI’s focus on rental income and its long-term investment horizon makes it an ideal investment partner for housing associations and local authorities.

“This, combined with ReSI’s focus on investment grade credit, should provide sustainable returns for its investors while contributing to the sector’s capacity to deliver socially and economically beneficial new housing.”

ReSI has a different business model to many of the other large equity investors that have targeted the sector over the past couple of years, as it seeks deals mainly with larger housing organisations.

Rather than leasing homes to housing associations on an index-linked rent, a common model for other equity investors, it strikes management agreements with providers for the properties.

This means the investor, rather than the housing association, carries the risk of rents not being collected.

To date, it has invested £215m, acquiring a portfolio of 2,414 properties, comprising a mixture of local authority and retirement housing.

It launched its registered provider arm in July, saying the move was to make it easier for housing associations to sell it properties and to secure joint ventures with associations.

It is believed to be the first time a listed company has registered a housing association subsidiary.

Explaining his issue with some for-profit providers to Inside Housing last month, Mr Orr said: “From the conversation I have had with different people in for profit organisations, I have divided them into two groups.

“There are some organisations doing new things and bringing something different to the table and this is helpful. [But] there is another group whose business model looks more like value extraction.”