Affordable starts and completions in London continue slump in first six months of this year

A total of 582 grant-funded affordable homes were started and 2,697 were completed in the capital in the first half of the 2024-25 financial year, according to the latest data from the Greater London Authority (GLA).

The mayor of London recorded 582 GLA-funded affordable housing starts in the six months from April to September 2024. Of these starts, 336 were for social rent, 170 were for affordable rent and 46 were for shared ownership.

Of the starts, 127 appeared to be delivered through the mayor’s Council Homes Acquisition Programme, suggesting they had been bought from the private sector rather than built from scratch.

Grant-funded starts were up threefold compared to April-September 2023, when work began on just 142 affordable homes.

However, the wider picture of grant-funded starts over the last few years shows a downward trend. In the last full financial year, 2023-24, 2,358 grant-funded affordable homes were started in the capital. This figure was a 90% fall compared with 2022-23, when 25,658 affordable homes were started in London.

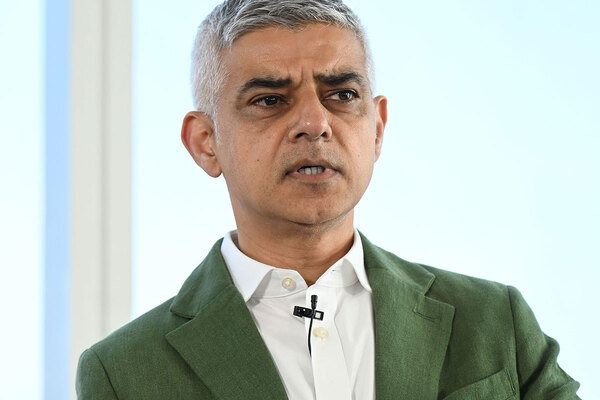

When the annual figure was released in May, Sadiq Khan, the mayor of London, said government investment in housing was too low and claimed ministers had delayed signing off the city’s latest Affordable Homes Programme.

GLA completions in the first half of 2024-25 were higher than starts, but also reflected a downward trend. A total of 2,697 affordable homes were completed from April to September 2024, down 23% from 3,505 in April-September 2023.

The 2,697 completions comprised 1,680 homes for social rent, 493 for shared ownership, 310 for affordable rent, 108 “other intermediate” and 106 for London Living Rent.

By contrast, 10,949 affordable homes were completed in the last full financial year, 2023-24, while 13,954 were completed in 2022-23.

Robert Colvile, director of the Centre for Policy Studies thinktank, called the latest figures “indefensible”.

Tom Copley, the deputy mayor of London for housing and residential development, said in response that the GLA had completed 11,500 homes for social rent in the past two-and-a-half years. “We’re working hard with social landlords to overcome the disastrous inheritance your party left,” he added.

A spokesperson for the Mayor of London said: “The disastrous inheritance from the previous government has left national housebuilding on its knees, with developers predicting housebuilding could fall to the lowest level since the Second World War. While the impact of this legacy is being felt acutely in London, it is apparent across the country with the Office for Budget Responsibility projecting housing completions will fall this year and next.

“Despite this, thousands of affordable homes are still being built across London, with the mayor’s success on affordable housing meaning the capital is well placed to carry on building homes, even during this incredibly tough period.

“The mayor has started more new council homes than any time since the 1970s, and he will continue to work hand-in-hand with the new government to turn the tide on the last 14 years of underinvestment in housebuilding, helping to create a better, fairer London for everyone.”

The latest figures on starts and completions came as the GLA published its annual Housing in London report, which compiles data on the capital’s housing market.

According to the report, local authorities and housing associations owned a combined total of 799,880 low-cost rented homes in London in 2023, an increase of 0.8% from 793,250 in 2022.

In 2023, there were 22,770 homes in multiple occupation with mandatory licences in London, an increase of 5% from 2022.

There were 5,490 households assessed as unintentionally homeless and in priority need in the first quarter of 2024, an increase of 73% from 3,170 in the first quarter of 2023, and 11,993 people were seen sleeping rough in London in 2023-24, an increase of 19% from 2022-23.

London is home to both the fastest and slowest-growing local housing stocks in England.

In the year to Q1 2024, 43,016 homes received planning permission in London, down 36% from 66,602 in the year to 2022 Q4. Approvals are also being concentrated on fewer, larger sites.

Increasing construction on small sites might be key to increasing overall delivery, with 66,420 new build homes completed on small sites between 2012-13 and 2021-22.

The mayor recommended 30,609 homes for approval at planning stage two and three in calendar year 2023, down 35% from the year before. Of homes recommended for approval by the mayor in 2023, 38% were affordable, the same as in 2022 and the joint highest figure since 2012.

Social housing landlords in London owned just under 800,000 affordable homes for rent in 2023, the highest total since 2002. Sales of council homes through the Right to Buy scheme have been on a downward trend since their peak in the 1980s, totalling 1,080 in 2023-24.

With development figures in London struggling, the mayor said he hoped the capital would receive 20% of the £500m top-up for the Affordable Homes Programme announced by the Treasury at the end of last month.

Elsewhere in the new report it was revealed that Citizens Advice dealt with 56,908 housing-related issues in London, up 8.5% from the previous 12 months. The biggest increases in percentage terms were issues reported by people experiencing homelessness or threatened with it, and issues with local authority homelessness services.

As the growth in energy costs and other essentials slowed, there was an overall improvement in the financial situation of Londoners the past year. In July 2024, 11% of homeowners said they were struggling to make ends meet, going without their basic needs and/or relying on debt to pay for them, compared with 26% of private renters and 28% of social housing tenants.

Sign up for our development and finance newsletter

Already have an account? Click here to manage your newsletters