The signature that never was: how an east London block became embroiled in an EWS saga

Since 2019, tens of thousands of leaseholders have been caught up in the External Wall System (EWS) crisis, but few have a story with as many twists and turns as those living in one development in east London. Jack Simpson investigates the saga of the EWS signature that never was

Cecilia’s story begins like many leaseholders caught up in the building safety crisis.

Last year, seven months after moving into her flat in the Mojo Development in Bow, east London, she was greeted unexpectedly with an email from the building’s manager.

It said her block, the Fortius building, had received an External Wall System 1 (EWS1) check, which had identified dangerous materials.

A waking watch was installed, costing thousands of pounds, and residents waited nervously for the inevitable remediation bills.

But here is where the story of Cecilia diverges.

The signature on the EWS1 form was not what it seemed. It belonged to someone who had never seen the form. In fact, the person had never heard of the company she was supposed to have signed it for.

Her signature appeared to have been forged.

But how did this happen? How did a form that was launched to help leaseholders embroiled in the building safety crisis, drag them into a saga that would dominate their lives for 18 months.

And it is a story not just confined to Cecilia’s Fortius block, either. The same signature has been found on several forms across England and Wales, leading to a saga that has resulted in a police investigation being launched and hundreds of leaseholders left powerless and frustrated.

“It feels like everyone involved has failed us,” Cecilia says, reflecting on what has happened.

Buying a worthless flat

But living in her flat was not always like this. When she first bought it in December 2019, it was a time of excitement.

The five-storey Fortius block is one of three on the Mojo Development, which was built in 2010 by Bellway. Fortius is the second biggest, situated between the eight-storey Altius block and the four-storey Citius.

Cecilia had done her research.

“We read countless reports on subsidence, flooding risk etc,” she explains. “The fire risk report even said that the building would be out of scope of the cladding concerns because it was below 18 metres.”

But unbeknown to her, fire safety guidance was changing. Just two weeks after her purchase, the Royal Institution of Chartered Surveyors (RICS) launched its EWS1 form.

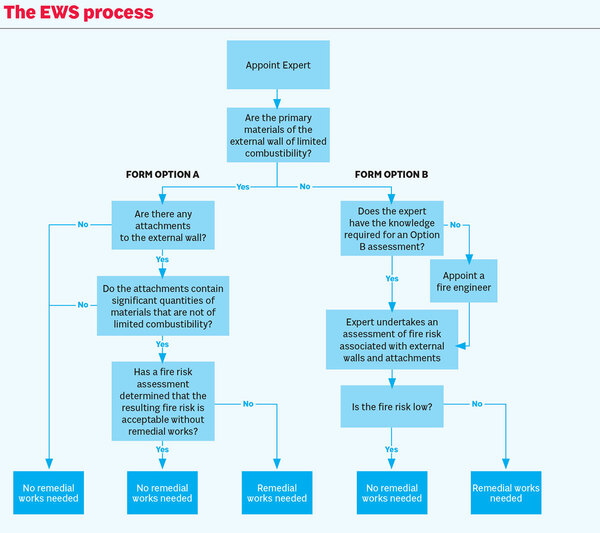

Set up to try and unstick the flat sale market, it required all buildings above 18 metres to be checked by qualified professionals to see if dangerous cladding was present. If not present, the building would get a clean bill of health and banks would provide mortgages. If it did have these materials, leaseholders would be trapped until expensive remediation work removed them.

This was initially just for buildings taller than 18 metres, but in January 2020 the government launched its Consolidated Advice Note. The now infamous guidance deemed that all buildings, regardless of height, now required checks. This brought thousands more buildings, including Cecilia’s, into scope.

It was not until July that Cecilia realised that her block and the neighbouring Altius had become embroiled in the building safety crisis, when an email from their management company, Harlow-headquartered Warwick Estates, informed them that both blocks had undergone EWS1 checks and had not met the requirements of government guidance.

A subsequent letter would confirm a waking watch patrol costing £20,000 a month was now in place across the development.

“The fire risk report even said that the building would be out of scope of the cladding concerns because it was below 18 metres”

In the space of seven months, Cecilia had gone from buying her first home, worth £420,000, to discovering that her dream flat was now covered in dangerous materials, unsellable and effectively worthless.

So, who was checking the cladding?

Newbridge-based Specialist Facade Inspections (SFI) officially launched in October 2019. Set up to help tackle what it called an “increasing demand to offer advice on existing and new build cladding systems”, its role was to assess external wall systems. Since then, it has completed more than 200 inspections.

The managing director of the company was Joshua Tedstone. Mr Tedstone was 21 when he launched the company.

His LinkedIn page, now updated, previously indicated that he graduated with a degree in business management in November 2019. The profile also previously said that his work experience before launching SFI involved “working between university holidays” at PT Consultancy, a roofing and cladding contractor where his father, Paul Tedstone, was a director.

Paul Tedstone, who is described in SFI documentation as its chief technical director, has a long track record in the cladding industry, which he says has spanned 27 years.

SFI was chosen to carry out cladding checks on the Fortius and Altius buildings in June 2020. As part of its work, SFI says it was contracted to inspect the buildings and provide a report which gave diagnostic information about the external wall materials.

The report, seen by Inside Housing, includes pictures of the block’s external walls, as well as explanations of the materials present. On its front page, it carried a large “FAIL”. It was prepared and edited by Joshua Tedstone, and reviewed by Paul Tedstone. It also listed another reviewer, Woman A* (name has been changed to protect her anonymity).

But a cladding report like this one is not enough for leaseholders these days. An EWS1 form is also needed to let lenders know if flammable materials are present.

Despite carrying out the cladding survey, SFI says it was not its job to produce the EWS1 form. Instead, it says, it was contracted to carry out an intrusive inspection of the external wall and produce information to a third party for review, and it was the third party that ultimately signed the EWS1 form. This, it insists, complied with RICS guidance.

Warwick Estates disputes SFI’s view, stating that “no third-party contractors were authorised to be used by SFI” and that the “subcontracting was in defiance of Warwick’s contract and best practice”.

The RICS has no specific guidance around using third parties to sign forms and would not comment directly on whether this was correct practice or not.

However, it does state in the notes section on the EWS1 form that the signatory can use evidence, photographic or through an inspection, gathered by a third party. The RICS has also said the signatory must have “sufficient confidence” in the party and be prepared to explain why if asked by the organisation.

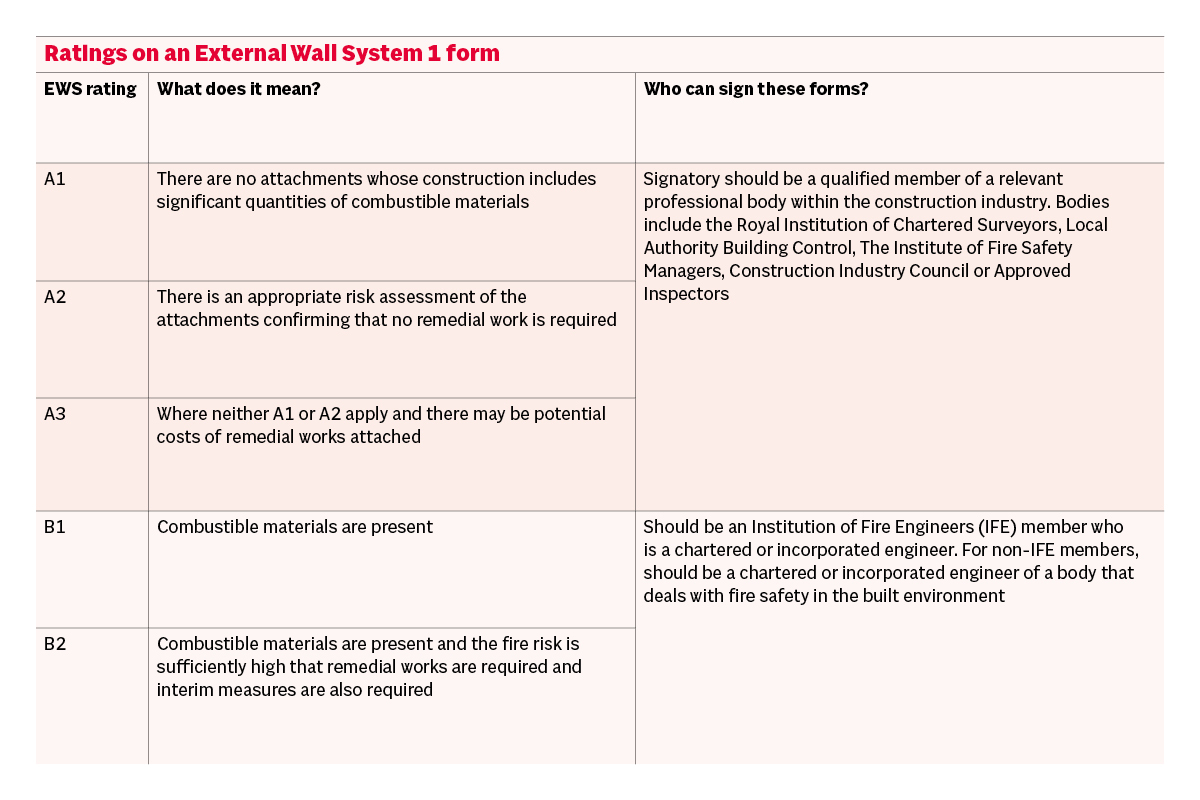

For the Fortius and Altius blocks, EWS1 forms were produced, with the buildings given B2 ratings. This means dangerous materials were found and that remediation was needed.

At the bottom of the form, Woman A’s name appeared again, this time as the sole signatory.

The disappointed leaseholders mentally prepared themselves for the worse – trapped in their unmortgageable homes, waiting for the inevitable costly remediation bills to land.

They took it for granted that the signatory on the EWS1 form was authentic.

They were wrong.

The start of the saga

Fortius and Altius were not the only buildings to receive an EWS1 form signed by Woman A.

A month prior to the Altius and Fortius’ checks, leaseholder and former fraud squad detective Gareth Griffiths first discovered that his block in the huge Century Wharf development in Cardiff had also received an EWS1 form carrying Woman A’s signature.

Unaware of what an EWS1 form was, Mr Griffiths, who had spent three decades in the police, did some detective work.

He looked up the woman and when he found her LinkedIn page, he was shocked to read: “Any and all EWS1 forms or cladding inspection reports signed off using my name are fraudulent, please report.”

He would not be the only leaseholder to find this message. Inside Housing has seen nine SFI cladding reports and EWS1 forms – covering eight buildings across Wales, London and the South East – which carry Woman A’s signature.

As the network of victims began sharing their stories, the news would trickle down to Fortius and Altius leaseholders. After speaking to Mr Griffiths, they would contact Woman A who would confirm her signature had been forged.

Inside Housing has independently contacted Woman A, who says that numerous leaseholders had contacted her regarding the signatures and she confirms that she had never reviewed any SFI reports and never signed any EWS1 forms, for SFI or anyone else.

Now, with the confirmation the form had been signed without Woman A’s knowledge, the leaseholders raised it with Warwick, and demanded that the waking watch be stopped immediately and no costs be passed on.

Warwick spoke to SFI and told residents that SFI had informed them that it had found an “internal HR issue” with some of the EWS1 forms, and SFI had now appointed a solicitor to help deal with the issues and would be re-issuing reports.

A further explanation was given in a letter to Warwick at the time from Paul Tedstone. He explained that following legal advice given after the HR issue was discovered, the company had “recalled a number of EWS certificates”, including those for Altius and Fortius.

He wrote that to “satisfy the MHCLG” (Ministry of Housing, Communities and Local Government), SFI needed a third party to sign off the EWS1 certification and this was carried out by Manchester-based surveyor Tom Clarke, who they believed was RICS accredited.

In a statement to Inside Housing, SFI further explains that its role was to produce “diagnostic information”, in the form of a cladding report, to a suitably qualified third party, and it was the third party – in this case Mr Clarke – that was responsible for providing third-party endorsement and signing off the EWS1 forms.

It was not the first time SFI had worked with Mr Clarke.

Inside Housing has found a ‘certificate of compliance’ report for a building in Manchester which was carried out by SFI. At the bottom of the report, dated November 2019, it states that it was prepared and authorised by Joshua Tedstone, while it was verified by Thomas Clarke, next to the job title ‘senior compliance manager’.

SFI says it had known Mr Clarke for at least two years after dealing with him through a larger agent, but said he had never been a direct employee.

But was he qualified enough to sign off an EWS1 form?

The EWS1 process splits buildings into two categories. For ‘Category A’ buildings, where little or no cladding exists, a form can be signed off by a wide range of professionals, which include RICS-accredited chartered surveyors. Buildings where dangerous materials are present are graded ‘Category B’ and require incorporated or chartered engineers with experience in fire safety to sign them off (see table above).

Mr Clarke is neither a chartered nor incorporated engineer, so could not sign off any building as a B2. However, Inside Housing has now discovered that while he has previously worked as a surveyor, he was not a chartered surveyor, so was never in a position to sign off any type of EWS1 form.

RICS-accredited chartered surveyors can be easily found using the ‘find a member’ tool on its website.

A search of the database does reveal two individuals named Thomas Clarke whose profiles respond to a search for ‘Tom Clarke’ or ‘Thomas Clarke’. These are not the Tom Clarke engaged by SFI.

Inside Housing understands that Mr Clarke is an assessment of professional competence (APC) candidate with the RICS. Surveyors who have either done a university course or have been practicing for five or more years can apply to complete the APC. During this process, they must fulfil expected behaviours and the continuing professional development (CPD) requirements to become a fully chartered surveyor.

Mr Clarke has yet to complete this.

Mr Tedstone explained in his letter to Warwick that SFI had received a notification that “Mr Clarke’s RICS membership had expired”, and that to ensure that the EWS1 certificate could still be signed. Mr Clarke said he would instead get a colleague, in this case Woman A, to sign on his behalf.

SFI tells Inside Housing it was unaware that Mr Clarke was not correctly qualified at the time and that he did not inform Woman A of the extent of the use of her name.

Woman A confirms to Inside Housing she is not a chartered fire engineer, so could not sign off a building as B2. She also says that while she is a chartered surveyor, so could technically sign off a Category A building, her specialism is in commercial property and she has little experience of residential.

Paul Tedstone apologised to Warwick at the time and said SFI was “extremely embarrassed by the situation”.

Nevertheless, he added that it stood by all of its reports and there would be no change to the content and conclusion of its findings. This has been reiterated in a statement made to Inside Housing, in which SFI says its findings have not been “challenged or superseded” by more recent reports.

The two buildings were inspected again by a new company in March this year, which concluded the buildings’ facades included combustible materials that should be removed. They were given a B2 rating again.

After Mr Tedstone’s August letter, Warwick told residents that SFI had agreed to reissue the EWS1 forms and cladding reports, with a new signatory with the correct qualifications.

But that was not the end of the story.

The second EWS1 form

The arrival of the second report for the blocks was slightly delayed, with SFI blaming the backlog of reports it had to work through due to the aforementioned issues.

By 8 September 2020, a new cladding survey had been completed, and a new cladding report and EWS1 form were published. The documents were nearly identical to the last, however there was a new signatory.

But, once again, the person who SFI assured Warwick had the correct qualifications to sign off an EWS1 form as Category B-rated buildings, did not.

The person who signed it at the time was not a chartered fire engineer or incorporated engineer.

While they were a member of the Institution of Fire Engineers (IFE), they only had an ‘AIFireE’ rank at the time. It is one of the lowest IFE member ranks and a rank the IFE believe should not be signing off any type of EWS1 form, according to its matrix.

Once again, the leaseholders were left with an invalid EWS1 form.

This problem of wrongly qualified people signing EWS1 forms is not consigned to just the Fortius and Altius blocks. There have been widespread issues across the sector of professionals with the wrong qualifications signing off EWS1 forms. The Building Safety Register reported in April that of the EWS1 forms for 81 blocks it had analysed, 27% did not have a valid signatory according to RICS guidance.

After leaseholders spotted the issue, they raised it with Warwick and urged it to act. Warwick wrote to residents to say it had now asked SFI to confirm the new signatory’s certifications, had asked SFI for a template to show their method and instructed its own solicitors in regard to the matter, which it said it was taking “very seriously”.

SFI says that at this point, it offered to instruct another accredited surveyor to undertake further investigations and meet the residents to explain the issues and the combustible materials present. None of these offers were followed up by Warwick, it adds.

With leaseholders getting increasingly concerned about the EWS issues and the thousands of pounds they were forking out each month for a waking watch, they enlisted legal advice. A letter was sent to Warwick by lawyers representing the leaseholders, detailing the issues around the forms. It demanded a new survey be carried out by a different supplier, the waking watch be stood down and no costs be paid to SFI for their work.

Warwick tells Inside Housing that with regards to the waking watch, it was working closely with the London Fire Brigade (LFB) and following MHCLG guidance, and the waking watch was implemented after instruction from LFB and its client, the building’s freeholder.

It adds that it had suspended payments to SFI once it first heard about the issues surrounding the signatures on the forms and put instructions and payments on hold until it had investigated. After an investigation it appointed lawyers and refused to pay all invoices, it says.

SFI rejects that it had ceased working with Warwick, according to their response in June 2021.

But it was not only lawyers that the leaseholders of the Fortius and Altius blocks were speaking to. The leaseholders contacted RICS, which launched its own investigation, which is still ongoing.

Action Fraud was also contacted by Fortius leaseholders, as well as those from other blocks impacted across the country.

After being handed to the National Fraud Intelligence Bureau, the case went to the Merseyside Police, with the start of the investigation being confirmed in January of this year. At the end of February, the police confirmed that it had interviewed its first suspect.

In a statement to Inside Housing in April, Merseyside Police confirmed its detectives were “investigating a number of allegations of fraudulently completed external wall fire review forms being issued by a Merseyside-based company”. It did not confirm the name of the company. In its most recent statement, it says the investigation is still ongoing.

SFI tells Inside Housing that it is not being investigated by the police. In its latest statement, a spokesperson adds: “For legal reasons, it would be inappropriate for the company to comment at this stage.”

Warwick issued a statement to Inside Housing in April, in which then-chief operating officer Emma Power said: “Warwick Estates and many other industry agents had enlisted SFI’s expertise and were affected by the issues you raise. It is an episode that has been discussed with our industry’s regulator, and [we] will continue to assist our clients and the police, who are still investigating.”

Inside Housing has made repeated attempts to contact Mr Clarke and has spoken to him on the phone, but has yet to receive a response.

For those in the Fortius building, the frustration for the leaseholders unable to sell their homes continues, too. The majority are in the same position they were in August last year, just a lot poorer.

“It is a crushing feeling, seeing all of our savings, our parents’ savings, vanishing every week and being in a flat that is totally worthless”

A new surveying company carried out checks in March this year, which identified dangerous materials and gave the same B2 result.

While the Altius block, which is over 18 metres, has secured some funds through the government’s Building Safety Fund, Fortius, which is under 18 metres, remains in a precarious position. Advice by the government in the summer instructed banks to no longer ask for EWS1 forms on buildings under 18 metres.

However, the RICS said those blocks that have already received an EWS1 form, regardless of height, would likely still require remediation due to a “valuer’s duty” to report any fire safety information that may affect values.

“We’re still in limbo,” says Cecilia. “[Then-housing secretary] Robert Jenrick’s announcement means we shouldn’t need a form, but RICS has said that once fire issues are discovered, they cannot be unseen, so we still don’t know where we stand.”

This means the building could still require expensive work. While they wait for that, the waking watch has remained in place, swallowing up much of the building’s sinking fund, with leaseholders now having to pay a service charge that has more than doubled compared with previous years.

Nobody in Fortius can get a mortgage. Some leaseholders desperate to move have pursued selling to cash buyers at vastly reduced prices, but have been unsuccessful in finding potential buyers.

“It is a crushing feeling,” explains Cecilia. “Seeing all of our savings, our parents’ savings, vanishing every week and being in a flat that is totally worthless.”

The saga of Fortius underlines a bigger problem with the EWS system. The hurried nature of its inception has led to a system with a lack of clear rules on who can carry out the checks, leading to situations like the one outlined above. When the guidance is not met, there is also little recourse available to leaseholders, despite the costly repercussions. Unfortunately for those living in the Fortius block and other buildings embroiled in this saga, they have had to learn this the hard way.

Sign up for our fire safety newsletter

Already have an account? Click here to manage your newsletters