You are viewing 1 of your 1 free articles

90,000 social rent homes a year target may need to be increased, LUHC Committee chair says

The chair of the Levelling Up, Housing and Communities (LUHC) Committee has suggested that the target of building 90,000 social rent homes a year may need to be increased due to a lack of progress made since the goal was set.

Clive Betts, MP for Sheffield South East, made the comment as part of a panel discussion at the Social Housing Finance Conference in London on Wednesday.

Mr Betts was speaking after the findings of his cross-party parliamentary inquiry into the finances and sustainability of the social housing sector were published, also on Wednesday.

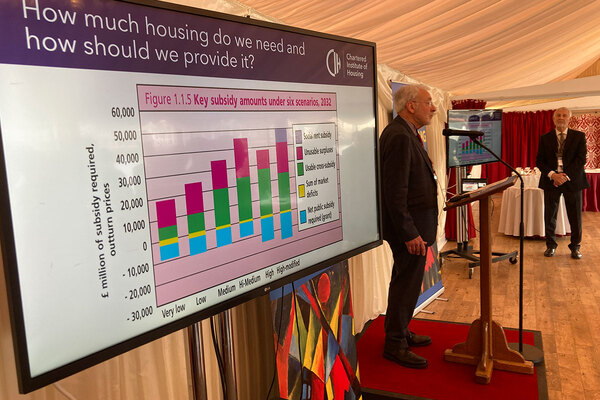

In the LUHC report, MPs said the government should scale up investment so that the country can hit a target of 90,000 new social rent homes a year, a figure proposed in a 2018 study by Professor Glen Bramley and supported by a 2020 LUHC Committee report.

The figure highlighted by Professor Bramley is the same as Inside Housing’s Build Social campaign, which calls on political parties in England to pledge to build 90,000 homes a year over the next decade.

However, Mr Betts told delegates: “We concluded that number about four years ago so there’s an argument it ought to be higher now, given the abject failure of the whole system to deliver more than 10,000 a year in subsequent years.”

He explained that these should be “minimum figures rather than absolute maximums”.

“If we’re going to achieve the wider target of 300,000 homes a year, there’s no way the private sector is likely to deliver more than 200,000 of those. It never has done in the last several decades,” Mr Betts added.

The LUHC Committee also criticised the government’s current use of grant to fund mainly affordable rent and shared ownership housing, rather than social rent homes where residents have the lowest rents.

This funding model was “inefficient”, the MPs said, when “these homes can be financially viable with no direct grant”.

Discussing how to achieve the targets for new social rent homes, Mr Betts told the conference that while Section 106 agreements are “clearly important”, they move with the business cycle rather than against it.

“Perhaps in the next year, if private building drops to the 160,000 forecast, then 106 funding will drop as well,” he said.

Mr Betts said that the Home Builders Federation had written in to point out that some sites were “stuck” because “they can’t get any registered social landlords to come in and pick up the 106 element of it. There clearly are challenges around there”.

Earlier this year, L&Q’s chief executive Fiona Fletcher-Smith warned that housing associations could stop buying Section 106 homes as they face a new homes “cliff edge”.

Speaking on another panel at the conference, Fiona MacGregor, chief executive of the Regulator of Social Housing (RSH), said that landlords should be “carefully monitoring their financial needs” and including “realistic assumptions on interest rates” in their business plans.

Discussing the growing need for increased investment in repairs and maintenance, she said the regulator recognised “the pressure it is placing on landlords’ cash resources and on interest cover”.

“We expect providers and their boards to be absolutely on top of the covenant position, engaging positively with funders at an early stage and talking to us as they work through those issues,” she told the conference.

“It’s no surprise that there are more providers graded V2 and V3,” Ms MacGregor noted, adding that the regulator welcomed the “constructive approach from funders” that had led to 25% of providers agreeing covenant carve-outs with lenders.

Jonathan Walters, deputy chief executive at the RSH, said last November that the latest wave of downgrades reflected the “economic reality” of the sector, with V2 the “new normal”.

Ms MacGregor also commented on the new programme of inspections for social landlords with more than 1,000 homes.

“We expect providers to be able to demonstrate how well they know their stock, their tenants and their business, and the investment that that will need. We’re about a month into the first wave of inspections, so it’s too early to see what the outcomes of those will be,” she said.

Ms MacGregor said evidence from pilot inspections “clearly indicates that even the best landlords have got room for improvement”.

This week the RSH announced its plans to hike the fees social landlords pay by more than 70% per social home to help it deliver its expanded role.

Sign up for our development and finance newsletter

Already have an account? Click here to manage your newsletters