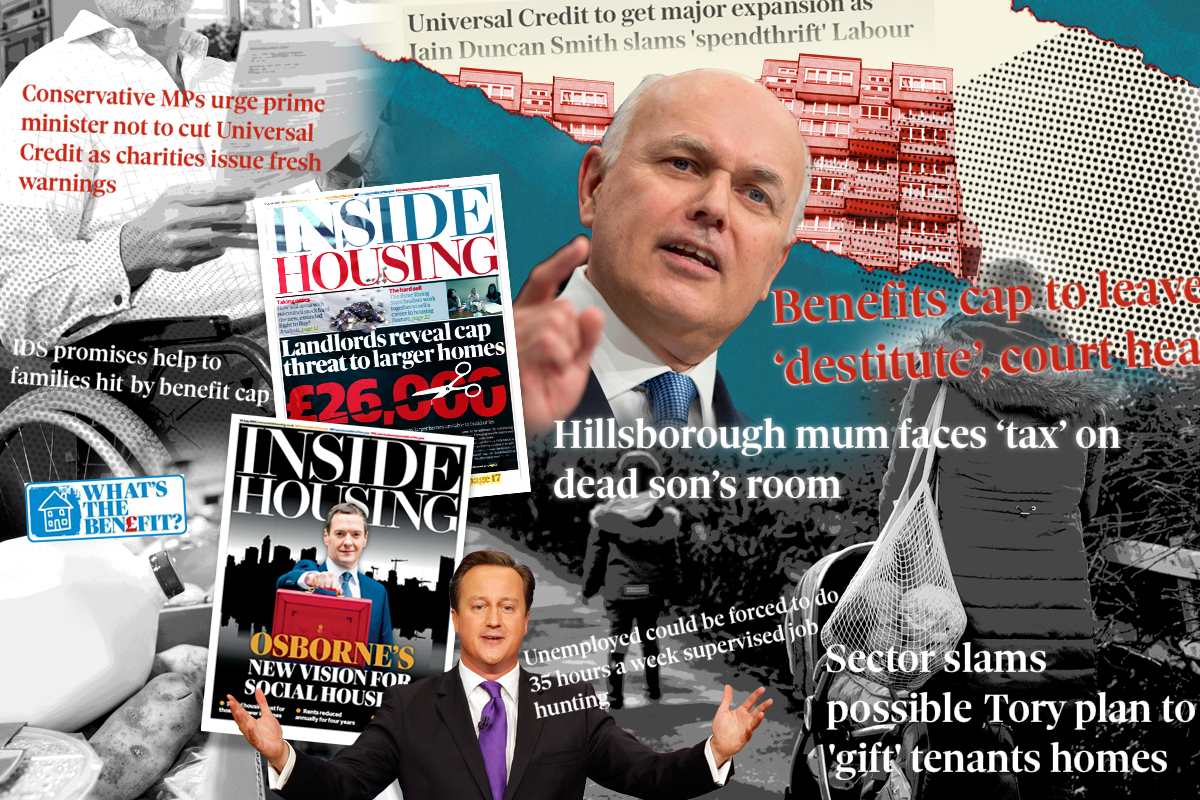

A housing association makes the case for reforming the welfare system

With a general election on the horizon, Grand Union has published a report calling for wholesale reform of the benefits system, to lift people out of poverty and make the system easier to navigate. Sian Norris finds out what the report is calling for – and why

“As we move towards an election next year, I would really like to see some acknowledgement from the political parties that the welfare system needs fixing,” says Aileen Evans, chief executive of Grand Union Housing. “The system is not efficient for the government or for claimants.”

She is explaining why, more than a decade on from sweeping reforms to the welfare state introduced by the 2010 coalition government, 12,000-home Grand Union has published a report calling for a wide-ranging review. This is necessary, argues Investing in the Future: Reforming the UK’s Welfare System, in order to move people out of deprivation and debt.

With rising poverty rates and a cost of living crisis that is pushing even the people who are “just about managing” into hardship, the need for reform has never been more urgent. The report points to “Kafkaesque” systems and muddled customer service that cut people off from support, while administrative failings, “nonsensical” rules and a postcode lottery for council tax relief are widening the gap between surviving and thriving.

But arguably the crucial failing of the welfare state is that benefits are often not enough to live on. This shortfall has grown as a result of the cost of living crisis and the long-term impact of the pandemic, with more families struggling to make ends meet and more living with long-term sickness. Whether a family is claiming in-work benefits designed to top up low wages and high living costs, or a person requires support because they cannot work, Grand Union’s report finds that benefits have failed to keep up with costs and need, pushing households into debt and entrenching poverty.

Accumulating debt

This is the case for Sana, a single mother, Grand Union tenant and full-time carer of her son Tariq, who is disabled. Sana, whose story is featured in the report, is entitled to both Universal Credit and Disability Living Allowance, but the rising cost of living has left her short of more than £100 every month. Struggling to make ends meet, and unable to work because of her caring responsibilities, Sana has accumulated more than £8,000 in council and private debt.

“These people do not have lavish lifestyles,” explains Ms Evans. “But they end up having no money at the end of the month, and they end up making their debt worse. This is the situation for around one-third of our clients.”

Ms Evans and her team see every day how inadequate levels of state support, combined with the rising cost of living, is pushing people like Sana to crisis point. From having to choose between heating and eating, to being forced to forego the essentials that give people dignity, the welfare system is failing to lift people out of poverty, which is impacting the physical and mental health of the nation. At the same time, rising child poverty is harming children’s educational attainment – leading to a potential lost generation.

It is for these reasons that Grand Union has made a passionate call for welfare reform that focuses on five clear ambitions: a welfare system built on adequacy, accessibility, fairness and flexibility. This would result in benefits that are paid at a level which meets the basic needs of a household, a more accessible system to all who need it, an end to the postcode lottery for support, and claimants having more choice and a voice. The report also calls for greater collaboration between government, local authorities, social landlords and charities to ensure vulnerable people’s needs are met.

Reforming the welfare system, Grand Union argues, is a proactive investment that will help to create a healthier and more equal society. Benefits can offer a safety net that helps move people out of crisis so they can flourish. But successive governments have taken the opposite view, instilling a shame-based narrative around welfare. A punitive system has led to higher rates of deprivation, rent arrears and spiralling debt.

“It’s like we see benefits entitlement as a punishment,” Ms Evans tells Inside Housing. “We should see it as investing in citizens when they need support. It’s a state investment to help people get back on their feet and create homes where children can grow up and achieve.”

The latest poverty statistics show how many families are struggling. 2020-21 data published by the Joseph Rowntree Foundation shows how one in five people in the UK are living in poverty – or 13.9 million. Of these, nearly four million are children. In-work poverty has also increased. More than half (57%) of people in poverty are living in a working household.

“There’s this common myth that people in social housing are scroungers. Well, they’re not actually,” says Ms Evans. “Many of our tenants have two or three jobs. Only 4% of Grand Union tenants are unemployed, which is the same as the national average. What we are seeing is more people in in-work poverty.”

When former prime minister David Cameron and chancellor George Osborne moved into Downing Street in 2010, the coalition government launched a range of austerity measures that focused on cutting welfare spending and public services. Mr Cameron described the policies as “the most ambitious, fundamental and radical changes to the welfare system since it was created”.

Central to the austerity programme was a wholesale reform of benefits, including the introduction of Universal Credit, a system that integrated a number of previous benefit payments under one umbrella.

“The principle of Universal Credit was to simplify the benefits system,” says Ms Evans. “There’s nothing wrong with combining the benefits. But we have ended up with confusion and people unable to access support.”

Easily avoidable errors in decision-making, and basic failures to recognise the reality of people’s jobs, relationships and needs, have led to households missing out on support or struggling to access what they are entitled to.

These failings combined to leave Ian struggling to make ends meet when ill health and caring responsibilities led to him claiming Universal Credit. Ian always worked and provided for his family, wife Carol and their disabled son Andy. But after an arthritis diagnosis forced him to quit his job, he turned to the state for support. Ian was quickly confronted by administrative complexity and barriers that meant he was unable to access the financial support he and his family were entitled to. Because Carol’s carer allowance was paid every four weeks, rather than monthly, the Department for Work and Pensions would sometimes stop the family’s benefits, as they believed she had been paid double her entitlement. This pushed Ian into debt.

“I hate owing money,” he says. “I have always kept up with paying things on time. It drove me to distraction.”

Missing entitlement

The issue was compounded when it became apparent that Ian and Carol were, in fact, owed a carer’s premium as part of their Universal Credit, meaning they had been underpaid £162 every month. It was thanks to a Grand Union welfare advisor that the missing entitlement was spotted. Without their help, Ian dreads to think what would have happened to his family.

“We are spending £600,000 a year helping people like Ian navigate the welfare system,” says Ms Evans. “We do it because it’s the right thing to do. But imagine if the system was simple enough that people could navigate it without our help. We could invest the money we spend on support into building more social housing.”

Central to Grand Union’s calls for reform is a total review of the system to identify where it can be more accessible to vulnerable people. The report recommends making Universal Credit more user friendly, and introducing a single digital platform for people to make and manage their Universal Credit claims.

The report also calls for changes to aspects of the system that are, at best, failing to lift people out of poverty and are, at worst, entrenching poverty. These include reducing the debt burden on vulnerable families who are facing third-party deductions taken from a person’s Universal Credit to serve debts such as rent arrears. Data from the Joseph Rowntree Foundation found that 94% of Universal Credit claimants who are paying back deductions are “going without”, with some households paying back as much as £130 each month. Such a system “impoverishes” people, argues Grand Union in its report, and drives homelessness.

In addition, the report suggests a review of the bedroom tax – where social housing tenants with a spare room saw their housing benefit reduced – and the scrapping of the two-child tax credit limit, which means third or subsequent children born after 2017 are not entitled to the benefit. These policies in particular, Ms Evans says, “have ended up making people poorer”.

A further reform called for in the report is a change to the way in which disabled people and people with complex health conditions receive support. Currently, claimants for disability-related benefits are assessed on a regular basis to see if they still qualify for financial assistance. These assessments cause anxiety and distress – and often fail to accurately recognise need.

“There’s an assumption that everyone will get better,” says Ms Evans. “Some people have chronic health conditions that are only going to get worse. Assessments offer a snapshot of how a person is doing and there’s very little recognition of the long-term context. We need a more nuanced and medically informed system.”

Ms Evans is clear that change does not start and end with welfare reform. She argues that we need to see more investment in health and social care, in communities and in housing, in order to prevent people falling into crisis and therefore in need of a safety net in the first place. “We need the state to invest in its citizens,” Ms Evans tells Inside Housing.

Sign up for the IH long read bulletin

Already have an account? Click here to manage your newsletters