Do we need a new consumer code on shared ownership?

What is the Shared Ownership Council’s new guidance and why is it needed? Ruth Barnes, partner, and Charlotte Coleman, legal director, at Winckworth Sherwood explain

Shared ownership plays a vital role in the step towards homeownership. So successful is the model that there are now around 250,000 shared ownership households in the UK.

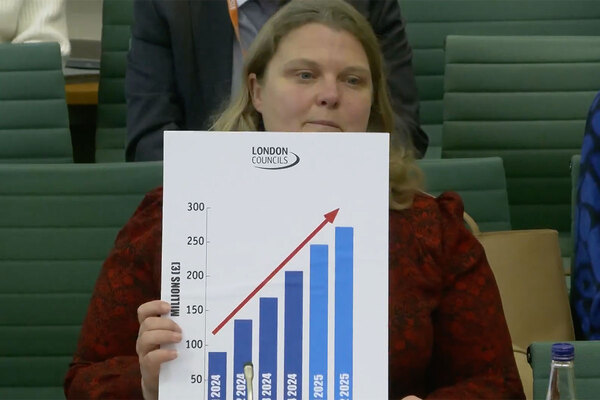

Yet, the cross-party Housing, Communities and Local Government Committee (previously called the Levelling Up, Housing and Communities Committee) reported earlier this year that many shared ownership households face rising rents, uncapped service charges and disproportionate repair and maintenance costs.

The committee said this was pushing the tenure out of reach for many.

The Shared Ownership Council (SOC), an industry-led initiative that “aims to improve the consumer experience of shared ownership, ensure best practice and drive clarity and consistency in the information available to consumers”, has responded with a new code of best practice.

The code focuses on six overarching principles:

- The provision of clear information on what shared ownership is and the roles and responsibilities shared owners have

- SOC members should provide clear information on costs and how they might change over time

- Ensuring shared owners buying new homes have the same standards in terms of sales, transparency and completion as other homeowners

- Provision of clear and accessible policies on staircasing

- Better support to help households manage unplanned costs better

- Clear policies on addressing customer complaints

The SOC code is voluntary, but has gathered widespread support from mortgage lenders and social housing providers.

So why is it needed? To answer that, it helps to look at current regulation, where it applies to shared ownership and, more importantly, where it fails to protect shared ownership households.

“Property lawyers have, perhaps rightly, pointed out that the burden of compliance falls on sellers’ shoulders, offering little protection for buyers and nothing for property with shared ownership tenures”

First, guidance from the National Trading Standards requires those selling homes, including shared ownership tenures, to provide greater amounts of material information on a property when it is marketed. It has been suggested that its primary purpose has been to help estate agents comply with Consumer Protection from Unfair Trading Regulations by putting key information on sales particulars.

Property lawyers have, perhaps rightly, pointed out that the burden of compliance falls on sellers’ shoulders, offering little protection for buyers and nothing for property with shared ownership tenures.

The Consumer Protection from Unfair Trading Regulations and the law relating to misrepresentation, including under the Misrepresentation Act 1967, both apply to shared ownership.

The regulations prohibit a trader from engaging in unfair commercial practices when dealing with consumers and extend, for example, to misleading information given about the characteristics of a property, such as room size, using inaccurate photographs or withholding information that is considered material to the purchase.

The act protects against statements made carelessly or without reasonable grounds for believing them to be true.

“Despite the weight of regulations and codes, there remain considerable gaps that leave shared ownership exposed”

Then there is the Consumer Code for Home Builders. This requires developers to ensure all sales and marketing materials are clear, truthful and use plain English. Such material should include details such as the size of the property, tenure, energy performance ratings, mobility adaptions, legal completion date, warranty provisions and any restrictions on using or living in the property. The current version of the code does not extend to shared ownership homes.

Finally, there is the New Homes Quality Code and the New Homes Ombudsman Service. Currently voluntary, a statutory requirement to make it compulsory is expected. Indeed, it has recently been announced that the New Homes Ombudsman has urged the government to make it mandatory for house builders to join its service, which includes adopting the code.

The code aims to drive up the quality of new homes and strengthen protections for customers. It includes a 14-day cooling-off period, during which reservation fees will be refunded and prohibits financial incentives for immediate decisions and restrictions on the choice of professional advisors. Again, the code does not extend to shared ownership homes.

Despite the weight of regulations and codes, there remain considerable gaps that leave shared ownership exposed. We have been told by the New Homes Quality Board that they decided not to extend the New Homes Quality Code to shared ownership earlier this year, but that they are offering assistance to the SOC. That is why the SOC believes a new and dedicated code is needed.

The SOC’s code, which is being consulted on at present and so is not in force, goes beyond the scope of existing regulations and codes, addressing staircasing and the concerns raised by the parliamentary committee around costs. It is a code that will offer some comfort to shared ownership households if it is adopted in its current form.

Ruth Barnes, partner in the residential development sales team, and Charlotte Coleman, legal director in the property dispute resolution team, Winckworth Sherwood

Sign up for our regulation and legal newsletter

Already have an account? Click here to manage your newsletters

Sign up to the Regulation and Governance Conference 2024

At a time of major regulatory change, the Regulation and Governance Conference is designed to give board members and governance and risk professionals the insight they need to plan and prioritise effectively.

Join more than 250 delegates and 45 speakers to confidently navigate the change ahead and ensure you have the right governance structures and assurance frameworks to keep tenants safe and run a viable business.