You are viewing 1 of your 1 free articles

Charities warn homelessness services will close if National Insurance hike goes ahead

Charities have warned that homelessness services will close if the increase in employers’ National Insurance contributions goes ahead.

Speaking to Inside Housing, they said the rise, coupled with the 6.7% increase in the National Living Wage, will cost them thousands of pounds, increase caseloads for staff, and could lead to smaller charities closing altogether.

In the Budget, chancellor Rachel Reeves announced a rise from 13.8% to 15% in the amount employers will have to pay on their National Insurance contributions from April 2025.

She also lowered the £9,100 threshold at which employers start paying National Insurance on employees’ earnings to £5,000.

Nationally, Homeless Link estimates the National Insurance increase alone could cost the homelessness sector up to £60m per year.

The NCVO said the hike could cost the whole charity sector £1.4bn a year.

Alongside the National Insurance increase, the government announced £233m of extra funding in the Budget to tackle homelessness.

However, charities said the government was “giving with one hand but taking with the other”.

They have called for charities to be exempt from the increase and for the government to provide sustainable long-term funding for the homelessness sector.

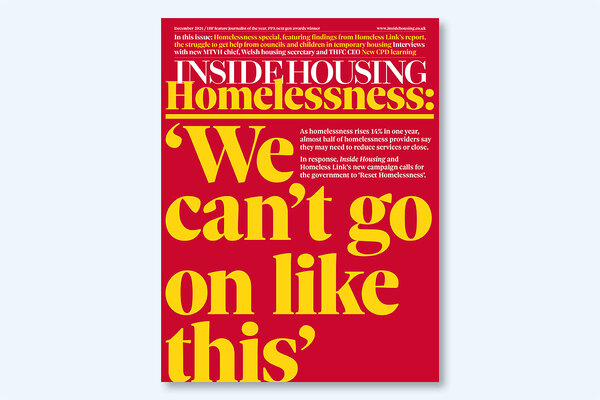

Inside Housing and Homeless Link launched a joint campaign on Monday, Reset Homelessness, calling for a systemic review of homelessness funding in England.

Steve Hoey is chief executive of Turning Lives Around (TLA), a homelessness charity operating in Leeds and Wakefield for more than 50 years.

TLA, which has just under 150 staff members, has some stock and works with around 1,200 people every year. It does homelessness prevention, houses rough sleepers in hostels and helps people to be independent. It mainly does contractual work for local authorities.

Mr Hoey said: “We were pretty shocked with the Budget announcement around employers, and particularly there not being any exemption for charities, because it’s going to hit us pretty hard.

“Nationally, it’s going to cost the charity sector something like £800m next year in additional costs,” he said, and that does not cover the living-wage increase.

Mr Hoey said this increase was “in principle, a great thing, but obviously it does have an impact on our finances”.

Both increases are going to cost the charity £142,000 next year.

“The chancellor kept saying that they weren’t going to hit employers’ pay packets and there wouldn’t be any taxes on working people. But this really feels like a back-door tax on working people, because it’s definitely going to hit wage settlements next year across the charity sector,” Mr Hoey said.

He warned the increase could also result in redundancies and some charities going bust.

“Some smaller charities just won’t be able to function. They’ve got really small staff teams, and if you can’t afford to pay them all, you’ve got to lose one. And if you lose one, you haven’t got a team anymore.”

He said the charity sector was already “really close to the bone with finances”.

He said TLA was hopefully not going to have to make anyone redundant, “but we will be thinking about structure and trying to make efficiencies”.

“Certainly, none of our services will close as a result of this, [but] it definitely puts a squeeze on everything.

“It means things like wages will be squeezed. Caseloads might go up,” Mr Hoey said.

He said he could see that the government needed to raise tax revenue.

“But I honestly don’t think that was the best way of doing it, because it’s hit charities, small businesses and social enterprises,” Mr Hoey said.

“Obviously, in our sector, we’d love to do more work. Homelessness is on the increase at the moment, and in order to turn that curve, we need to invest in prevention and give the services and local authorities and their partners around the country the resources they need.

“So we needed more income, more funding, more resources. We’ve not seen that yet.

“They’ve still got this Spending Review to come up with stuff, [so] I’m not going to be too critical just yet, but we really need to see more investment in homelessness services and prevention around the country.”

Jools Ramsey-Palmer, chief executive of Ipswich Housing Action Group, said the charity offered a homelessness hub that was open six days a week, and provided some accommodation through the local housing-related support contract with Suffolk County Council.

The hub is open for people who are sleeping rough and those in emergency accommodation, offering a safe space and essentials such as showers, food, lockers and a postal service. It also helps people set up bank accounts. The organisation has around 20 paid members of staff and some volunteers.

Ms Ramsey-Palmer said: “Staff are my greatest asset, because the nature of the people we work with is really complex, so that’s why we have a higher number of staff to volunteers. And that, of course, is my biggest expense in terms of staff costs.”

She said the National Insurance contribution increase will cost the charity £16,000.

“And, of course, our hub is a free-to-access service, so I’ve got no end consumer that I can pass that on to,” Ms Ramsey-Palmer said.

The government has also announced a 6% increase in the minimum wage.

Ms Ramsey-Palmer said she “absolutely applauds this”, but it was another pressure on the charity’s budget.

“I want to make sure that the staff team I have are able to manage themselves through both a cost of living and a cost of housing crisis.

“I have to look at being able to put a competitive salary package together to encourage people to come and work for us, but I simply cannot raise everybody’s salary by 6%, because my income has not gone up by 6%,” she said.

She said her concern was that charities will close if the measures go ahead.

“We are going to see vital services that support our local communities lost. And once they’ve gone, they’ve gone.

“We know there is already pressure on statutory services to meet the needs of people, particularly around homelessness, and that pressure is just going to mount.

“As homelessness numbers rise, and I suspect they will continue to rise, I just can’t see how that demand is going to be met.”

She said the government has pledged additional money to the homelessness sector, including the £230m announced in the Budget.

“I’m just really fearful that a significant number of providers will look at reducing their services or closing services altogether,” she said.

She said the government “has to realise” that the charity sector “plays such a vital role” and is a safety net for people, particularly in terms of prevention.

“If everybody ends up in crisis and knocking on the door of statutory services, that will cost the country a great deal more than finding sustainable funding for charities that are able to get to people first,” she said.

A government spokesperson said: “This Budget took the tough choices needed to fix the foundations and restore economic stability.

“Our tax regime for charities, including exemption from paying business rates, is among the most generous anywhere in the world, with tax relief for charities and their donors worth just over £6bn for the tax year to April 2024.

“We have protected small charities and businesses by more than doubling the employment allowance to £10,500, meaning more than half of them with [National Insurance contribution (NIC)] liabilities either gain or see no change next year.

“Charities will still be able to claim employer NIC relief, including where eligible, and are still exempt from business rates.”

Following the Budget, Manningham Housing Association warned that the National Insurance rise for employers could “endanger the government’s housebuilding plans”.

Sign up for our homelessness bulletin

Already have an account? Click here to manage your newsletters