You are viewing 1 of your 1 free articles

Jules Birch is an award-winning blogger who writes exclusive articles for Inside Housing

Will the half-baked Right to Buy extension ever be implemented?

Making a speech announcing plans to “bring back Right to Buy” is one thing. Making it work is quite another, argues Jules Birch

How exactly should we take Boris Johnson’s plans to “bring back Right to Buy” and “turn Generation Rent into Generation Own”?

Many housing association tenants will welcome the chance to own their own home and private renters may welcome official recognition that they are stuck paying more in rent than for the mortgage they can’t get.

Equally, most social landlords will feel that they have no choice but to take very seriously a major change for housing associations and what could be yet another threat to council housing.

And anyone with even the vaguest interest in seeing more genuinely affordable homes will greet the latest guff about one-for-one replacements with a groan.

But it’s also very hard not to be cynical about this latest cover version of Margaret Thatcher’s number one from the 1980s. The suspicion is that this is all about a lame duck prime minister having something catchy to announce regardless of how – or even if – it will work out in practice.

Even so, it’s impossible not to wonder about the practicalities of a plan to finance mortgages from housing benefit in the middle of a cost of living crisis, with interest rates about to rise at the peak of a housing market bubble that could be about to burst.

And it’s hard not to contrast Mr Johnson’s tired old rhetoric about social tenants on housing benefit being “dependent on the state” with the plans announced just 24 hours earlier for a Social Housing Regulation Bill that will “mean more people living in decent, well looked-after homes enjoying the quality of life they deserve”.

Calling the plan “benefits to bricks” looks like trolling of those who have genuinely attempted to find ways to shift subsidy to new homes.

And all of these reactions are subject to the politics of a wounded prime minister desperate to send the right signals to his party after 41% of his own MPs said they have no confidence in him.

“The suspicion is that this is all about a lame duck prime minister having something catchy to announce regardless of how – or even if – it will work out in practice”

The issues with the extension of the Right to Buy to housing association tenants remain the same as they were when David Cameron revived it in 2015, Theresa May dropped it in 2018 and Mr Johnson floated it again in May.

Yes, Michael Gove is promising one-for-one replacements, but we’ve heard that before when the original Right to Buy was reinvigorated with higher discounts and when housing association Right to Buy was piloted in the Midlands. The sums simply do not add up.

True, Mr Gove has also promised that the funding for the discounts (averaging £65,000 per home in the Midlands) won’t come out of the Affordable Homes Programme – but where will the money come from?

Remember that the levy on the forced sale of vacant higher-value council houses remains on the statute book despite being repudiated in the Social Housing Green Paper.

“Calling the plan ‘benefits to bricks’ looks like trolling of those who have genuinely attempted to find ways to shift subsidy to new homes”

There are strong hints that the scheme will be rationed to control costs, perhaps at £500m a year in discounts.

The least controversial bit of the new plan is reform of the mortgage market, something that Mr Gove has been pushing for some time, and it seems quite reasonable to find ways to make it easier and less expensive for low-income households to buy.

The new and potentially most controversial bit is the plan to let people who are in work use their housing benefit to pay their mortgage.

That would be a major shift for housing and for the benefits system, and it would apply to private renters as well as social tenants. But you only to have to think about that for a few seconds before the flaws become clear.

If the scheme works it will simply fuel demand and house prices without creating a single new home.

But how many tenants will be able to afford a deposit? For those who can, the scheme could create a new benefit trap in which they will lose support for their mortgage if they start to earn more.

Will banks and building societies really be prepared to lend? It’s only relatively recently that many of them removed restrictions on lending to buy-to-let landlords with tenants on benefit.

Then there is the government’s past form on benefits. Most private renters already face significant shortfalls between their Local Housing Allowance and their rent, so how many who receive it will be able to afford a mortgage? Even if the new supported owners can afford their mortgage, what happens if they are sanctioned or benefits are frozen?

“Most private renters already face significant shortfalls between their Local Housing Allowance and their rent, so how many who receive it will be able to afford a mortgage? Even if the new supported owners can afford their mortgage, what happens if they are sanctioned or benefits are frozen?”

It’s not clear whether the scheme will apply to council tenants – the press release only mentions housing associations and private renters – but if it does it could lead to a new wave of Right to Buy at discounts that will undermine local authority plans to build new homes.

There are also serious implications for the wider benefits system, since it’s hard to see how the government can allow housing benefit to be used to support mortgages for some low-income households without extending it to others.

Governments have spent the past 30 years rowing back from this. In the housing market crash of the early 1990s, the cost of Income Support for Mortgage Interest (ISMI – essentially a form of housing benefit for homeowners in financial problems) doubled in the space of four years to £1.2bn a year.

“This week’s announcement anticipates some problems, such as saving enough for a deposit triggering the loss of entitlement to benefit, but it still looks on the under-cooked side of half-baked”

ISMI was steadily scaled back, renamed Support for Mortgage Interest and finally converted into a loan that will now be available a few months earlier.

You have to wonder what the Treasury and the Department for Work and Pensions think of this latest idea. Remember Iain Duncan Smith’s whacky proposal to give away council homes to tenants? The whole point was to slash the housing benefit bill, not use it to support mortgage payments.

This week’s announcement anticipates some problems, such as saving enough for a deposit triggering the loss of entitlement to benefit, but it still looks on the under-cooked side of half-baked.

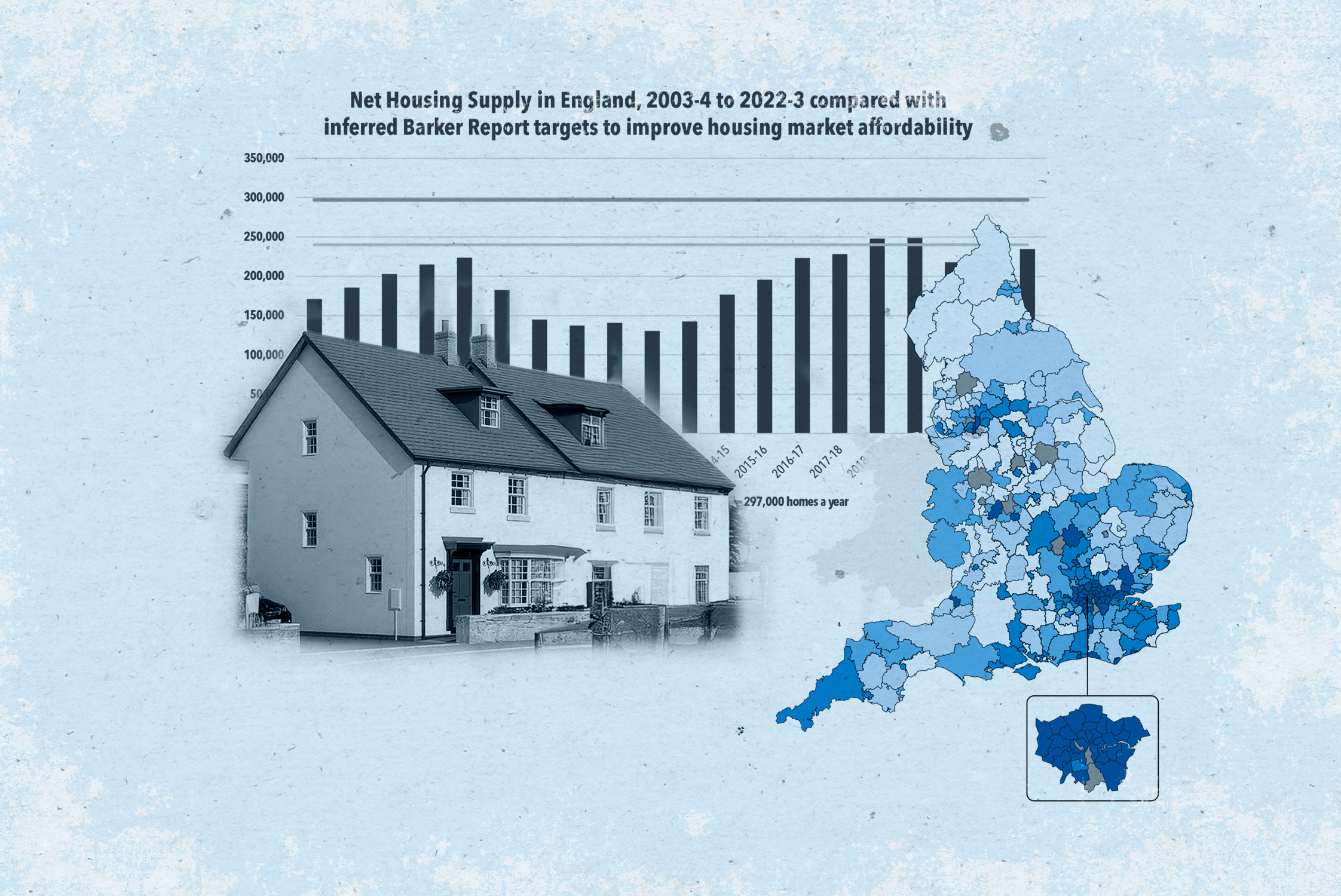

The full speech highlights England’s poor record on supply without mentioning the government’s retreat from planning reform, and “the scourge of unfair leasehold terms” without mentioning its failure to go ahead with the second stage of leasehold reform.

But none of that matters very much in a world where government is conducted by announceables and the news cycle has already moved on.

Jules Birch, columnist, Inside Housing

Sign up for our Week in Housing newsletter

Already have an account? Click here to manage your newsletters