Inside Housing Board Member Briefing: managing development risk

In the second in our series of board member briefings, Peter Apps looks at how the boards of housing providers can manage development risk in a difficult operating climate for the housing sector

Building new homes is a challenge at the moment.

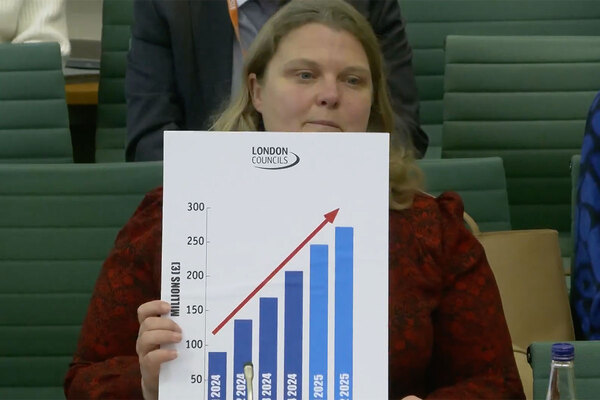

Build costs have shot up rapidly, labour is in short supply, the housing market is unpredictable and contractors are going bust at the fastest rate in a decade.

At the same time, social landlords must prioritise expenditure on existing homes – as the sector rushes to address the post-Grenfell crisis in fire safety, disrepair and the race to net zero.

Working out how to navigate this environment, and how to keep building without getting into financial trouble, falls to an organisation’s board.

So this month’s Board Member Briefing asks how board members should approach this. How do they keep the social homes we desperately need coming out of the ground, without putting their organisation at risk?

Making development plans

Some might think the most risk-free approach in the current climate would be to stop building. But this may be the wrong assumption, says Matt Cowen, a senior associate at Winckworth Sherwood, who advises housing association boards on their approach to development.

“The first question I always ask to boards who are thinking about a new development is how does this align with your core purpose and strategic objectives?” he says.

“They need to think about the implications of not developing and how that might impact on their core purpose and the reputation of the sector, as well as the risks associated with developing.”

David Weaver, chair of Orbit and a veteran of the financial services sector, adds: “The first question I have for any board has to be, is this part of your strategy? Is building homes part of your strategy? And if the answer to that is ‘yes’, then that’s a fairly serious strategic commitment and the entire business has to wrap itself around that decision.”

“One of the things I would stress is [board members] should think about what the opportunities are and the positives which would come from a new development and not get locked into the negative, because that can quite easily happen in the current market,” adds Jonathan Corris, a partner at law firm Devonshires.

The first step for a new board member, Mr Corris adds, is understanding the decision-making structure at the organisation they have joined.

“Have the financials already been tested, have the building safety elements and all of the other necessary questions already been considered within different committees?” he says.

Some organisations will run every development opportunity past its main board. Others will have a development sub-committee which will sign the individual schemes off and use the main board to oversee the strategy.

Others will blend the approach – sending schemes to the main board if they are over a certain value, for example, or if they involve a major amount of market sale, and using sub-committees to assess the rest.

Mr Weaver explains that at Orbit, the board has set hurdles which a new development opportunity must pass before it starts the approval process.

It will then be “reviewed pretty extensively” within the business – moving up through a senior executive team and the board of the development unit of the business. Anything large will then move up to the group board.

Choosing a structure

This all sits alongside “performance monitoring and cost management and demand management that goes on on a daily, weekly and monthly basis”, he adds.

But whatever structure a board adopts, its members needs to be confident that risks have been properly taken into account.

“Providers should undertake sensitivity analysis at a scheme level when approving new schemes to show the impact on key development measures, in addition to subjecting the whole development plan to stress-testing through annual business planning cycles,” says Nick Atlay, an associate director at Savills Affordable Housing Consultancy.

“You need to understand at an organisational level what impact risks would have if they crystallised, and how you would repair the business plan if they did.”

“I think one of the main questions at the moment is, what are the options to get out of it?” adds Mr Corris.

The most tempting answer may be to change tenure: if a market sale scheme fails to sell, could it become affordable housing? If the costs are racking up, could rented housing be flipped to shared ownership to bring a receipt in faster?

But these actions are not always practically achievable, and certainly need to be planned for.

“Board members need to really interrogate officers to see if they really thought about that, because it isn’t always as easy as you might think to change tenures part-way through,” says Mr Corris.

“There could be planning restrictions – some Section 106 agreements might constrain the ability to flip a scheme to 100% affordable. A board member needs to ask, can we change tenure within planning? Do the grant conditions allow it? Is there anything in the purchase contract that stops us?”

Considering the social purpose

If tenures do change, Mr Corris adds, the board will also need to think about whether the development is still sitting in the right part of the organisation.

A market development built through a commercial arm, for example, may need to move to the charitable arm if the tenure changes. Discounted private rents may sit more comfortably in a different part of the structure to affordable rent.

The board must also ask how the organisation’s social purpose is being served by the development, alongside just the risk, explains Mr Weaver.

For example, a large, low-risk development outside Orbit’s core operating area may be less attractive than one with higher risk, but which meets an immediate housing need right in the area it wants to serve.

“These are all 10-year decisions,” he says. “It’s for the next generation of board members and probably executive team members to continue to carry through that strategy. So you do have a duty to get these things right for the long term.”

Another major issue with development at the moment is counterparty risk – in simple terms, the danger of a contractor on a major scheme going bust half-way through.

“It’s not enough to just identify the risk, the next step is to say how can we mitigate it to make it more palatable to us?” says Mr Cowen. “Take counterparty risk. We have obviously seen a huge amount of disruption to the supply chain, so do you do enhanced due diligence, do you think about payment structures that can help keep them solvent?”

“Counterparty risk is very prominent at the moment,” adds Mr Atlay. “Construction companies have been going out of business at the fastest rate in the last decade. It is very important providers are undertaking credit checks and are aware of declining performance, and also ensure that there is no over-reliance on one single contractor.”

While the regulator is never going to set out a clear step-by-step process, its governance and viability standards, as well as the recently published annual sector risk profile are good places to start. “The sector risk profile is great for board members because that sets out the risks of development they need to be considering,” says Mr Cowen. “They should absolutely be reading that cover to cover and building it into their conversations.”

These conversations need to be challenging.

“Boards have a duty to get the right information and make decisions based on it. That requires professional curiosity. There has got to be challenge. I don’t think that has to be confrontational, but it has to be robust,” says Mr Cowen.

They need to have assurance from the executives that the sums have been done. “What happens if this is delayed two years? What does that impact? Are there any issues with regards to, for example, on-lending [lending between different parts of the same business].

“Does that therefore mean we wouldn’t be able to do some other activity? The board particularly needs to ask the finance and treasury team: would such a delay impact negatively on our lending covenants,” says Mr Corris.

As well as having stress-tested development schemes before embarking on them, the board also needs to have systems in place to alert it if things are going wrong.

“As well as having prudent assumptions at the start of the process, it’s also important to have early warning systems in place,” says Mr Atlay.

He explains that this could be linked to development or sales performance – for example, a quarter-on-quarter increase in unsold units for two consecutive quarters – or the organisation’s forecast covenant performance or liquidity.

Looking after customers

Mr Weaver adds that development should not simply be seen as a trade-off with work to existing homes.

“We have an absolute responsibility to look after our customers as effectively as we can,” he says. “In terms of the core element of maintenance, this is pretty much something that we absolutely have to do. We do make mistakes, but we wouldn’t want those to be the result of spending decisions.

“So I think to portray it [development] as a trade-off is a little bit overly simplistic. I think it’s more of a risk management exercise that a board undertakes as to how much capital and how much exposure it wishes to carry.”

Overall, though, the difficult process of taking the right amount of risk is the aim – if social landlords want to keep developing new homes for a new generation of residents to benefit from.

“Ultimately social housing providers’ core purpose is to provide social housing. They are politically mandated by the government to do so. It’s not risk-free to develop, but it’s not risk-free to say we are not going to develop either,” says Mr Cowen.

“With the level of direct and also implicit government support the sector has, we have, frankly, a duty to build houses for people who need them. And I think if we don’t, we’re not fulfilling our purpose,” adds Mr Weaver.

Working out how to keep doing this without putting the business at risk is the job boards around the country face. It has rarely been harder. But it has also rarely been more important.

Sign up to our Best of In-Depth newsletter

We have recently relaunched our weekly Long Read newsletter as Best of In-Depth. The idea is to bring you a shorter selection of the very best analysis and comment we are publishing each week.

Already have an account? Click here to manage your newsletters.