State of the nation: East Midlands saves £1m with restructure

Collapsed structure and bond issue part of plan to ramp up development

‘It certainly wasn’t value for money,’ Chan Kataria, chief executive of East Midlands Housing Group says, speaking about the organisation’s previous group structure.

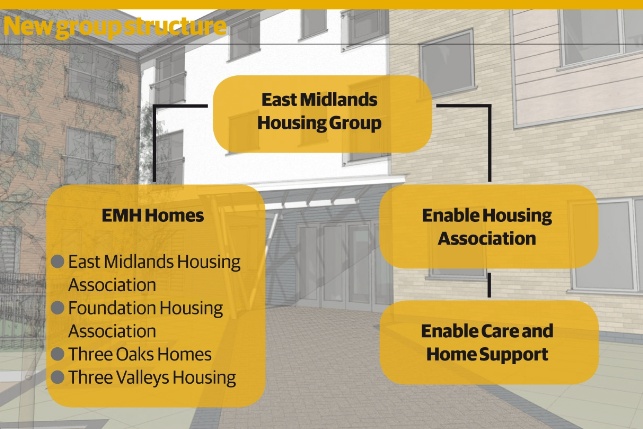

In a move that has taken two years, and involved protracted discussions with lenders, councils, unions and staff, the 18,000-home organisation amalgamated four existing housing associations into one organisation called East Midlands Homes, part of a new simplified EMHG. Mr Kataria says this has already led to £1 million a year in savings.

The organisation, which manages homes in more than 40 council areas in counties including Leicestershire and Nottinghamshire, has radically changed its group structure under its ‘Fit for the Future’ plan. The group also issued a £200 million bond in February, as part of a plan to ramp up its development from 250 homes to more than 300 homes a year. So what is driving this flurry of activity?

Video:

Chan Kataria talks restructure at East Midlands Housing Group

One reason is the rapid expansion of the group over the past 10 years. East Midlands Housing Association took over Foundation Housing Association, a small black and minority ethnic organisation in Leicester, in 2005. Three Oaks Homes, a 2,200-home stock transfer organisation in Blaby, Leicestershire joined in 2008. Another stock transfer organisation, 5,200-home Three Valleys Housing in Derbyshire, joined three years later followed by care and support provider Enable Housing Association last year.

While this increased group turnover from around £19 million in 2004 to £90 million by 2013 it also left the organisation with a bureaucratic federated structure. Seven organisations sat underneath the main group.

‘We are talking about each one with its own board, own management teams’, says Mr Kataria. ‘It was tantamount to over-governance.’

The four landlords have now merged into one organisation called EMH Homes in a process that was completed last September. The group now consists of just two major operating businesses, EMH Homes and care arm Enable. The old structure had an unwieldy 66 board members, while the new structure, with 21 members, has around a third of that figure.

EMHG is building 50 extra care homes in Blaby, Leicestershire

In a potentially controversial move, the group has stripped tenants of their automatic right to have representatives on all of the subsidiary boards. Mr Kataria says the previous set-up, under which around a dozen tenants sat on boards, had caused confusion.

‘Below the boards we have scrutiny panels, and some tenants were acting in both capacities, they were criticising themselves,’ he says.

The organisation has also moved towards a closed membership, meaning only current board members have the right to vote on decisions affecting the group. The company also had to cut deals with lenders. Under existing covenants, lenders had the right to approve the business plan.

‘We wanted to remove that right because the moment we started using the assets to develop they would have re-priced our entire back book,’ Mr Kataria explains.

The group negotiated with lenders, including Santander, Nationwide, Royal Bank of Scotland and Newcastle Building Society to exit deals for an undisclosed fee and in some cases set up new lending agreements.

The group’s simplified new structure helped support the bond issue, raising £200 million at a spread over gilt - the price of government borrowing - of 108 basis points, a better price than many recent similar bond issues.

The structure has also led to cost savings. Around 20 posts were scrapped, with four managing director posts axed and replaced with one group director of operations and two regional housing offices have been earmarked for closure. Mr Kataria says this has led to £1 million of efficiencies in the budget for 2014/15 and will increase to £1.5 million a year within five years.

The group will expand its development from around 250 homes a year to more than 300, focusing on social rent and shared ownership, but not ‘speculative’ market sale.

‘There is a huge need in this region for social housing, many of our areas are former coal mining communities, rundown and not very economically active,’ says Mr Kataria. The landlord will also look to expand further into care through Enable.

By cutting down its structures, EMHG has become a bigger player. It now has the structure and the finance in place to become even larger.

In numbers: East Midlands Housing Group as of 2012/13

18,000

homes

£72 million

turnover*

£7.1 million

surplus

£200 million

bond issued in February

* prior to takeover of Enable in 2013