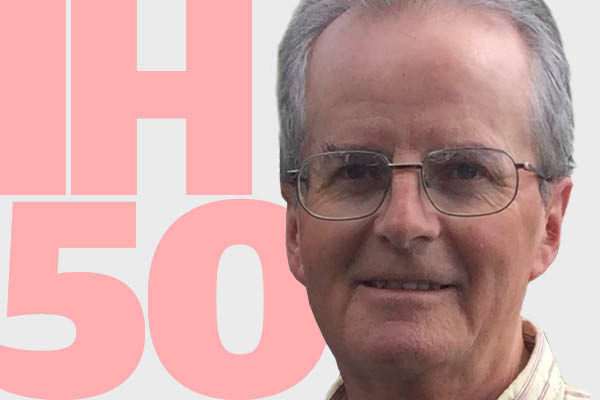

Alison Inman is a board member at Saffron and Tpas; former president of the CIH; and co-founder of SHOUT

Are furnished tenancies the answer?

The sector has significant purchasing power. Alison Inman asks: is it time landlords thought about offering their tenants furniture, instead of them getting into debt?

Apologies to those who have heard this before, but I knew a woman once who worked at Provident, going door to door on one of the larger estates in Colchester, Essex.

Part of her job was to be all over Homechoice and she had to visit each new tenant within a fortnight of them moving in.

That gave her a chance to welcome people to the estate, clock what they needed to make their new home perfect, and sign them up for a loan to pay for it. Carpet? Curtains? Beds for the kids? She could help, and help quickly.

The cost of borrowing £500 in cash from Provident, paid back over a year (according to their website), is £18 a week – 299% APR.

And we all know that one loan is often rolled into another, and it’s really hard to prioritise any debt over the one whose representative comes knocking at the door.

Put that in the context of the benefit cap and direct payments, and watch those rent arrears rocket and misery increase.

Back in the midst of time, when I was a young welfare rights advisor and we had a reasonably functioning social security system, there were single payments of supplementary benefit that specifically helped the poorest when they were moving into new accommodation.

They were an entitlement, not a hand-out or a discretionary payment made on the whim of an over-stretched gatekeeper.

Those days are long gone and the effects are well documented by the excellent folk at End Furniture Poverty. For a house to be a home, it needs a bed, a cooker and a fridge – and if we don’t help some of our tenants to access these necessities, they’ll turn to those who will or they’ll suffer without.

As the campaign makes clear: “It is the single mother and child sharing a mattress on the floor for a bed; the family with no cooker who can only make hot food that requires hot water from a kettle; the family with no wardrobes or chests of drawers so clothes are stored in black bags on the floor; the family where there is no table for children to eat from or do their homework. When there isn’t enough money for fuel or food, where does the money for furniture and appliances come from?”

The group’s research estimates that in the Liverpool City Region alone, 10,000 children do not have a serviceable bed of their own to sleep in.

They are sharing with parents, siblings, on a couch or on the floor – and that floor may well have no carpet.

“I’m not sure whether all landlords are even aware of what the furniture and furnishing needs of their tenants are. There is some excellent practice across the sector, but certainly some that’s not so good”

A woman I know told me of her neighbour, who lived in an absolutely beautiful housing association property and had three carpet sample squares on the bare floor in front of the TV – that was where the three children sat and ate their meals.

As a sector, we are rightly proud of the homes we build and we spend a lot of money on them.

In order to lead good lives, though, our tenants need access to floor coverings, blinds, furniture and white goods.

All of these are routinely available in the private rented sector and may become an increasing factor in whether people choose to live in the social sector or not.

I’m not sure whether all landlords are even aware of what the furniture and furnishing needs of their tenants are. There is some excellent practice across the sector, but certainly some that’s not so good.

Too many landlords still skip perfectly serviceable carpets and white goods, often sending new tenants straight into the arms of Bright House.

Take a look at the great work done by Orbit a couple of years ago, when it began to leave good-quality curtains and carpets in its properties, gifting them to the new tenant.

It saved the person moving in a substantial amount of money and was cost neutral to the organisation.

More and more landlords are thinking about this, putting tenants in touch with local organisations that can help.

“It’s time we realised that giving a new tenant a leaflet for the local credit union at the tenancy sign up just isn’t good enough”

But maybe we should be thinking more broadly: are furnished tenancies the answer for some people?

We have immense purchasing power across the sector.

As well as using it to procure the best deals for repairs and capital works, isn’t there much more we could do to ensure that no one has to sleep on the floor or take the kids out of the property to get their homework done?

It’s time we realised that giving a new tenant a leaflet for the local credit union at the tenancy sign-up just isn’t good enough.

We are sending people into the arms of high-interest loan providers and there’s nothing to celebrate about that.

Alison Inman, board member, Colne, Saffron Housing Trust and Tpas