Risk Register Survey 2024

What were the biggest threats facing landlords last year? Kate Youde looks at the 100 largest housing associations to find out what was top of their risk registers – and what they are doing in response. Illustration by Mr Woody Woods

Social landlords operate in an uncertain world. For the second year, Inside Housing has analysed the strategic risks identified by 100 of the largest housing associations in the UK, in their annual reports and financial statements.

Based on this, we have produced an extensive guide to what landlords view as the biggest threats to their operations. The key risks reflect the changing landscape. Damp and mould, which was referenced in relation to other risks last year, is now a named strategic concern. And there are growing concerns over external economic conditions and the political environment.

Associations continue to navigate the impacts of the conflict in Ukraine, Brexit and the COVID-19 pandemic. Some of those impacts include rising inflation, interest rates and energy costs. They also face newer challenges.

During the last financial year, organisations came under increased scrutiny for the condition of their homes, with tighter regulation, and experienced what L&Q describes as “the fall-out from the instability in the UK government”. Orbit wrote: “The regulatory environment and economic climate is challenging and has raised the inherent risk for the sector.”

The sample of 100 reports studied for 2022-23 is slightly different to last year’s inaugural Risk Register Survey due to mergers. Organisations continue to take varied approaches to stating risks, with the number of principal risks identified per organisation ranging from two to 26. Where associations specified key risks but then included a full list, Inside Housing only included the top risks. Like last year, we have grouped concerns under themes where applicable. This may mean a topic that is counted as one risk in an organisation’s report falls into a number of categories for our purposes, or vice versa.

Our analysis examines some of the major concerns identified. We also share lessons and mitigations landlords have put in place to address some of their top risks, to help drive learning across the sector.

Risk management

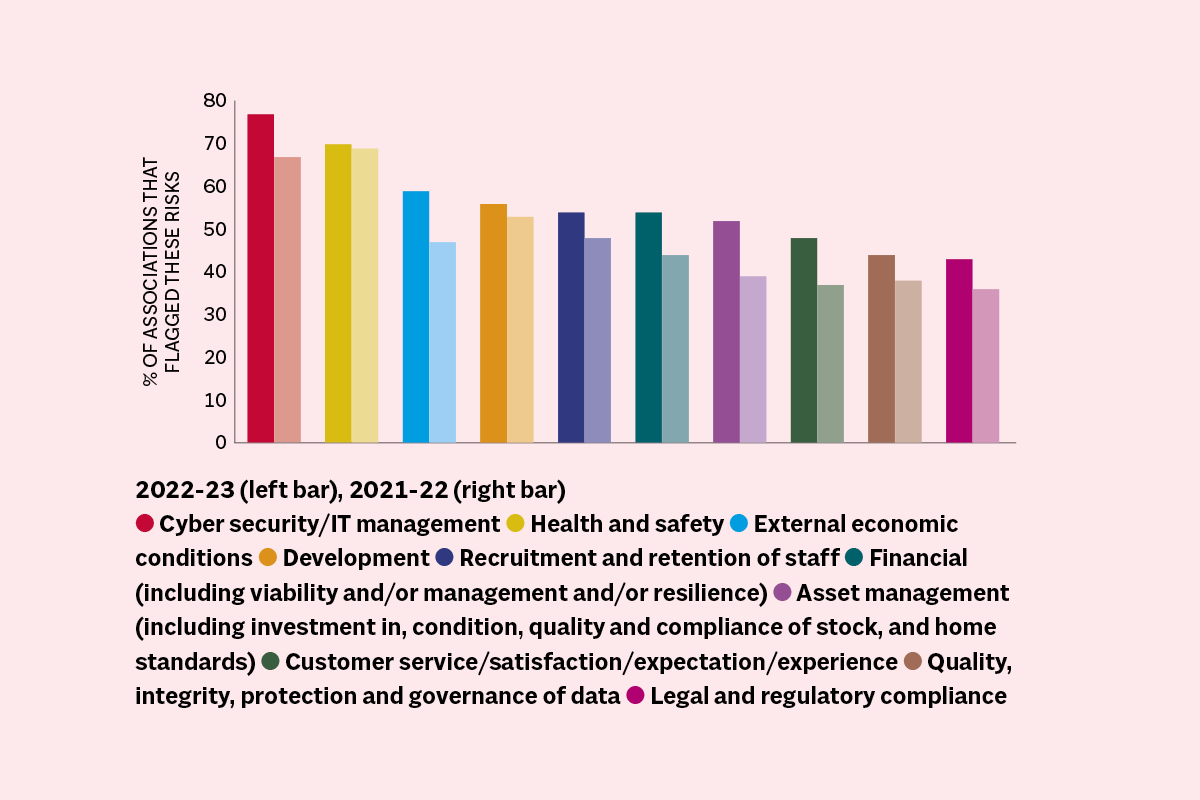

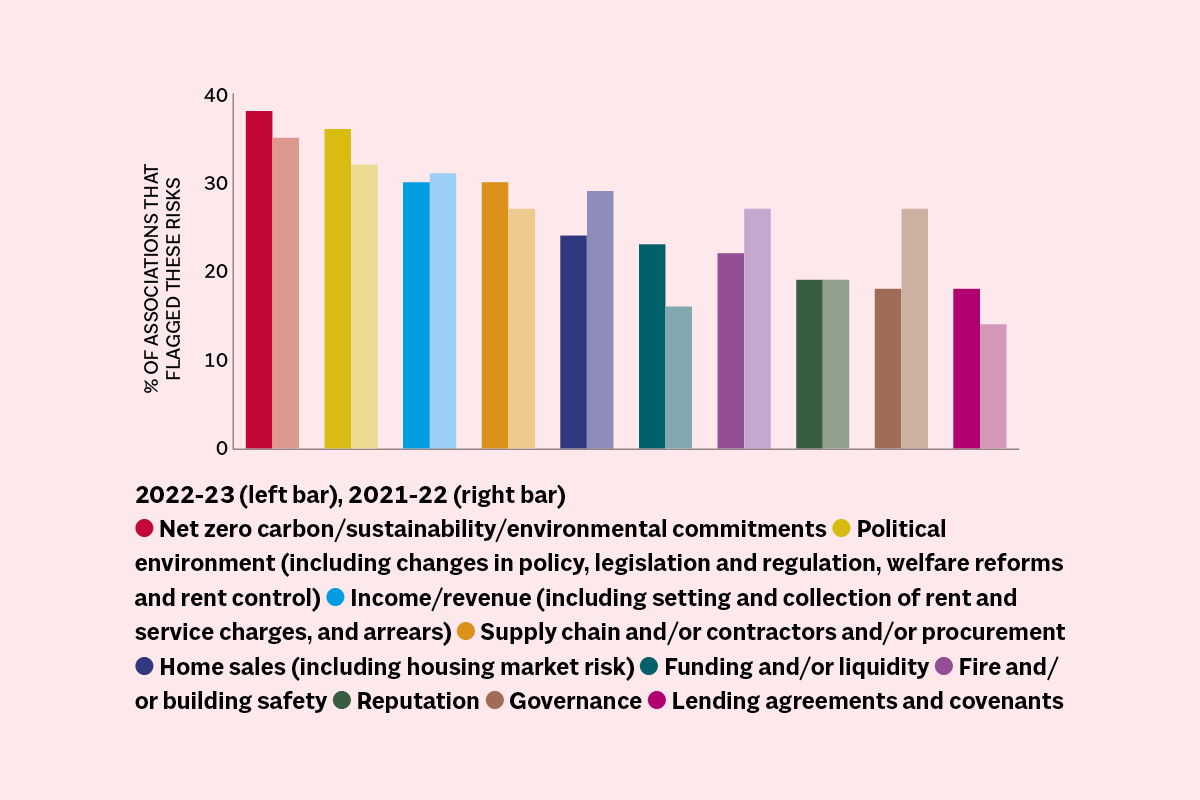

Inside Housing’s research found that associations flagged more than 50 different top risks again this year. However, there were year-on-year changes in the proportion identifying individual risks. In the case of Mosscare St Vincent’s Housing Group the “breadth of potential risks” to the association has increased due to the “ever-changing operating environment”.

Effective risk management is key to associations identifying and then mitigating risks. Grand Union Housing Group is among the organisations that made changes in this area during the 2022-23 financial year. The landlord introduced a new “Risk Universe”, comprising every type of risk that could impact its ability to operate, and developed an agreed risk appetite. It used the Risk Universe categories to help define its 10 principal risks.

The 13,000-home association aims to “further improve and embed” risk management across the organisation in 2023-24 and is working with an external consultant to support its progress. It will introduce “risk champions” to boost understanding of the interdependency of risk across the business, run workshops to promote risk management, and communicate to teams the intelligence, information and trends about risk it gathers from external sources so this can be fed into the delivery of services.

“We will continue to embed the importance of risk management at every level of Grand Union and encourage colleagues not to view risk management in silos, but to understand how a risk in their service area may affect other areas and the achievement of our overall aims, objectives, priorities and vision,” the landlord says.

We hope, in turn, that our round-up furthers understanding of risk across the sector by offering ideas for action and lessons to share.

Political environment

The external political environment, including changes in policy, legislation and regulation, welfare reform and rent control, is a strategic risk for more than a third of landlords (36%). The revolving door at Number 10 has not helped: the UK had three different prime ministers during 2022-23: Boris Johnson, Liz Truss and Rishi Sunak. Next door in Downing Street, there were four chancellors of the exchequer: Mr Sunak, Nadhim Zahawi, Kwasi Kwarteng and Jeremy Hunt.

As Places for People puts it: “There has been a range of changes in the political leadership in 2022-23, which has caused a lack of certainty and clarity of policy direction.” The landlord has raised the rating for a risk that includes the political environment and macro-economy from “medium” to “high”, and suggests the risk has progressed from “likely” to happen and have a “minor” impact to being “likely” with a “moderate” impact.

Associations “continue to operate in a period of political flux”, says Sanctuary. A general election has to be held by 28 January 2025, but is expected in 2024.

Government policy, legislation and regulation is the 120,000-home landlord’s highest-rated risk, with the risk increasing year on year due to uncertainty regarding rent. It says there is a “risk that future rental uplifts will be below inflation, which would impact our ability to deliver fully funded services”.

Common mitigations by landlords include monitoring of the evolving political landscape, stress-testing in relation to potential policy changes, and external engagement.

Southern Housing says its relationships with politicians, local authorities and civil servants allow “a greater level of insight and influencing”, while the 78,000-home landlord also works with organisations including the G15 group of London housing associations and the National Housing Federation to influence government policy.

Supply chain/contractors/procurement

Concerns within this category, flagged by 30% of landlords, include the failure of a supplier or contractor, supply chain disruption and procurement. Separately, counterparty risk (the probability that the other party in a contract will not fulfil its part of the deal or default) is identified by 4%. Supply chains and “dependency on third parties and counterparties” to deliver its strategic objectives was an “escalating” risk for Karbon Homes. The 32,000-home landlord had to respond to the failures of contractors Go-Centric, a call centre provider, and Tolent Construction.

Here are some steps landlords are taking to mitigate risk involving their supply chain, contractors and procurement:

- Background checks: Cross Keys Homes carries out due diligence on key suppliers before a contract is signed.

- Contract management: Settle has a nominated contract manager for third-party contracts and provides training for these staff, while Wheatley uses a contract management system to flag risks such as higher prices.

- Performance tracking: Clarion uses key indicators to monitor service delivery and performance.

- Financial checks: Stonewater uses checks by business data provider Dun & Bradstreet “to ensure early visibility of any financial challenges” its contractors may be facing.

- Regular engagement: Metropolitan Thames Valley talks regularly with site teams and senior figures at contractors/developers, while clerks of works, development managers and health and safety inspectors make regular site visits.

- Diversification: Platform spreads work across different contractors so it is not dependent on only one.

- Service delivery: Home Group has adopted “new models” of delivery for its repairs and maintenance services and brought some of these services in-house.

- Inflation tracking: Bromford closely monitors inflation and works with suppliers to manage costs.

- Stock monitoring: Incommunities expects its suppliers “to maintain agreed levels of supplies to avoid disruption”.

- Industry collaboration: Network Homes is working with other G15 members on the issue of supply chain fragility.

- Conflict assessment: Futures Housing reviewed whether it had contracts with suppliers sourcing services and goods from Russia, and whether there was a risk to any supplies or materials that came through Ukraine.

- Currency checks: Futures has been assessing its supply chain to establish exposure to exchange rate movements.

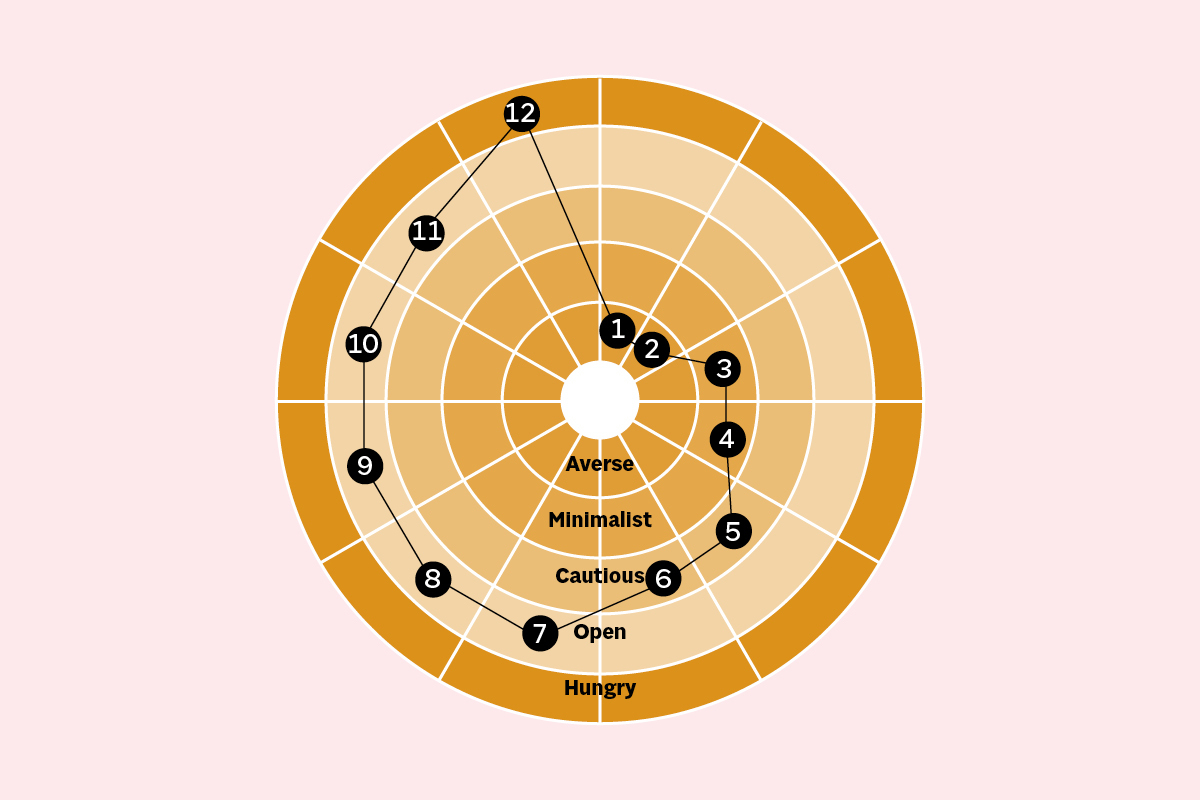

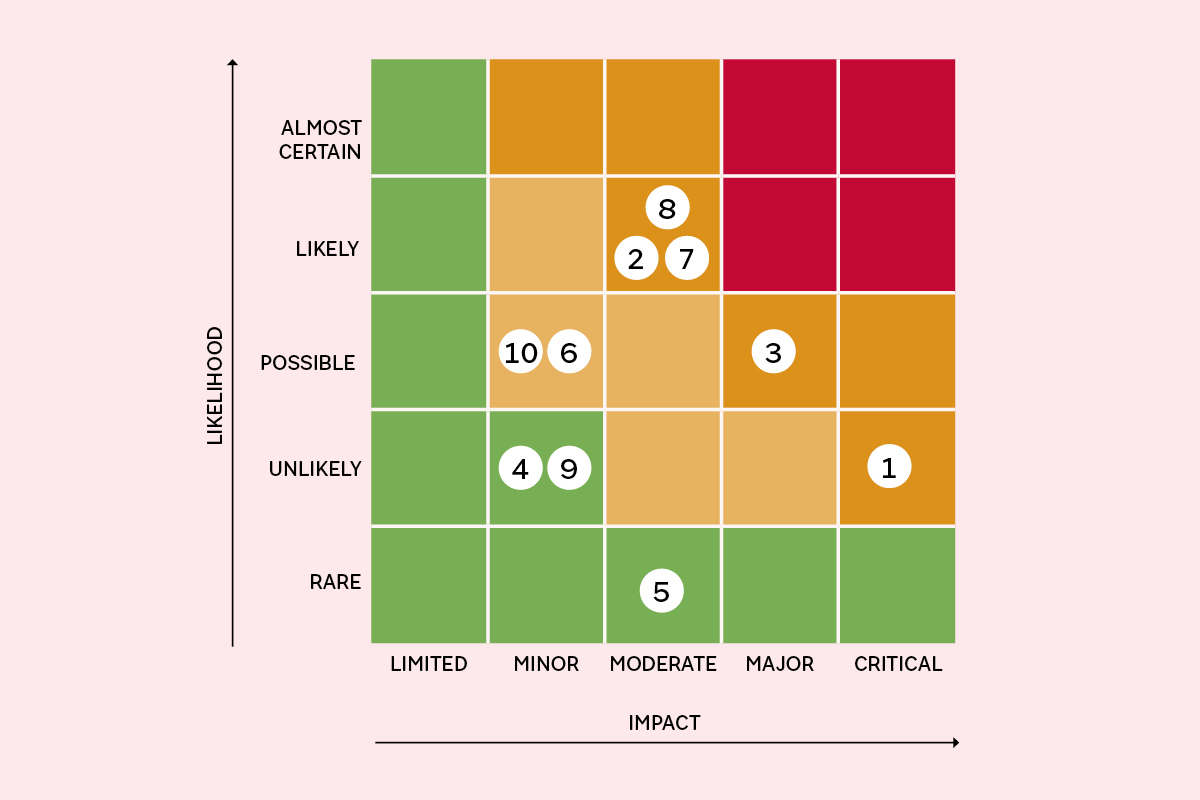

Hyde Group’s risk management framework

Hyde Group sets a level of risk appetite, which guides its decision-making and strategy.

The housing association has risk appetite statements across 12 key areas that establish its capacity for taking and absorbing risk and provide principles for decision-making. Its board manages risks and reviews its risk appetite every year.

The 12 categories are show on the diagram, above:

1. Regulatory and health and safety

2. Fraud, bribery, theft and corruption

3. Core service delivery

4. Data, privacy and information security

5. Business continuity and resilience

6. Funding and liquidity

7. Legal

8. Development, investment and asset management

9. Outsourcing

10. Change and transformation

11. Reputation

12. People

Finance-related risks

The proportion of landlords flagging financial shock, viability, health, management and/or resilience as a strategic risk has risen 10 percentage points year on year to 54%. This is perhaps unsurprising against a backdrop of global economic uncertainty: 59% of organisations cite external economic conditions, including inflation, rising costs, the cost of living and global events, as a key risk. The figure was 47% in 2021-22.

“The volatility of the economy has been unprecedented with inflation and interest rates rising rapidly,” notes LiveWest, which increased the status of its financial resilience risk year on year. “We carried out extensive business plan stress-testing, which included single and multi-variant scenarios of inflation, rent, interest rate and a housing market slowdown to ensure our continued viability and ability to meet our strategic objectives.”

There is growing concern among landlords across a number of different finance-related risks. Almost a fifth (18%) of associations flag lending agreements and covenants as a strategic risk, compared to 14% last year.

4%

Rent arrears at Bromford in 2022-23, an increase from 2% the previous year after a cyber incident

5.5k

Rochdale Boroughwide properties that were checked for damp and mould over three-month period

£15.9m

Yorkshire Housing’s capital investment in existing stock in 2022-23, up from £7.5m

£17m

Cost of cyberattack in June 2022 to Clarion

Damp and mould

A total of 17% of landlords reference damp and mould as a strategic risk heading, while more mention it in relation to other risks and hazards elsewhere in their reports. In February 2023, the government announced ‘Awaab’s Law’ in the wake of the death of two-year-old Awaab Ishak in 2020 due to prolonged exposure to mould in his family’s flat, managed by Rochdale Boroughwide Housing. This will place new requirements on social landlords to address damp and mould within specified timeframes.

Rochdale Boroughwide Housing’s report says it started taking a “proactive approach” to identifying and treating damp and mould as a result of a “significant increase” in linked repairs in 2022-23 following Awaab’s death and the coroner’s report. The 12,000-home landlord established a damp and mould taskforce, which reports weekly to the executive team about progress with inspections and repairs.

The organisation provided repairs operatives and other staff who visit homes with online training in identifying mould, and required them to carry out “a damp and mould visual check” on every property visit. The landlord performed checks on 5,500 homes within the first three months, which prompted requests for technical inspections in 2,246 homes. It commissioned a 100% stock survey to provide a “complete picture” of the condition of the organisation’s homes by the end of 2023.

According to Rochdale Boroughwide Housing, early indications are that the treatments it applies in affected homes “eliminates the mould… we have only had 3% of cases reporting mould return – all of these are then inspected to identify any root cause”. It has commissioned a 100% stock survey to provide a “complete picture” of the condition of the organisation’s homes by the end of 2023.

Yorkshire Housing says the “sector had a wake-up call”. Tackling damp and mould was both a strategic risk and a priority for the 20,000-home landlord in 2022-23, with the organisation increasing its capital investment in its existing stock from £7.5m to £15.9m year on year.

Preventative strategies Midland Heart is developing include: the prioritisation of investment in energy efficiency on homes with damp and mould; “targeted educational programmes on heating and ventilation”; and programmes during the summer months to “check and clear rainwater gutters and test extractor fans”.

Reputation

“The environment we operate in remains challenging. The sad event in Rochdale that led to the death of Awaab Ishak put the sector under the spotlight and we are working hard to maintain the trust of our stakeholders,” says Onward Homes. The 35,000-home landlord is among the 19% of organisations that name a strategic risk relating to reputation. Contributing factors highlighted by associations include negative media coverage, customer dissatisfaction, the quality of homes and strategic decisions. The area of customer service/satisfaction/expectation/experience is of growing concern in the sector: 48% of organisations flag it as a key risk, compared to 37% 12 months ago.

So what controls are landlords adopting to mitigate the risk to their reputation? Here are 10 examples:

- Complaint-handling: Housing association Settle logs and manages all complaints it receives centrally, and has a specialist team that follows up on disrepair and damp and mould cases, which are reported separately.

- Case load: PA Housing has introduced a new “escalation team” that deals with priority customer service cases.

- Performance reviews: Magna Housing has regular performance reviews with key partners, including the provider of its out-of-hours emergency call centre and the contractors it uses for warden alarms.

- Customer engagement: Acis Group mitigates against “poor customer/stakeholder perception” with a “customer-first” approach, and encourages “customer involvement and feedback”.

- Social media: Link Group’s communications team monitors social media on a regular basis to identify “defamatory comments” made by members of staff, former employees or the public that could cause deterioration of reputation.

- Explaining decisions: GreenSquareAccord sets out in corporate communications the “rationale for any changes in strategic direction”.

- Communications strategy: Beyond Housing, which provides media awareness training, has a crisis communications plan aligned to the organisation’s major incident response plan.

- Positive news: Aster takes proactive steps to communicate the positive impact the organisation has made, “celebrating the difference safe and secure homes make” to its residents and highlighting the work of the Aster Foundation.

- Monitoring opinion: Network Homes uses market research company Voluntas to conduct customer surveys and holds tenant consultations prior to starting major works.

- Recording risks: Karbon Homes keeps a “reputational risk log”.

Places for People’s risk management framework

1. Health and safety: The group suffers a major incident impacting the health, safety, or well-being of multiple customers, colleagues or contractors where the harm to the stakeholder is severe or the sanction faced is material.

2. Customer experience: A major failure to meet customer expectations, either permanent or temporary, leading to a significant reduction in customer satisfaction, reputation loss, regulatory censure and/or financial loss.

3. Technology data and security: The data management, governance, or technology is unable to meet the information needs or cyber security and/or privacy requirements of the business, leading to financial loss, poor decision-making, inefficiency, compliance failures, data breach, system loss/failures, penalties and/or reputational damage.

4. Legal and regulatory: The group could fail to comply with its legal/regulatory requirements, including the delivery of value for money and compliance with anti-bribery, anti-money laundering and modern slavery regulations, safeguarding, the Welfare Reform and Work Act 2016 and rent regulations. There could also be a loss of assets and/or reputational damage due to fraud, bribery or theft.

5. Strategy and governance: The group has an ineffective strategy and/or governance leading to a lack of control or direction, impacting our ability to deliver the business plan and social impact objectives. Operational performance is compromised due to merger/acquisition failure, or in pursuing new business.

6. People: The group is unable to deliver the business plan or provide satisfactory service to customers due to a failure in employment practices, key person dependency, or an inability to retain, recruit or develop people in sufficient numbers, or with sufficient quality and skills.

7. Business performance: Business performance impacts the group’s ability to deliver the business plan, or deliver more affordable homes, due to unplanned cost increases, revenue reductions, insufficient liquidity, development or planning-related issues, or supply or counterparty failures.

8. Political, environment and macro-economy: Changes in government policy and practice, or economic disruption to the UK or worldwide economy impact negatively on the products and services the group offers and/or the achievement of performance targets in the group business plan.

9. Sustainability and uneconomic assets: The group is unable to adequately respond to climate change, decarbonisation requirements, uneconomic assets or environmental risk factors, impacting on our ability to achieve strategic goals, customer safety, and/or regulatory compliance.

10. Business disruption: The group suffers a major incident, impacting the continuity of the business and delivery of customer services. Significant disruption or prolonged business restrictions impacts the business plan.

Cyber security/IT management

The risk of a cyberattack compromising IT systems and data security has overtaken health and safety as the most commonly flagged concern, according to Inside Housing’s research. It was a strategic risk for 77% of landlords in 2022-23, a rise of 10 percentage points. 56,200-home Home Group notes an increase in the frequency of attempted cyberattacks, while in its report, Clarion says: “Cyber security threats have continued to evolve over the last year and remain a major challenge.”

Clarion experienced a cyberattack in June 2022 that had “significant and prolonged impacts on access to systems”, and reduced its service to customers for three-and-a-half months. This contributed to the failure of the UK’s largest association to achieve its target for complaints. The £17m cost linked to the incident impacted its surplus, while its rent collection rate dropped from 99.96% to 96.7% due to the attack affecting its processes. Afterwards, Clarion “accelerated” plans to introduce new technology, swapping its contact centre “telephony”, which was affected by the attack, for a cloud-based system. The 125,000-home landlord acknowledges the risk of a cyber security breach is “not a threat which stands still” so is investing in activities to reduce residual risks and strengthen resilience.

Bromford was hit by a cyber incident in summer 2022, rendering its systems “inaccessible”, causing the 46,000-home association’s arrears to increase from 2% to 4% during 2022-23, and a rise in empty homes. Bromford appointed a new head of data governance and information security. Inside Housing found that the linked issue of data quality, integrity, protection and/or governance is a strategic risk for 44% of organisations.

Network Homes flagged cyber security in its latest report, completed before its merger with Sovereign, after it was not included the year before. The report does not state a reason for this. The 62,190-home landlord also undertook a cyber security business continuity test.

Other recent data research features from Inside Housing

Inside Housing Chief Executive Salary Survey 2023

Inside Housing’s annual survey reveals the pay of more than 150 housing association chief executives. Katharine Swindells reports

Inside Housing’s annual list of the Biggest Builders shows who is building what homes, and how the economic climate is impacting on the development pipeline. Jess McCabe reports

English social landlords spent a record £6.5bn on repairs in 2021-22, with wide variations across the sector. Find out who is spending what and what landlords think will happen next. Caroline Thorpe reports

Sign up to our Best of In-Depth newsletter

We have recently relaunched our weekly Long Read newsletter as Best of In-Depth. The idea is to bring you a shorter selection of the very best analysis and comment we are publishing each week.

Already have an account? Click here to manage your newsletters.